SoftBank Results Presentation Deck

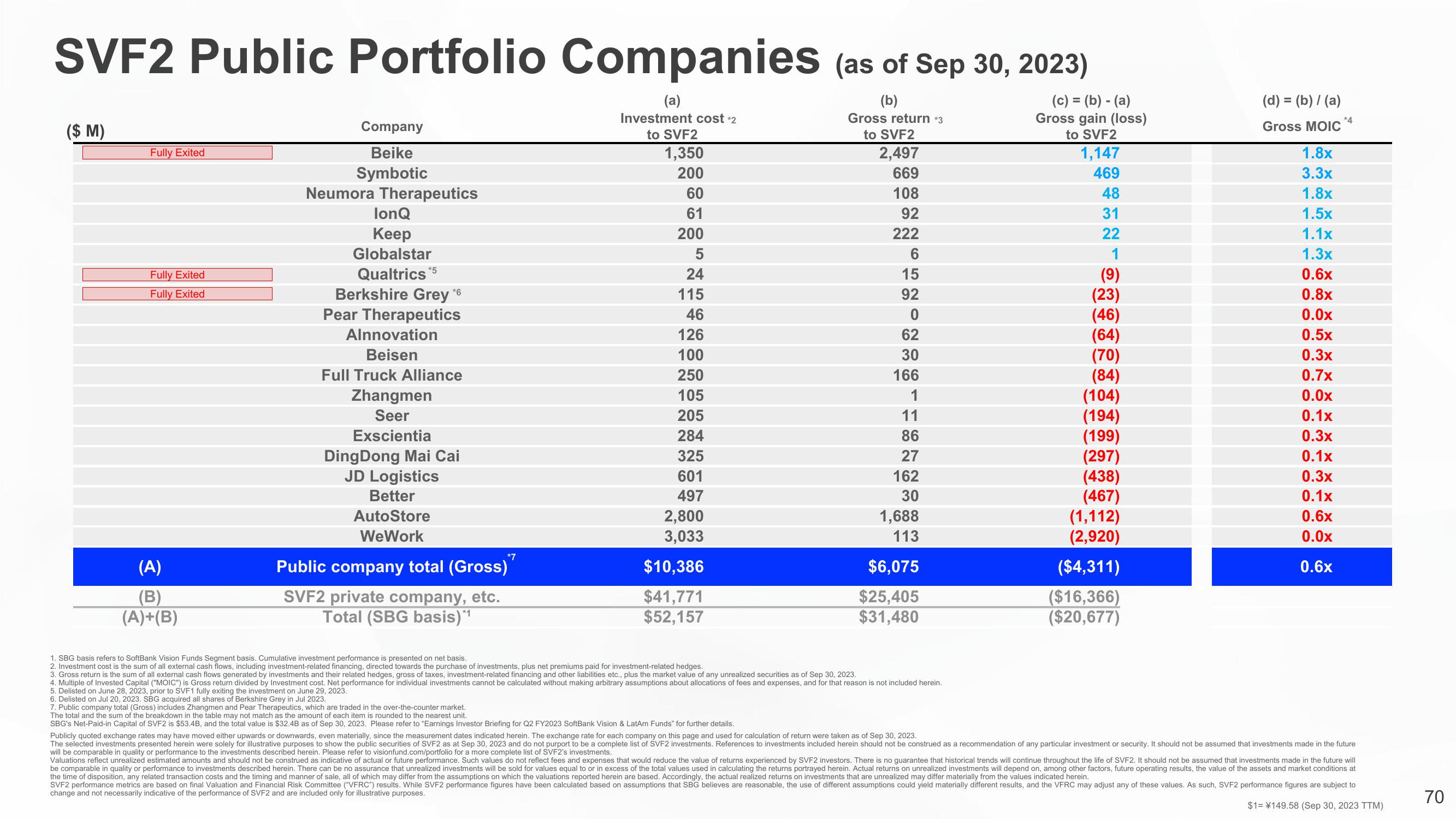

SVF2 Public Portfolio Companies (as of Sep 30, 2023)

(b)

(c) = (b) - (a)

Gross gain (loss)

to SVF2

1,147

469

($ M)

Fully Exited

Fully Exited

Fully Exited

(A)

(B)

(A)+(B)

Company

Beike

Symbotic

Neumora Therapeutics

lonQ

Keep

Globalstar

Qualtrics *5

Berkshire Grey *6

Pear Therapeutics

Alnnovation

Beisen

Full Truck Alliance

Zhangmen

Seer

Exscientia

DingDong Mai Cai

JD Logistics

Better

AutoStore

WeWork

*7

Public company total (Gross)

SVF2 private company, etc.

