Oaktree Real Estate Opportunities Fund VII, L.P.

Purchases

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

Appendix II: Evolution of Six Areas of Focus (Commercial)

Liquidations and

Refinancings

($ in millions)

$1,200

1,000

800

600

400

200

0

(200)

(400)

(600)

(800)

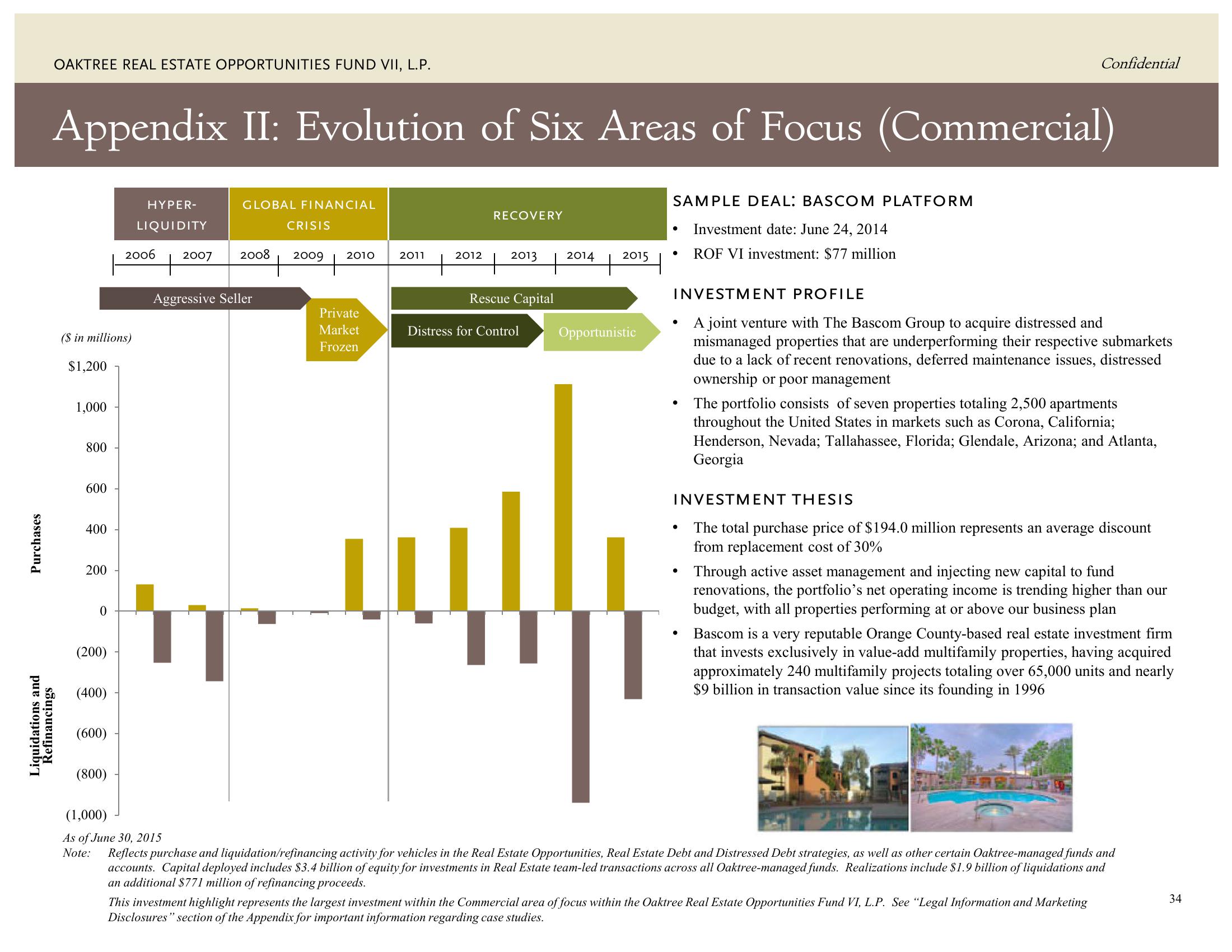

HYPER-

LIQUIDITY

2006 2007

GLOBAL FINANCIAL

CRISIS

2008 2009 2010

+

Aggressive Seller

Private

Market

Frozen

2011

2012

RECOVERY

2013

Rescue Capital

Distress for Control

2014

+

2015

Opportunistic

SAMPLE DEAL: BASCOM PLATFORM

Investment date: June 24, 2014

ROF VI investment: $77 million

●

Confidential

INVESTMENT PROFILE

A joint venture with The Bascom Group to acquire distressed and

mismanaged properties that are underperforming their respective submarkets

due to a lack of recent renovations, deferred maintenance issues, distressed

ownership or poor management

●

The portfolio consists of seven properties totaling 2,500 apartments

throughout the United States in markets such as Corona, California;

Henderson, Nevada; Tallahassee, Florida; Glendale, Arizona; and Atlanta,

Georgia

INVESTMENT THESIS

The total purchase price of $194.0 million represents an average discount

from replacement cost of 30%

Through active asset management and injecting new capital to fund

renovations, the portfolio's net operating income is trending higher than our

budget, with all properties performing at or above our business plan

Bascom is a very reputable Orange County-based real estate investment firm

that invests exclusively in value-add multifamily properties, having acquired

approximately 240 multifamily projects totaling over 65,000 units and nearly

$9 billion in transaction value since its founding in 1996

(1,000)

As of June 30, 2015

Note: Reflects purchase and liquidation/refinancing activity for vehicles in the Real Estate Opportunities, Real Estate Debt and Distressed Debt strategies, as well as other certain Oaktree-managed funds and

accounts. Capital deployed includes $3.4 billion of equity for investments in Real Estate team-led transactions across all Oaktree-managed funds. Realizations include $1.9 billion of liquidations and

an additional $771 million of refinancing proceeds.

This investment highlight represents the largest investment within the Commercial area of focus within the Oaktree Real Estate Opportunities Fund VI, L.P. See "Legal Information and Marketing

Disclosures" section of the Appendix for important information regarding case studies.

34View entire presentation