Allego SPAC Presentation Deck

Operational Benchmarking

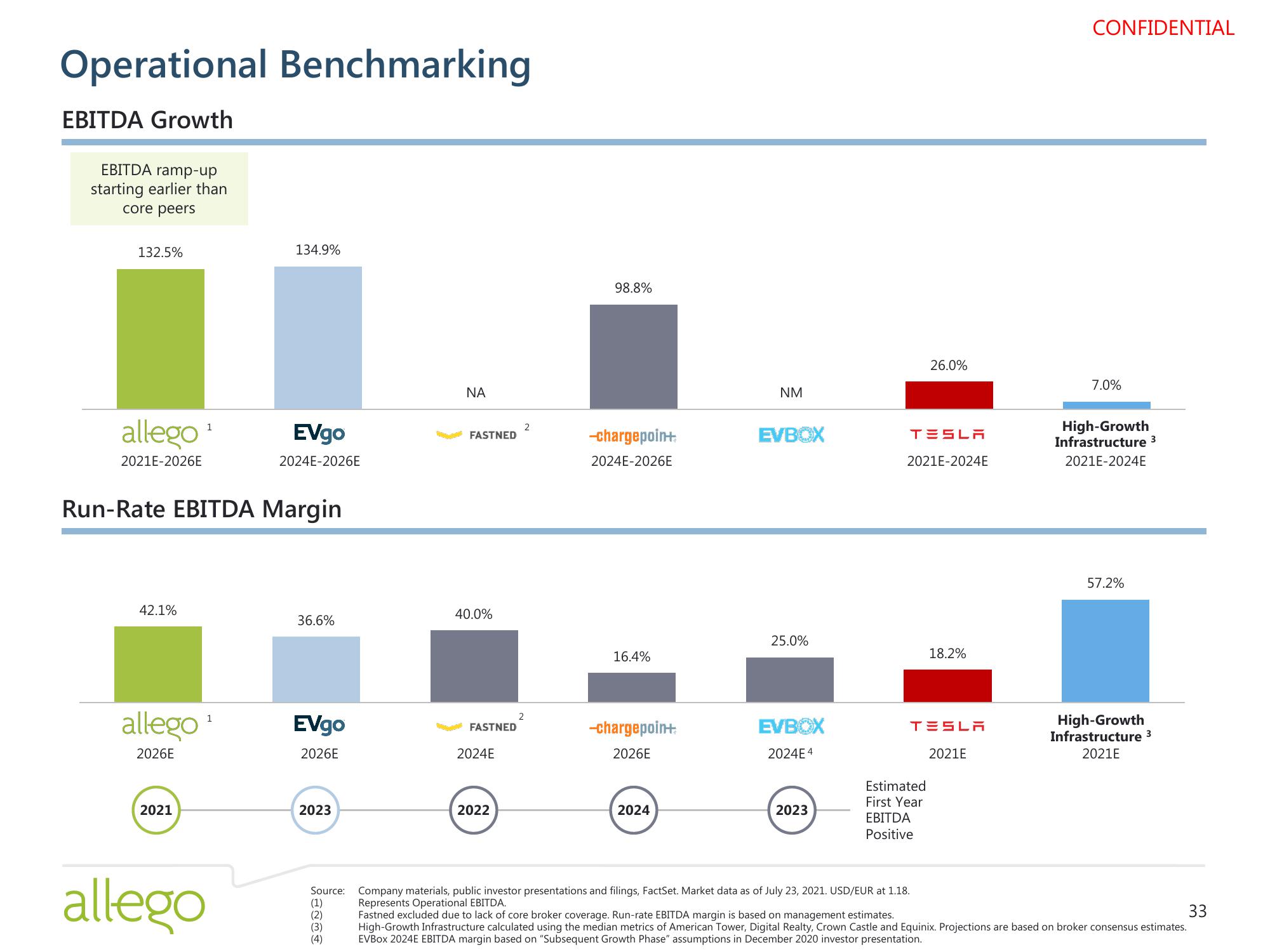

EBITDA Growth

EBITDA ramp-up

starting earlier than

core peers

132.5%

allego

2021E-2026E

42.1%

allego

2026E

1

Run-Rate EBITDA Margin

2021

1

134.9%

allego

EVgo

2024E-2026E

36.6%

EVgo

2026E

2023

ΝΑ

(1)

(2)

(3)

(4)

FASTNED

40.0%

FASTNED

2024E

2022

2

2

98.8%

-chargepoint

2024E-2026E

16.4%

-chargepoint

2026E

2024

NM

EVBOX

25.0%

EVBOX

2024E4

2023

26.0%

TESLA

2021E-2024E

Estimated

First Year

EBITDA

Positive

18.2%

TESLA

2021E

CONFIDENTIAL

7.0%

High-Growth

Infrastructure 3

2021E-2024E

57.2%

High-Growth

Infrastructure 3

2021E

Source: Company materials, public investor presentations and filings, FactSet. Market data as of July 23, 2021. USD/EUR at 1.18.

Represents Operational EBITDA.

Fastned excluded due to lack of core broker coverage. Run-rate EBITDA margin is based on management estimates.

33

High-Growth Infrastructure calculated using the median metrics of American Tower, Digital Realty, Crown Castle and Equinix. Projections are based on broker consensus estimates.

EVBOX 2024E EBITDA margin based on "Subsequent Growth Phase" assumptions in December 2020 investor presentation.View entire presentation