Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

PERFORMANCE

12.7%

(£39.9bn)

Senior

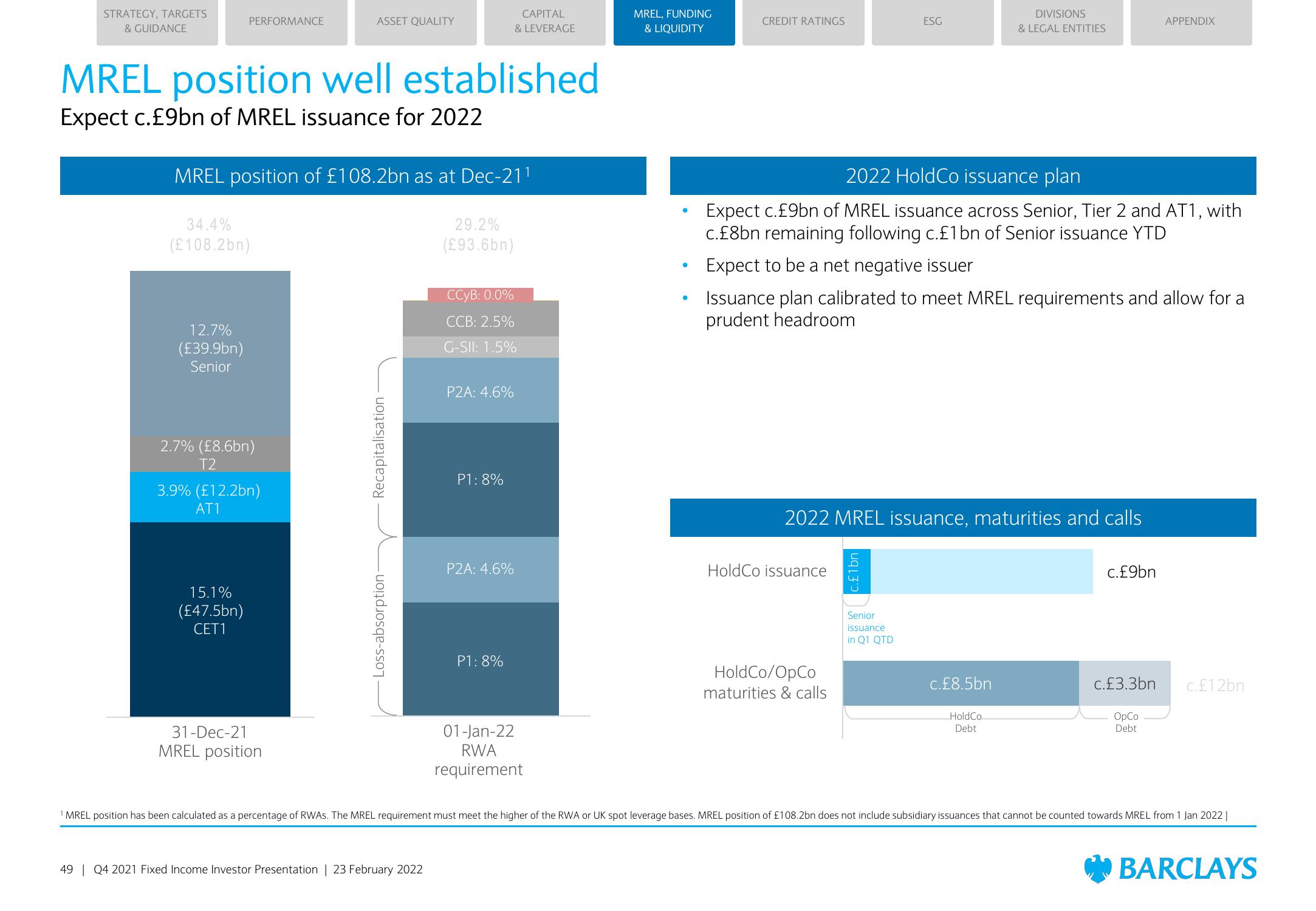

MREL position well established

Expect c.£9bn of MREL issuance for 2022

MREL position of £108.2bn as at Dec-211

34.4%

(£108.2bn)

29.2%

(£93.6bn)

2.7% (£8.6bn)

T2

3.9% (£12.2bn)

AT1

15.1%

(£47.5bn)

CET1

ASSET QUALITY

31-Dec-21

MREL position

Recapitalisation

Loss-absorption-

CCyB: 0.0%

CCB: 2.5%

G-SII: 1.5%

49 | Q4 2021 Fixed Income Investor Presentation | 23 February 2022

P2A: 4.6%

P1: 8%

CAPITAL

& LEVERAGE

P2A: 4.6%

P1: 8%

01-Jan-22

RWA

requirement

MREL, FUNDING

& LIQUIDITY

●

●

●

CREDIT RATINGS

HoldCo issuance

2022 HoldCo issuance plan

Expect c.£9bn of MREL issuance across Senior, Tier 2 and AT1, with

c.£8bn remaining following c.£1 bn of Senior issuance YTD

Expect to be a net negative issuer

Issuance plan calibrated to meet MREL requirements and allow for a

prudent headroom

2022 MREL issuance, maturities and calls

HoldCo/OpCo

maturities & calls

ESG

c.£1bn

Senior

issuance

in Q1 QTD

DIVISIONS

& LEGAL ENTITIES

c.£8.5bn

HoldCo

Debt

c.£9bn

c.£3.3bn

APPENDIX

OpCo

Debt

c.£12bn

¹ MREL position has been calculated as a percentage of RWAS. The MREL requirement must meet the higher of the RWA or UK spot leverage bases. MREL position of £108.2bn does not include subsidiary issuances that cannot be counted towards MREL from 1 Jan 2022 |

BARCLAYSView entire presentation