Wix Results Presentation Deck

Collections per new subscription increased for the third consecutive

quarter and was 14% higher than at the end of last year due to a greater

mix of subscriptions with a vertical application attached and increasing

App Market purchases.

Exceeded high end of guidance ranges with strong top-line growth and record

Adjusted EBITDA. Collections continued to grow in excess of 40% year over

year while exceeding the top end of our outlook and setting a new record.

Adjusted EBITDA was positive for the sixth consecutive quarter, to a record

$11.4 million, and we continued to generate positive free cash flow. Our unique

combination of scale, high-growth and positive cash flow is a direct result of

continued product innovation and marketing execution.

Strong initial results from Wix ADI. We made Wix ADI available in English to all

users globally in late August. Since the release, we have seen an improvement

in our overall conversion rate, as well as a dramatic reduction in the time it

takes our users to build a website on Wix. In addition, we have seen a

meaningful increase in adoption of our vertical applications. We continue to

make enhancements to the product and are even more excited by the potential

of Wix ADI than we were when we first unveiled it publicly.

US business accelerated and we continue to take greater market share.

Collections growth in the US accelerated to 48% year over year as we took

additional market share from our competitors. Our largest market is stronger

than ever as our brand and superior technology platform continues to resonate

strongly with small businesses.

Strong beat drove a significant increase in annual financial outlook. We are on

a significantly higher trajectory than we expected at the beginning of the year

when we introduced our full year guidance and are increasing our full year

outlook by a significant margin. Our consistent outperformance is proof that

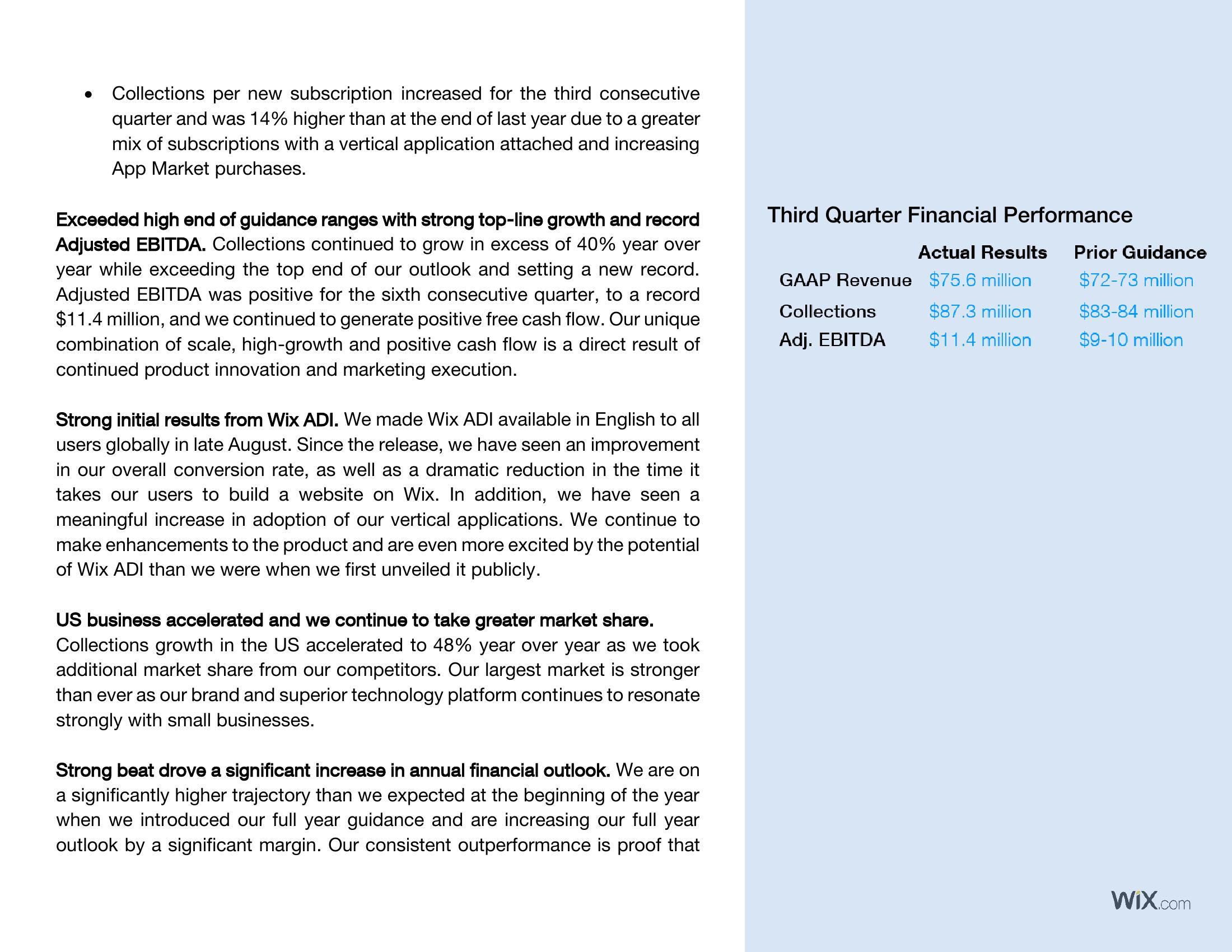

Third Quarter Financial Performance

Actual Results

$75.6 million

$87.3 million

$11.4 million

GAAP Revenue

Collections

Adj. EBITDA

Prior Guidance

$72-73 million

$83-84 million

$9-10 million

Wix.comView entire presentation