Li-Cycle Investor Presentation Deck

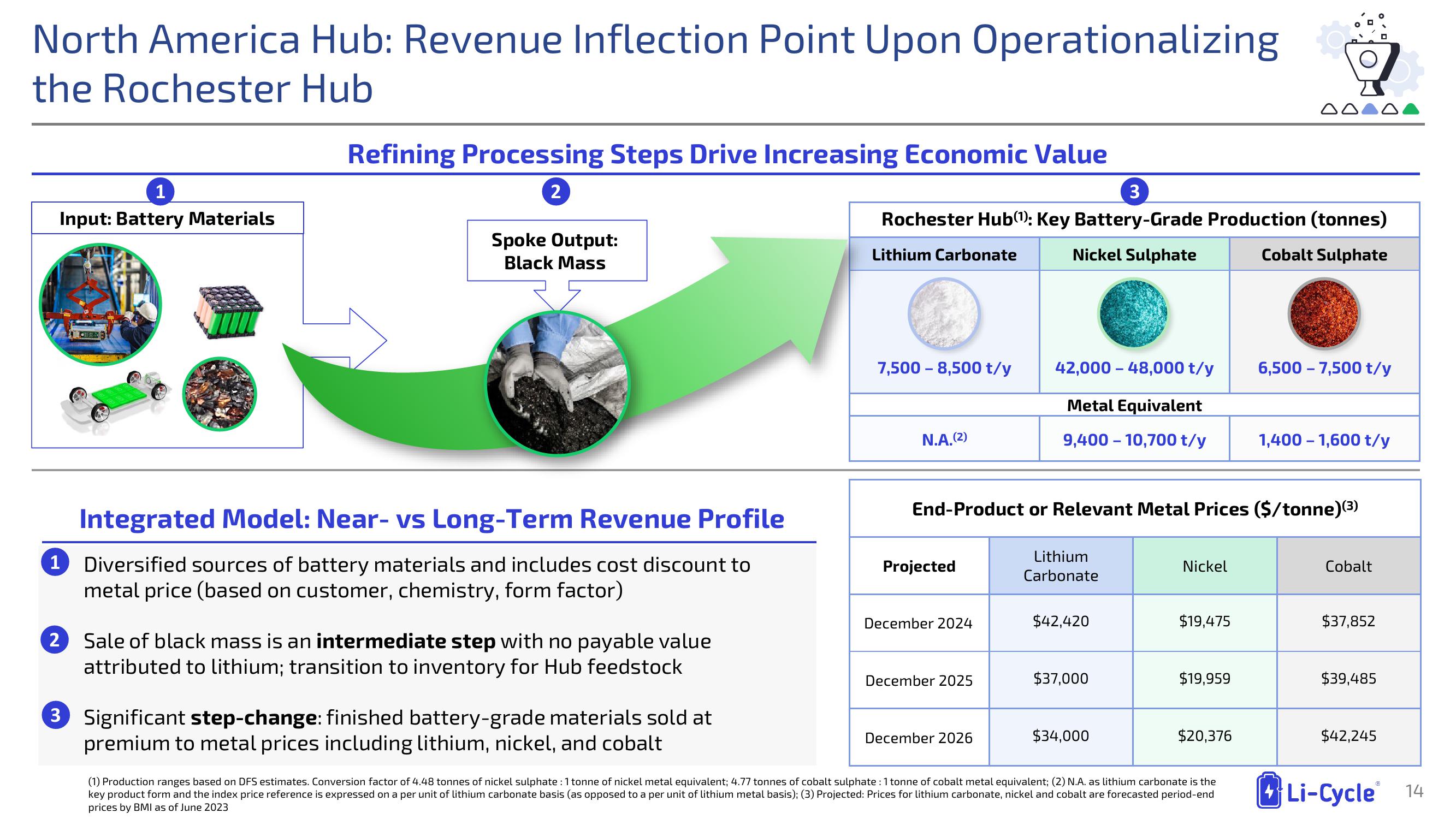

North America Hub: Revenue Inflection Point Upon Operationalizing

the Rochester Hub

1

Input: Battery Materials

1

OR

Refining Processing Steps Drive Increasing Economic Value

2

Spoke Output:

Black Mass

Integrated Model: Near- vs Long-Term Revenue Profile

Diversified sources of battery materials and includes cost discount to

metal price (based on customer, chemistry, form factor)

2 Sale of black mass is an intermediate step with no payable value

attributed to lithium; transition to inventory for Hub feedstock

3 Significant step-change: finished battery-grade materials sold at

premium to metal prices including lithium, nickel, and cobalt

3

Rochester Hub(¹): Key Battery-Grade Production (tonnes)

Nickel Sulphate

Cobalt Sulphate

Lithium Carbonate

7,500 - 8,500 t/y

N.A.(2)

Projected

December 2024

End-Product or Relevant Metal Prices ($/tonne)(3)

December 2025

42,000 - 48,000 t/y

Metal Equivalent

9,400 - 10,700 t/y

December 2026

Lithium

Carbonate

$42,420

$37,000

$34,000

Nickel

$19,475

$19,959

$20,376

6,500 - 7,500 t/y

(1) Production ranges based on DFS estimates. Conversion factor of 4.48 tonnes of nickel sulphate : 1 tonne of nickel metal equivalent; 4.77 tonnes of cobalt sulphate : 1 tonne of cobalt metal equivalent; (2) N.A. as lithium carbonate is the

key product form and the index price reference is expressed on a per unit of lithium carbonate basis (as opposed to a per unit of lithium metal basis); (3) Projected: Prices for lithium carbonate, nickel and cobalt are forecasted period-end

prices by BMI as of June 2023

1,400 - 1,600 t/y

Cobalt

$37,852

$39,485

$42,245

Li-Cycle 14View entire presentation