Silicon Valley Bank Results Presentation Deck

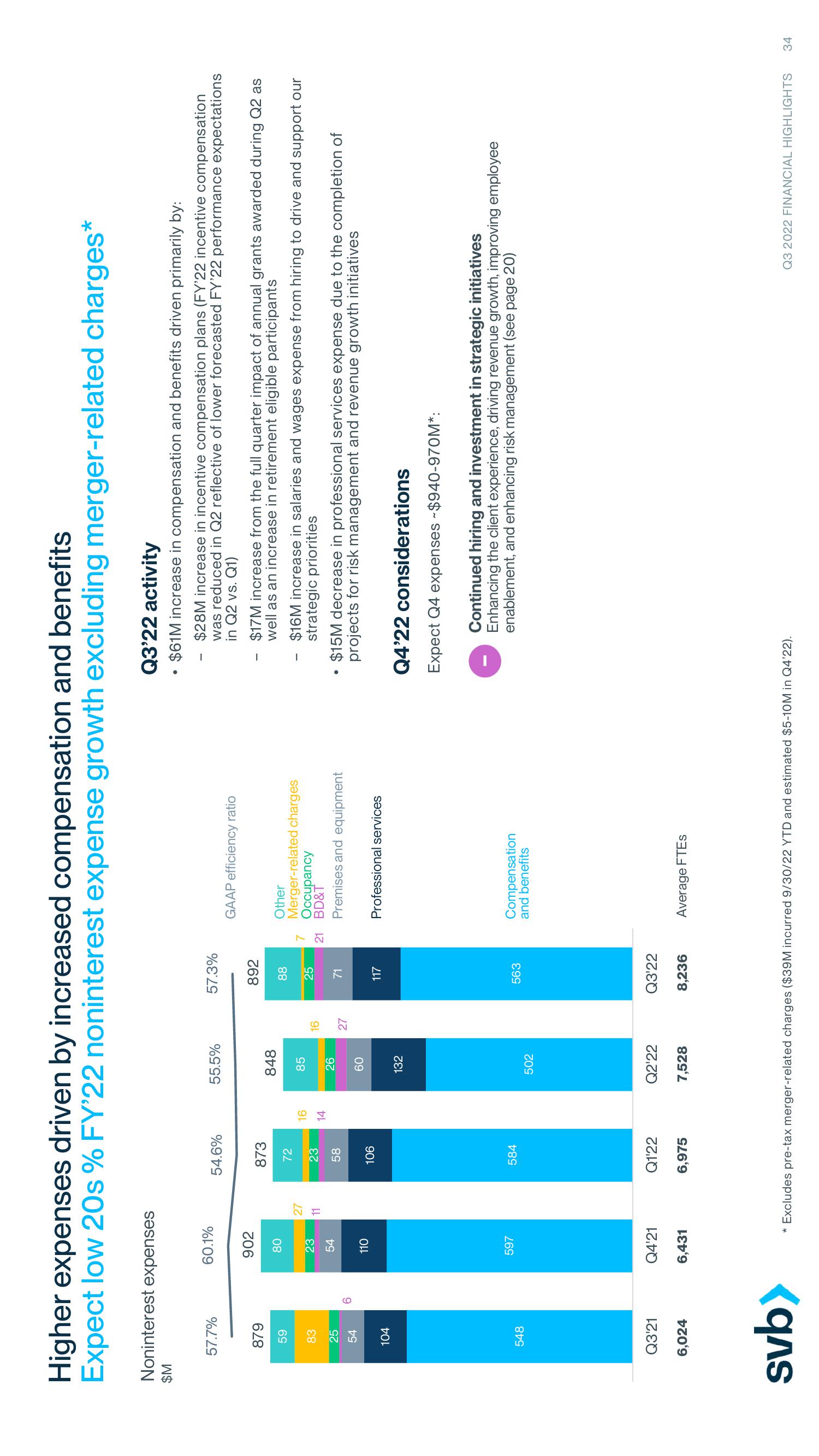

Higher expenses driven by increased compensation and benefits

Expect low 20s % FY'22 noninterest expense growth excluding merger-related charges*

Noninterest expenses

$M

57.7%

879

59

83

25

54

104

548

Q3'21

6,024

svb>

60.1%

902

80

23

54

110

597

Q4'21

6,431

27

11

54.6%

873

72

23

58

106

584

Q1'22

6,975

16

14

55.5%

848

85

26

60

132

502

Q2'22

7,528

16

27

57.3%

892

88

25

71

117

563

Q3'22

8,236

7

21

GAAP efficiency ratio

Other

Merger-related charges

Occupancy

BD&T

Premises and equipment

Professional services

Compensation

and benefits

Average FTES

Q3'22 activity

$61M increase in compensation and benefits driven primarily by:

$28M increase in incentive compensation plans (FY'22 incentive compensation

was reduced in Q2 reflective of lower forecasted FY'22 performance expectations

in Q2 vs. Q1)

·

$17M increase from the full quarter impact of annual grants awarded during Q2 as

well as an increase in retirement eligible participants

$16M increase in salaries and wages expense from hiring to drive and support our

strategic priorities

$15M decrease in professional services expense due to the completion of

projects for risk management and revenue growth initiatives

Q4'22 considerations

Expect Q4 expenses ~$940-970M*:

* Excludes pre-tax merger-related charges ($39M incurred 9/30/22 YTD and estimated $5-10M in Q4'22).

Continued hiring and investment in strategic initiatives

Enhancing the client experience, driving revenue growth, improving employee

enablement, and enhancing risk management (see page 20)

Q3 2022 FINANCIAL HIGHLIGHTS 34View entire presentation