Trian Partners Activist Presentation Deck

P&G Faces Numerous Challenges

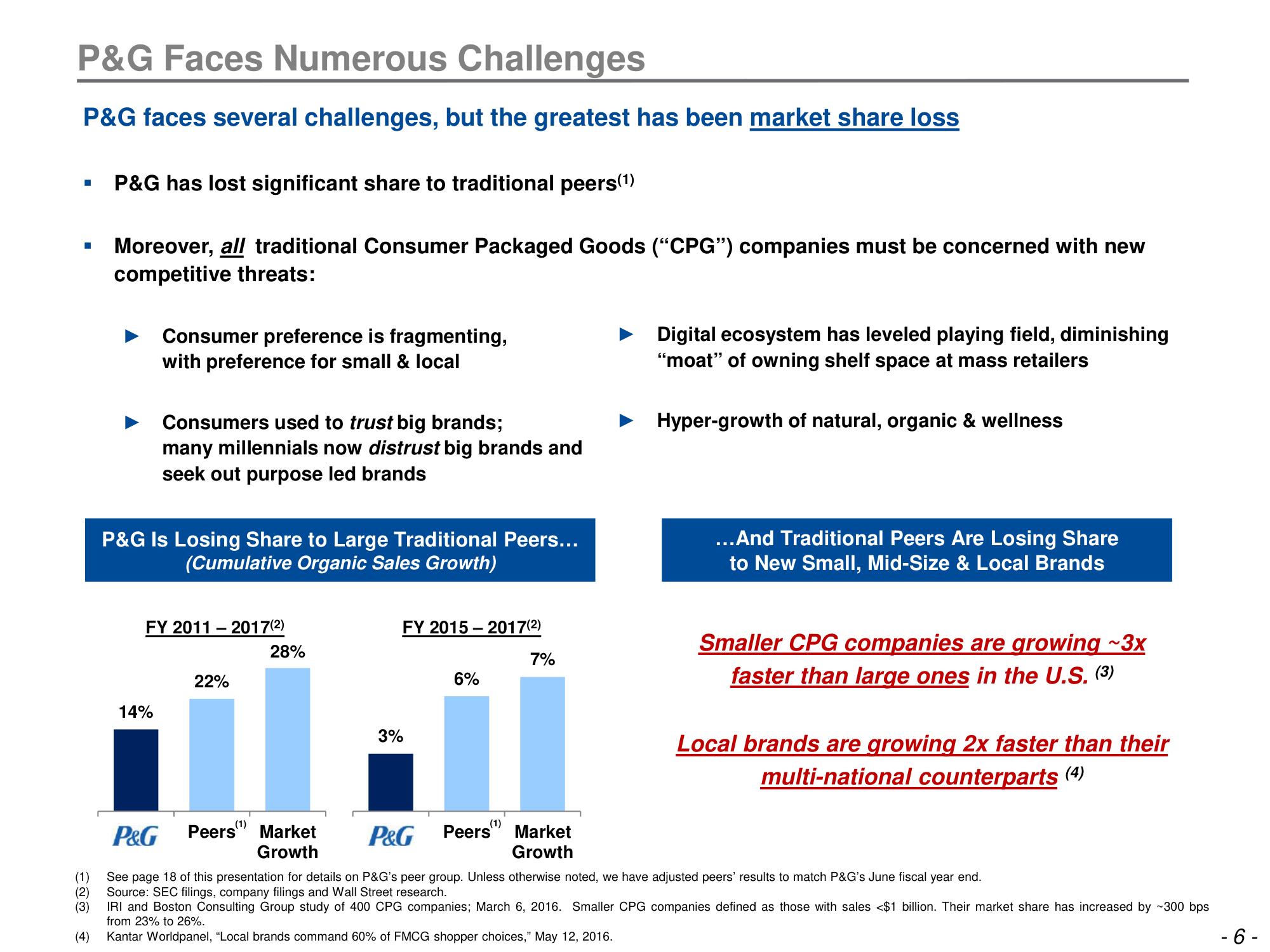

P&G faces several challenges, but the greatest has been market share loss

■

■

P&G has lost significant share to traditional peers(¹)

Moreover, all traditional Consumer Packaged Goods ("CPG") companies must be concerned with new

competitive threats:

Consumer preference is fragmenting,

with preference for small & local

Consumers used to trust big brands;

many millennials now distrust big brands and

seek out purpose led brands

P&G Is Losing Share to Large Traditional Peers...

(Cumulative Organic Sales Growth)

14%

FY 2011 - 2017(2)

22%

28%

P&G Peers¹ Market

Growth

FY 2015-2017(2)

3%

6%

7%

(1)

P&G Peers¹ Market

Growth

Digital ecosystem has leveled playing field, diminishing

"moat" of owning shelf space at mass retailers

Hyper-growth of natural, organic & wellness

...And Traditional Peers Are Losing Share

to New Small, Mid-Size & Local Brands

Smaller CPG companies are growing ~3x

faster than large ones in the U.S. (3)

Local brands are growing 2x faster than their

multi-national counterparts (4)

(1) See page 18 of this presentation for details on P&G's peer group. Unless otherwise noted, we have adjusted peers' results to match P&G's June fiscal year end.

(2) Source: SEC filings, company filings and Wall Street research.

(3) IRI and Boston Consulting Group study of 400 CPG companies; March 6, 2016. Smaller CPG companies defined as those with sales <$1 billion. Their market share has increased by ~300 bps

from 23% to 26%.

(4) Kantar Worldpanel, "Local brands command 60% of FMCG shopper choices," May 12, 2016.

- 6-View entire presentation