Baird Investment Banking Pitch Book

RELATIVE TRADING ANALYSIS

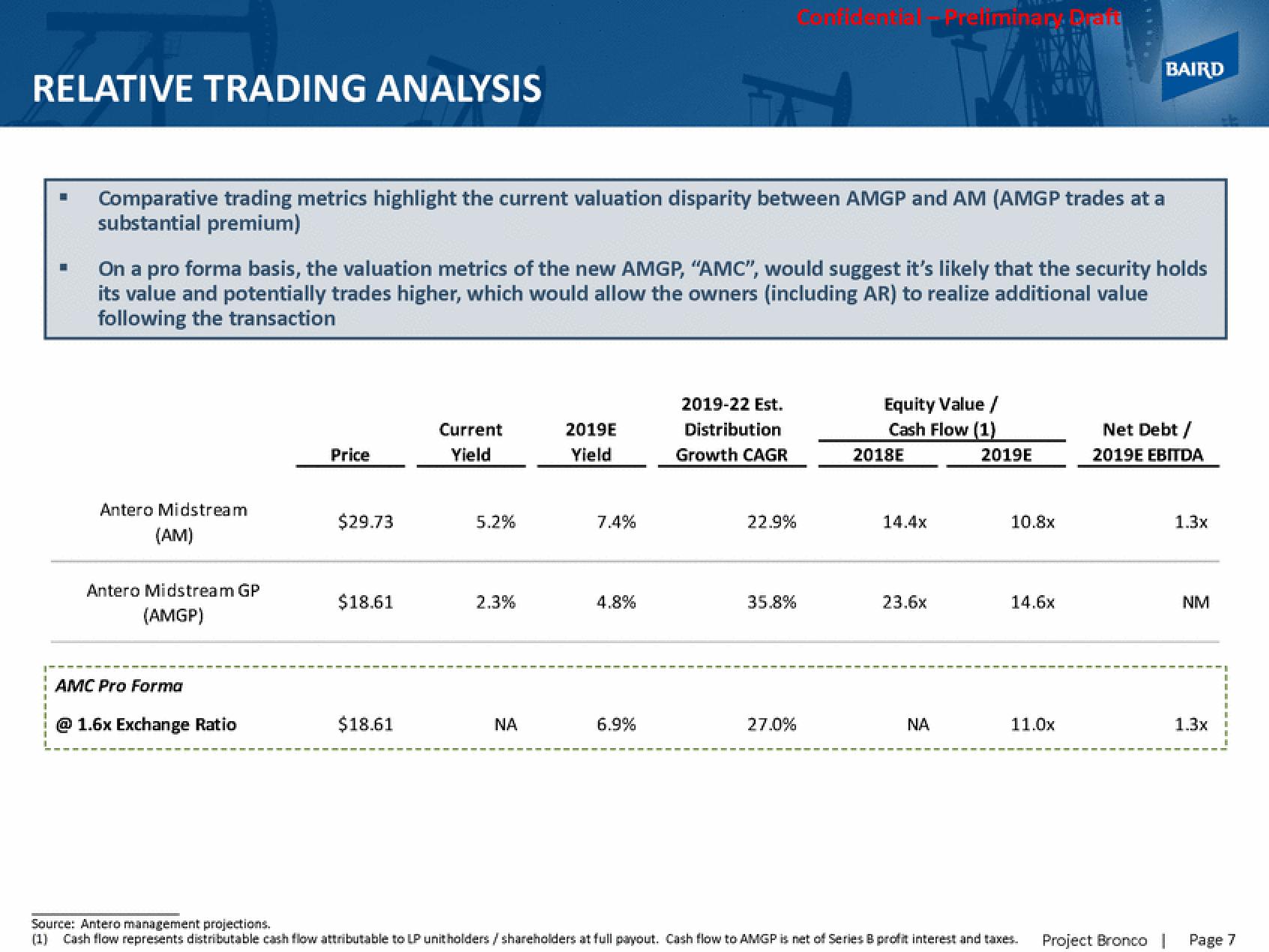

Comparative trading metrics highlight the current valuation disparity between AMGP and AM (AMGP trades at a

substantial premium)

Antero Midstream

(AM)

On a pro forma basis, the valuation metrics of the new AMGP, "AMC", would suggest it's likely that the security holds

its value and potentially trades higher, which would allow the owners (including AR) to realize additional value

following the transaction

Antero Midstream GP

(AMGP)

AMC Pro Forma

@ 1.6x Exchange Ratio

Price

$29.73

$18.61

$18.61

Current

Yield

5.2%

2.3%

NA

2019E

Yield

7.4%

4.8%

6.9%

2019-22 Est.

Distribution

Growth CAGR

22.9%

35.8%

27.0%

Equity Value /

Cash Flow (1)

2018E

Preliminar Paft

14.4x

23.6x

NA

2019E

10.8x

14.6x

11.0x

BAIRD

Source: Antero management projections.

(1) Cash flow represents distributable cash flow attributable to LP unitholders / shareholders at full payout. Cash flow to AMGP is net of Series B profit interest and taxes.

Net Debt /

2019E EBITDA

Project Bronco

1.3x

NM

1.3x

Page 7View entire presentation