Total (SBG basis)*¹

(a)

Investment cost *2

to SVF2

1,350

200

60

61

200

5

24

115

46

126

100

250

105

205

284

325

601

497

2,800

3,033

$10,386

$41,771

$52,157

Gross return *3

to SVF2

2,497

669

108

92

222

7. Public company total (Gross) includes Zhangmen and Pear Therapeutics, which are traded in the over-the-counter market.

The total and the sum of the breakdown in the table may not match as the amount of each item is rounded to the nearest unit.

SBG's Net-Paid-in Capital of SVF2 is $53.4B, and the total value is $32. as of Sep 30, 2023. Please refer to "Earnings Investor Briefing for Q2 FY2023 SoftBank Vision & LatAm Funds" for further details.

6

15

92

0

62

30

166

1

11

86

27

162

30

1,688

113

$6,075

$25,405

$31,480

1. SBG basis refers to SoftBank Vision Funds Segment basis. Cumulative investment performance is presented on net basis.

2. Investment cost is the sum of all external cash flows, including investment-related financing, directed towards the purchase of investments, plus net premiums paid for investment-related hedges.

3. Gross return is the sum of all external cash flows generated by investments and their related hedges, gross of taxes, investment-related financing and other liabilities etc., plus the market value of any unrealized securities as of Sep 30, 2023.

4. Multiple of Invested Capital ("MOIC") is Gross return divided by Investment cost. Net performance for individual investments cannot be calculated without making arbitrary assumptions about allocations of fees and expenses, and for that reason is not included herein.

5. Delisted on June 28, 2023, prior to SVF1 fully exiting the investment on June 29, 2023.

6. Delisted on Jul 20, 2023. SBG acquired all shares of Berkshire Grey in Jul 2023.

48

31

22

1

(9)

(23)

(46)

(64)

(70)

(84)

(104)

(194)

(199)

(297)

438)

(467)

(1,112)

(2,920)

($4,311)

($16,366)

($20,677)

(d) = (b)/(a)

Gross MOIC

1.8x

3.3x

1.8x

1.5x

1.1x

1.3x

0.6x

0.8x

0.0x

0.5x

0.3x

0.7x

0.0x

0.1x

0.3x

0.1x

0.3x

0.1x

0.6x

0.0x

0.6x

*4

Publicly quoted exchange rates may have moved either upwards or downwards, even materially, since the measurement dates indicated herein. The exchange rate for each company on this page and used for calculation of return were taken as of Sep 30, 2023.

The selected investments presented herein were solely for illustrative purposes to show the public securities of SVF2 as at Sep 30, 2023 and do not purport to be a complete list of SVF2 investments. References to investments included herein should not be construed as a recommendation of any particular investment or security. It should not be assumed that investments made in the future

will be comparable in quality or performance to the investments described herein. Please refer to visionfund.com/portfolio for a more complete list of SVF2's investments.

Valuations reflect unrealized estimated amounts and should not be construed as indicative of actual or future performance. Such values do not reflect fees and expenses that would reduce the value of returns experienced by SVF2 investors. There is no guarantee that historical trends will continue throughout the life of SVF2. It should not be assumed that investments made in the future will

be comparable in quality or performance to investments described herein. There can be no assurance that unrealized investments will be sold for values equal to or in excess of the total values used in calculating the returns portrayed herein. Actual returns on unrealized investments will depend on, among other factors, future operating results, the value of the assets and market conditions at

the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions on which the valuations reported herein are based. Accordingly, the actual realized returns on investments that are unrealized may differ materially from the values indicated herein.

SVF2 performance metrics are based on final Valuation and Financial Risk Committee ("VFRC") results. While SVF2 performance figures have been calculated based on assumptions that SBG believes are reasonable, the use of different assumptions could yield materially different results, and the VFRC may adjust any of these values. As such, SVF2 performance figures are subject to

change and not necessarily indicative of the performance of SVF2 and are included only for illustrative purposes.

$1= 149.58 (Sep 30, 2023 TTM)

70View entire presentation