Solid Power SPAC Presentation Deck

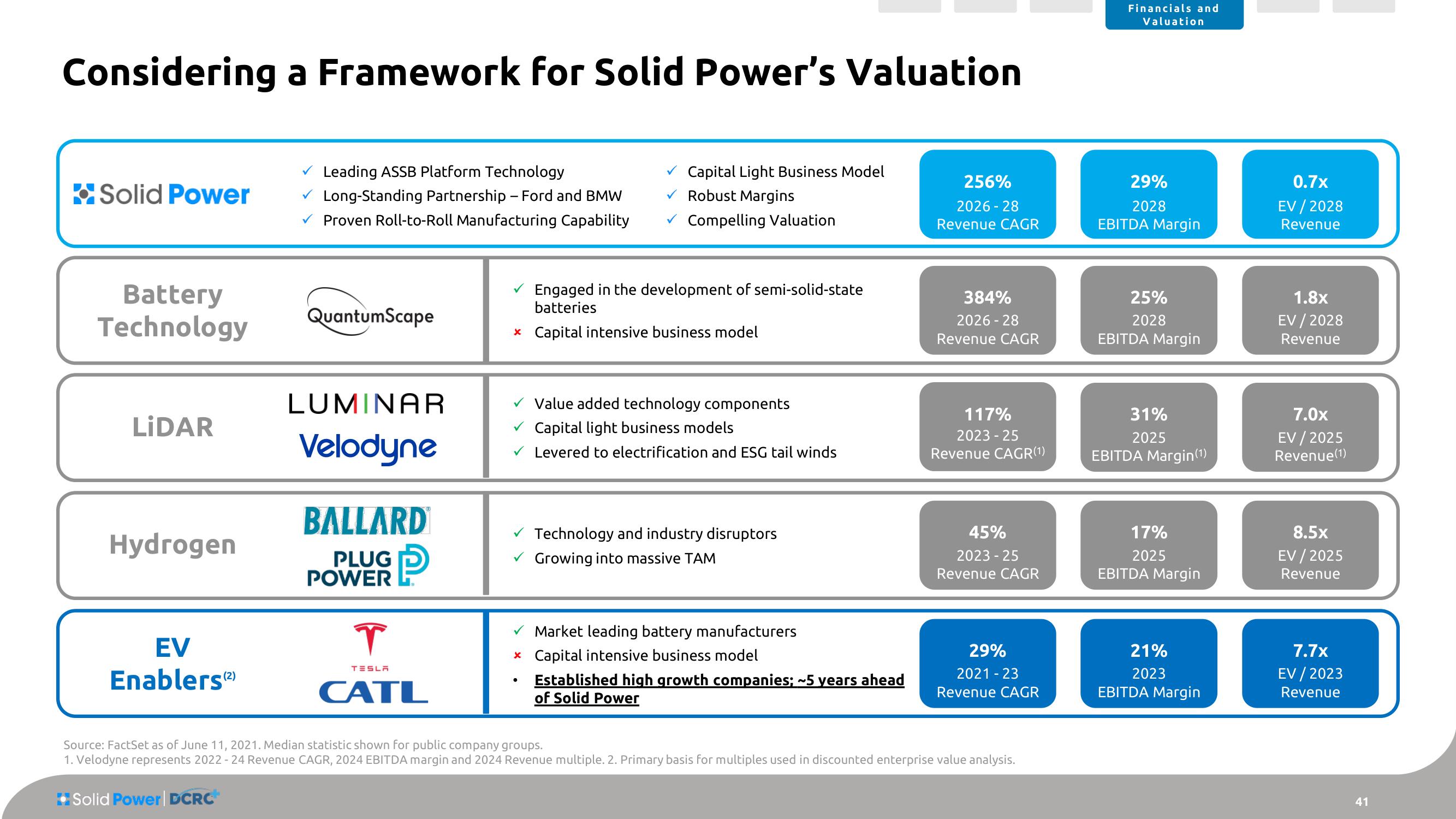

Considering a Framework for Solid Power's Valuation

Solid Power

Battery

Technology

LIDAR

Hydrogen

EV

Enablers (²)

✓ Leading ASSB Platform Technology

✓ Long-Standing Partnership - Ford and BMW

Proven Roll-to-Roll Manufacturing Capability

Solid Power | DCRC

QuantumScape

LUMINAR

Velodyne

BALLARD

PLUG

POWER

T

P

TESLA

CATL

✓ Capital Light Business Model

Robust Margins

Compelling Valuation

✓Engaged in the development of semi-solid-state

batteries

* Capital intensive business model

✓ Value added technology components

✓Capital light business models

✓ Levered to electrification and ESG tail winds

✓ Technology and industry disruptors

✓

Growing into massive TAM

✓ Market leading battery manufacturers

* Capital intensive business model

●

Established high growth companies; ~5 years ahead

of Solid Power

256%

2026-28

Revenue CAGR

384%

2026-28

Revenue CAGR

117%

2023-25

Revenue CAGR (1)

45%

2023-25

Revenue CAGR

29%

2021 - 23

Revenue CAGR

Source: FactSet as of June 11, 2021. Median statistic shown for public company groups.

1. Velodyne represents 2022-24 Revenue CAGR, 2024 EBITDA margin and 2024 Revenue multiple. 2. Primary basis for multiples used in discounted enterprise value analysis.

Financials and

Valuation

29%

2028

EBITDA Margin

25%

2028

EBITDA Margin

31%

2025

EBITDA Margin (¹)

17%

2025

EBITDA Margin

21%

2023

EBITDA Margin

0.7x

EV/2028

Revenue

1.8x

EV / 2028

Revenue

7.0x

EV / 2025

Revenue (1)

8.5x

EV / 2025

Revenue

7.7x

EV / 2023

Revenue

41View entire presentation