Vroom IPO Presentation Deck

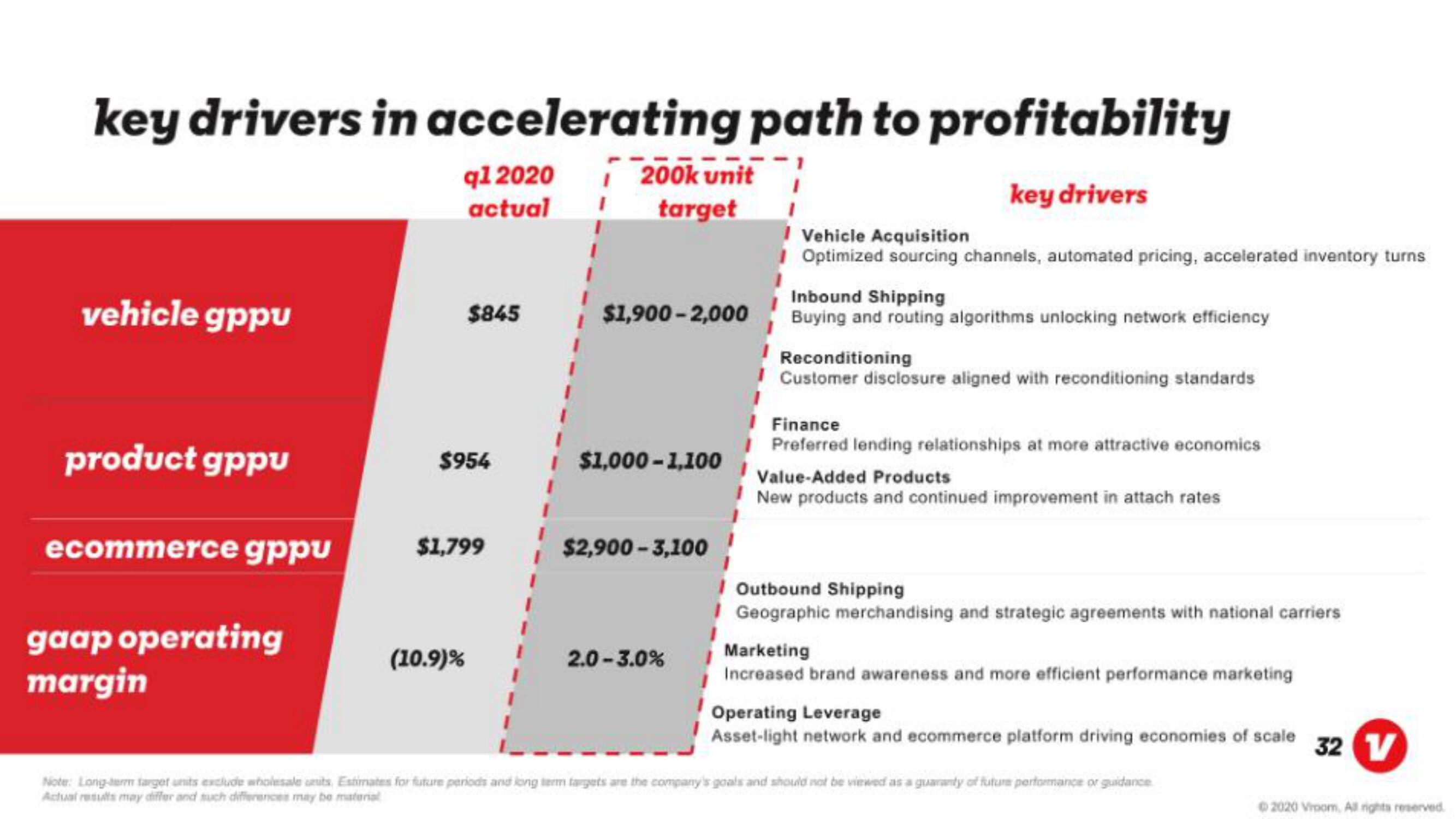

key drivers in accelerating path to profitability

q1 2020

actual

key drivers

vehicle gppu

product gppu

ecommerce gppu

gaap operating

margin

$845

$954

$1,799

(10.9)%

1

200k unit

I target

$1,900 -2,000

$1,000-1,100

$2,900-3,100

2.0-3.0%

1

Vehicle Acquisition

Optimized sourcing channels, automated pricing, accelerated inventory turns

Inbound Shipping

Buying and routing algorithms unlocking network efficiency

Reconditioning

Customer disclosure aligned with reconditioning standards

Finance

Preferred lending relationships at more attractive economics

Value-Added Products

New products and continued improvement in attach rates

Outbound Shipping

Geographic merchandising and strategic agreements with national carriers

Marketing

Increased brand awareness and more efficient performance marketing

Operating Leverage

Asset-light network and ecommerce platform driving economies of scale 32 V

Note: Long-term target units exclude wholesale units, Estimates for future periods and long term targets are the company's goals and should not be viewed as a guaranty of future performance or guidance

Actual results may differ and much differences may be material

©2020 Vroom. All rights reserved.View entire presentation