Vivid Seats Investor Presentation Deck

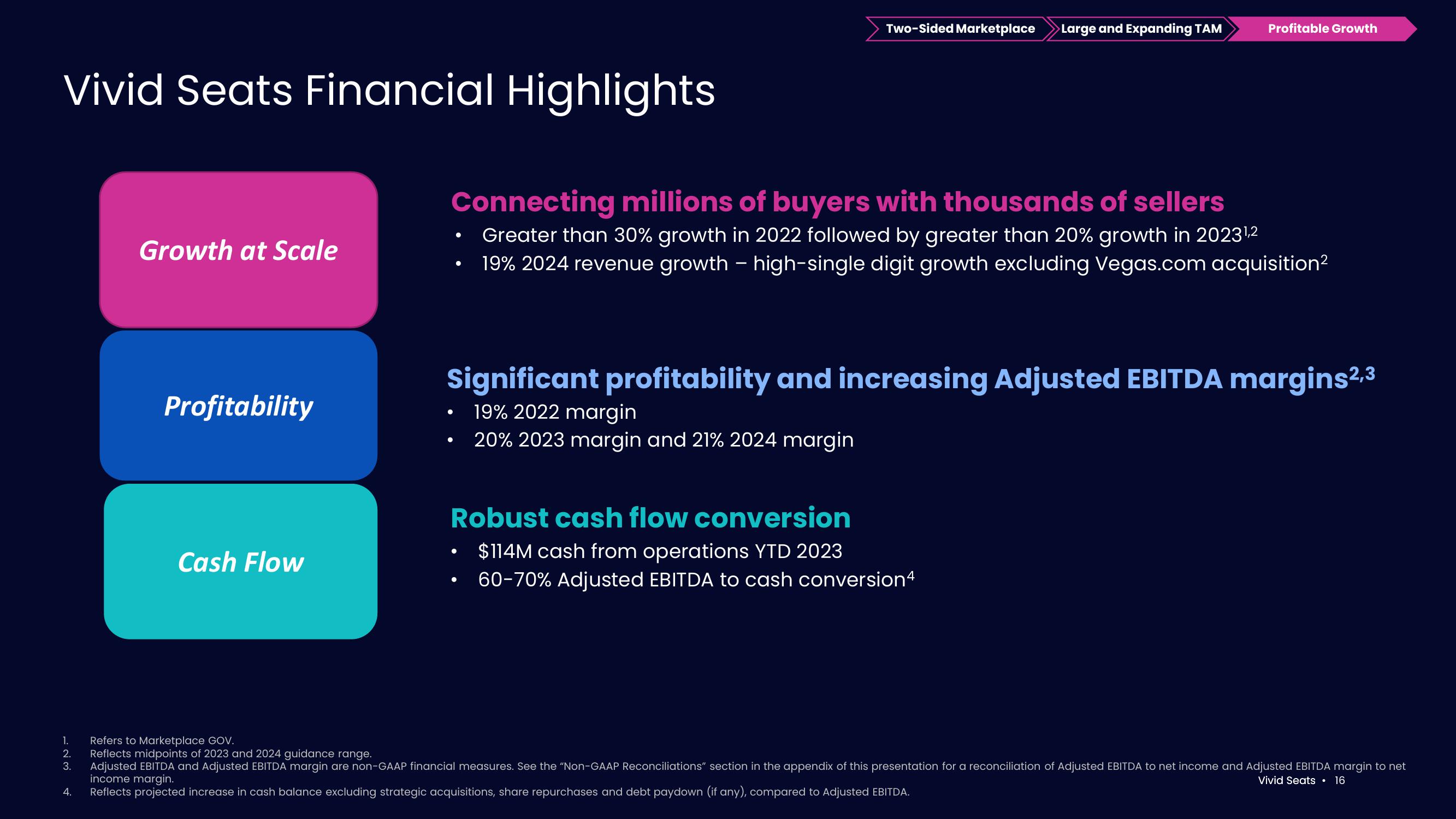

Vivid Seats Financial Highlights

1.

2.

3.

4.

Growth at Scale

Profitability

Cash Flow

Connecting millions of buyers with thousands of sellers

Greater than 30% growth in 2022 followed by greater than 20% growth in 2023¹,2

19% 2024 revenue growth – high-single digit growth excluding Vegas.com acquisition²

-

●

●

●

●

Two-Sided Marketplace >Large and Expanding TAM

Significant profitability and increasing Adjusted EBITDA margins2,3

19% 2022 margin

20% 2023 margin and 21% 2024 margin

Profitable Growth

Robust cash flow conversion

$114M cash from operations YTD 2023

60-70% Adjusted EBITDA to cash conversion4

●

Refers to Marketplace GOV.

Reflects midpoints of 2023 and 2024 guidance range.

Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See the "Non-GAAP Reconciliations" section in the appendix of this presentation for a reconciliation of Adjusted EBITDA to net income and Adjusted EBITDA margin to net

income margin.

Vivid Seats 16

Reflects projected increase in cash balance excluding strategic acquisitions, share repurchases and debt paydown (if any), compared to Adjusted EBITDA.View entire presentation