Moelis & Company Investor Presentation Deck

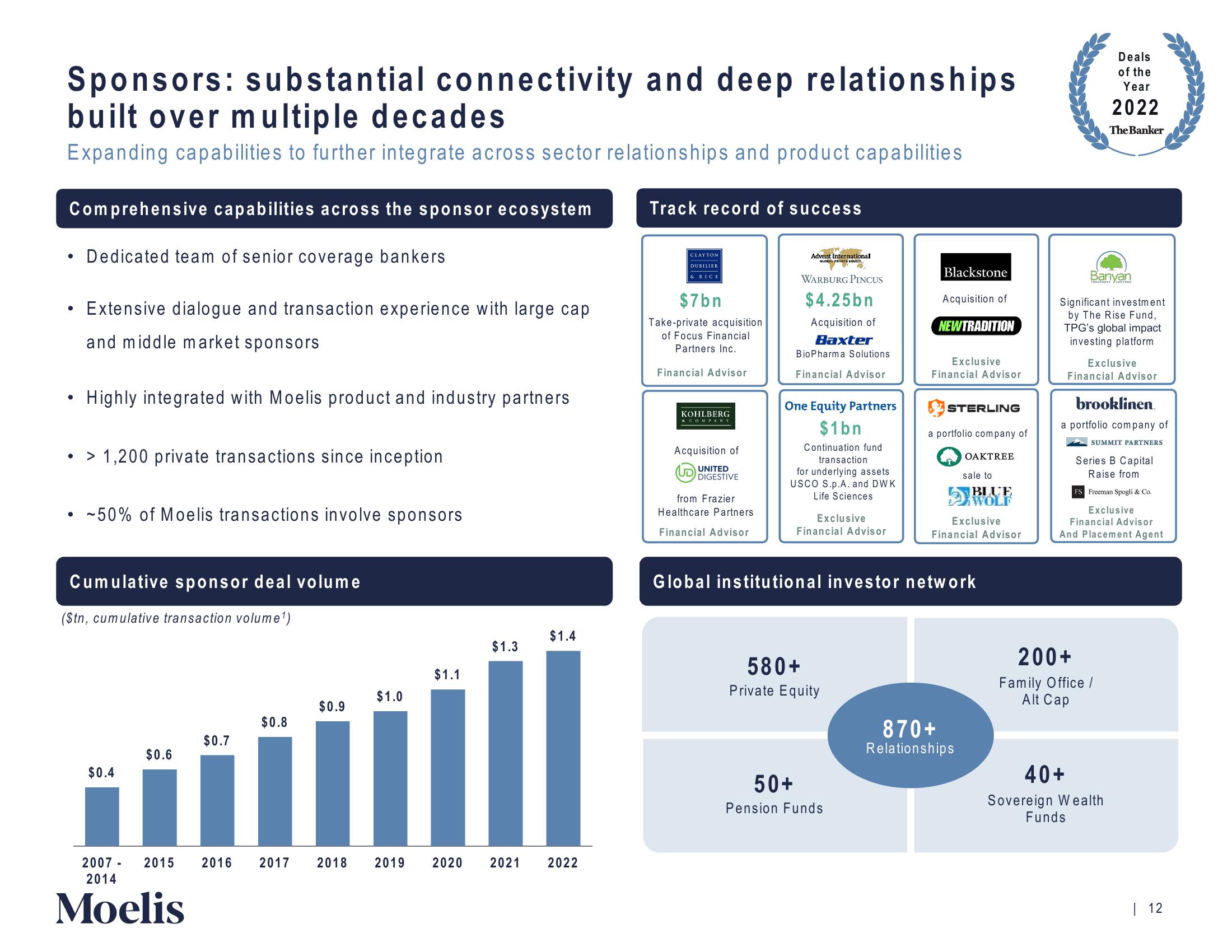

Sponsors: substantial connectivity and deep relationships

built over multiple decades

Expanding capabilities to further integrate across sector relationships and product capabilities

Comprehensive capabilities across the sponsor ecosystem

Dedicated team of senior coverage bankers

●

●

●

●

Extensive dialogue and transaction experience with large cap

and middle market sponsors

Highly integrated with Moelis product and industry partners

> 1,200 private transactions since inception

-50% of Moelis transactions involve sponsors

Cumulative sponsor deal volume

($tn, cumulative transaction volume¹)

$0.4

$0.6

$0.7

$0.8

$0.9

$1.0

$1.1

$1.3

2007 - 2015 2016 2017 2018 2019 2020 2021

2014

Moelis

$1.4

2022

Track record of success

CLAYTON

DUBILIER

& RICE

$7bn

Take-private acquisition

of Focus Financial

Partners Inc.

Financial Advisor

KOHLBERG

& COMPANY

Acquisition of

UD

UNITED

DIGESTIVE

from Frazier

Healthcare Partners

Financial Advisor

Advent International

GLOBAL PRIVATE EQUITY

VA

WARBURG PINCUS

$4.25bn

Acquisition of

Baxter

BioPharma Solutions

Financial Advisor

One Equity Partners

$1bn

Continuation fund

transaction

for underlying assets

USCO S.p.A. and DWK

Life Sciences

Exclusive

Financial Advisor

580+

Private Equity

Blackstone

50+

Pension Funds

Acquisition of

NEWTRADITION

Exclusive

Financial Advisor

STERLING

a portfolio company of

OAKTREE

sale to

BLUE

WOLF

Exclusive

Global institutional investor network

Financial Advisor

870+

Relationships

Banyan

Deals

of the

Year

2022

The Banker

Significant investment

by The Rise Fund,

TPG's global impact

investing platform

Exclusive

Financial Advisor

brooklinen.

a portfolio company of

SUMMIT PARTNERS

Series B Capital

Raise from

FS Freeman Spogli & Co.

Exclusive

Financial Advisor

And Placement Agent

200+

Family Office /

Alt Cap

40+

Sovereign Wealth

Funds

| 12View entire presentation