Netstreit Investor Presentation Deck

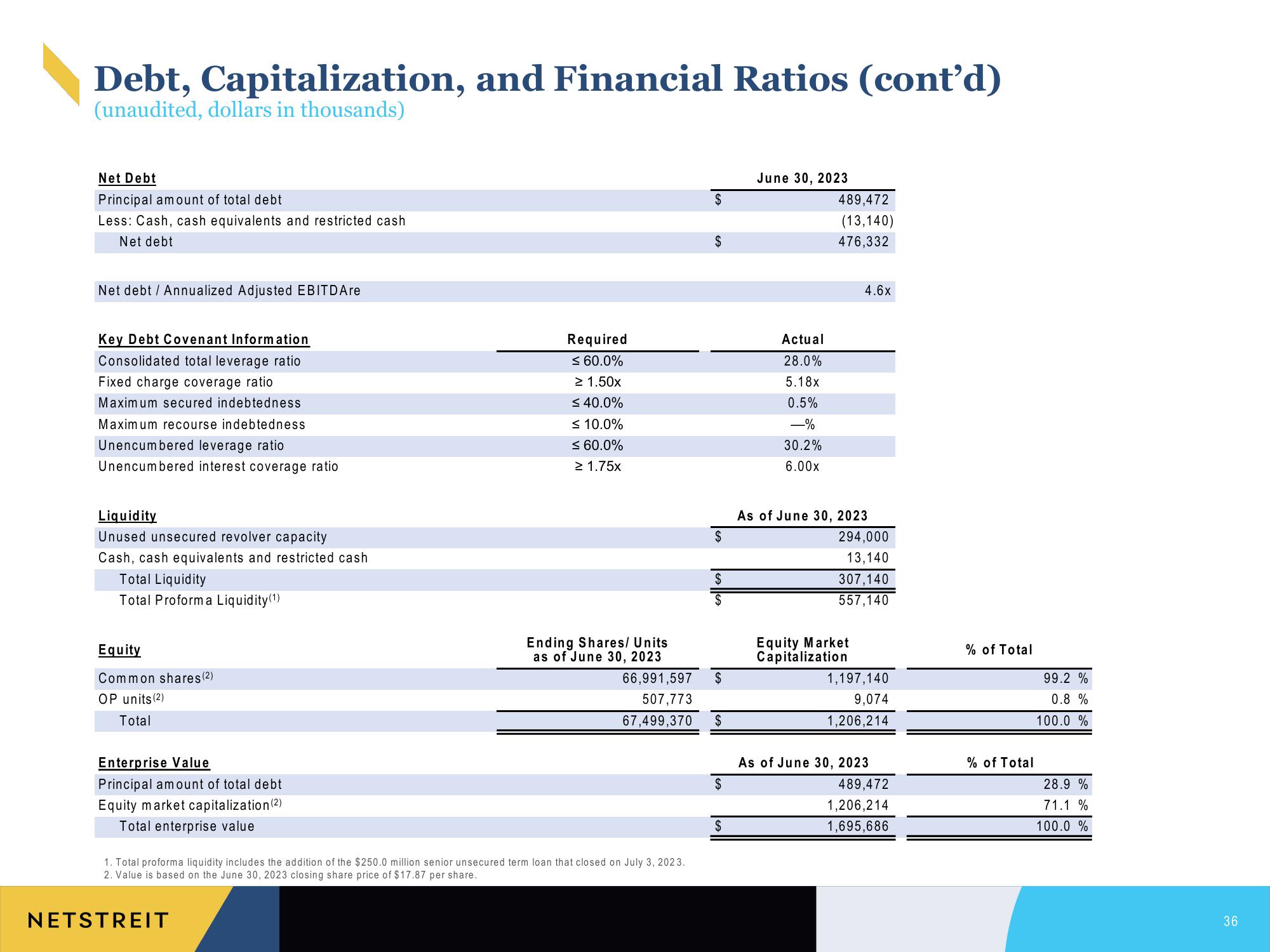

Debt, Capitalization, and Financial Ratios (cont'd)

(unaudited, dollars in thousands)

Net Debt

Principal amount of total debt

Less: Cash, cash equivalents and restricted cash

Net debt

Net debt / Annualized Adjusted EBITDAre

Key Debt Covenant Information

Consolidated total leverage ratio

Fixed charge coverage ratio

Maximum secured indebtedness

Maximum recourse indebtedness

Unencumbered leverage ratio

Unencumbered interest coverage ratio

Liquidity

Unused unsecured revolver capacity

Cash, cash equivalents and restricted cash

Total Liquidity

Total Proforma Liquidity (¹)

Equity

Common shares (2)

OP units (2)

Total

Enterprise Value

Principal amount of total debt

Equity market capitalization (2)

Total enterprise value

Required

≤ 60.0%

NETSTREIT

≥ 1.50x

≤ 40.0%

≤ 10.0%

≤ 60.0%

≥ 1.75x

Ending Shares/ Units

as of June 30, 2023

66,991,597

507,773

67,499,370

1. Total proforma liquidity includes the addition of the $250.0 million senior unsecured term loan that closed on July 3, 2023.

2. Value is based on the June 30, 2023 closing share price of $17.87 per share.

$

$

$

$

$

$

$

$

June 30, 2023

Actual

28.0%

5.18x

0.5%

-%

30.2%

6.00x

489,472

(13,140)

476,332

4.6x

As of June 30, 2023

294,000

13,140

307,140

557,140

Equity Market

Capitalization

1,197,140

9,074

1,206,214

As of June 30, 2023

489,472

1,206,214

1,695,686

% of Total

% of Total

99.2 %

0.8 %

100.0 %

28.9 %

71.1%

100.0 %

36View entire presentation