Credit Suisse Investment Banking Pitch Book

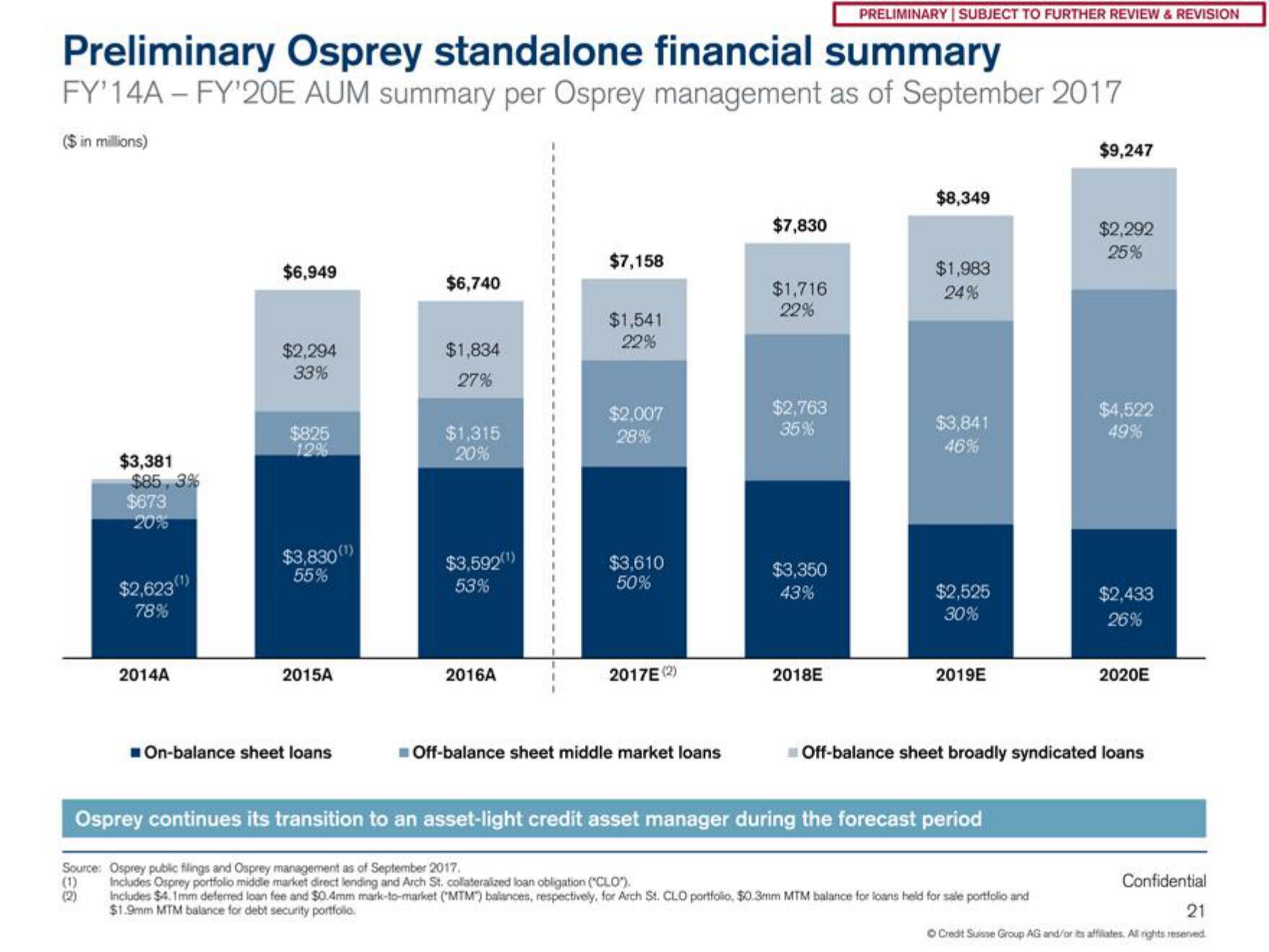

Preliminary Osprey standalone financial summary

FY'14A - FY'20E AUM summary per Osprey management as of September 2017

($ in millions)

$3,381

$85,3%

$673

20%

$2,623(¹)

78%

(1)

(2)

2014A

$6,949

$2,294

33%

$825

12%

$3,830 (¹)

55%

2015A

On-balance sheet loans

$6,740

$1,834

27%

$1,315

20%

$3,592(¹)

53%

2016A

1

1

1

1

$7,158

$1,541

22%

$2,007

28%

$3,610

50%

2017E (2)

Off-balance sheet middle market loans

$7,830

$1,716

22%

$2,763

35%

$3,350

43%

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

2018E

$8,349

$1,983

24%

$3,841

46%

$2,525

30%

2019E

Osprey continues its transition to an asset-light credit asset manager during the forecast period

Source: Osprey public flings and Osprey management as of September 2017.

Includes Osprey portfolio middle market direct lending and Arch St. collateralized loan obligation ("CLO").

Includes $4.1mm deferred loan fee and $0.4mm mark-to-market (MTM") balances, respectively, for Arch St. CLO portfolio, $0.3mm MTM balance for loans held for sale portfolio and

$1.9mm MTM balance for debt security portfolio.

$9,247

$2,292

25%

$4,522

49%

$2,433

26%

Off-balance sheet broadly syndicated loans

2020E

Confidential

21

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved

OView entire presentation