Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

PERFORMANCE

37%

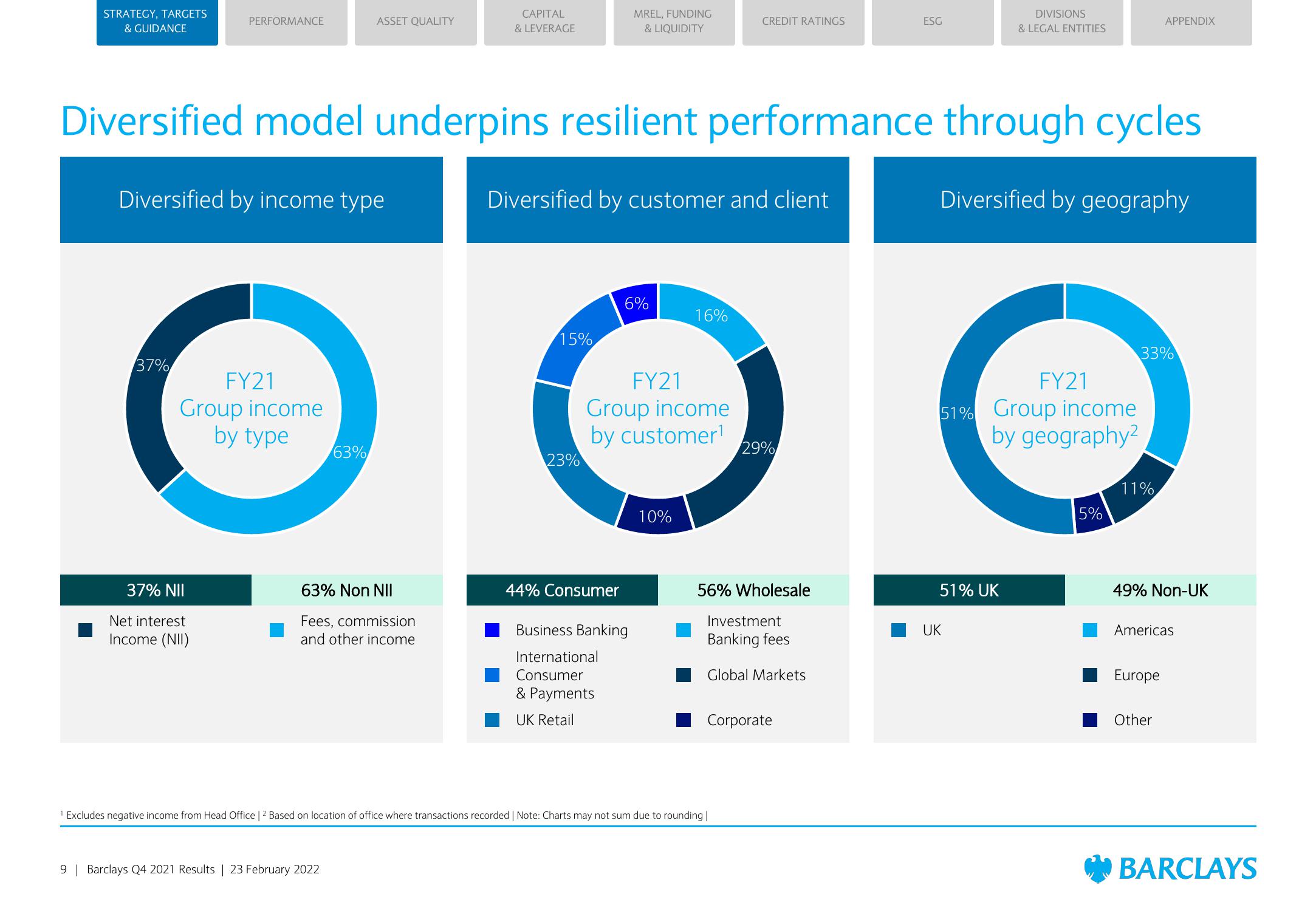

Diversified by income type

FY21

Group income

by type

37% NII

Net interest

Income (NII)

ASSET QUALITY

63%

Diversified model underpins resilient performance through cycles

63% Non NII

Fees, commission

and other income

9 | Barclays Q4 2021 Results | 23 February 2022

CAPITAL

& LEVERAGE

MREL, FUNDING

& LIQUIDITY

Diversified by customer and client

44% Consumer

CREDIT RATINGS

6%

16%

15%

FY21

O

Group income

by customer¹

29%

23%

10%

Business Banking

International

Consumer

& Payments

UK Retail

56% Wholesale

Investment

Banking fees

Global Markets

¹ Excludes negative income from Head Office | 2 Based on location of office where transactions recorded | Note: Charts may not sum due to rounding |

Corporate

ESG

DIVISIONS

& LEGAL ENTITIES

Diversified by geography

FY21

51% Group income

by geography²

51% UK

UK

5%

APPENDIX

33%

11%

49% Non-UK

Americas

Europe

Other

BARCLAYSView entire presentation