Hilltop Holdings Results Presentation Deck

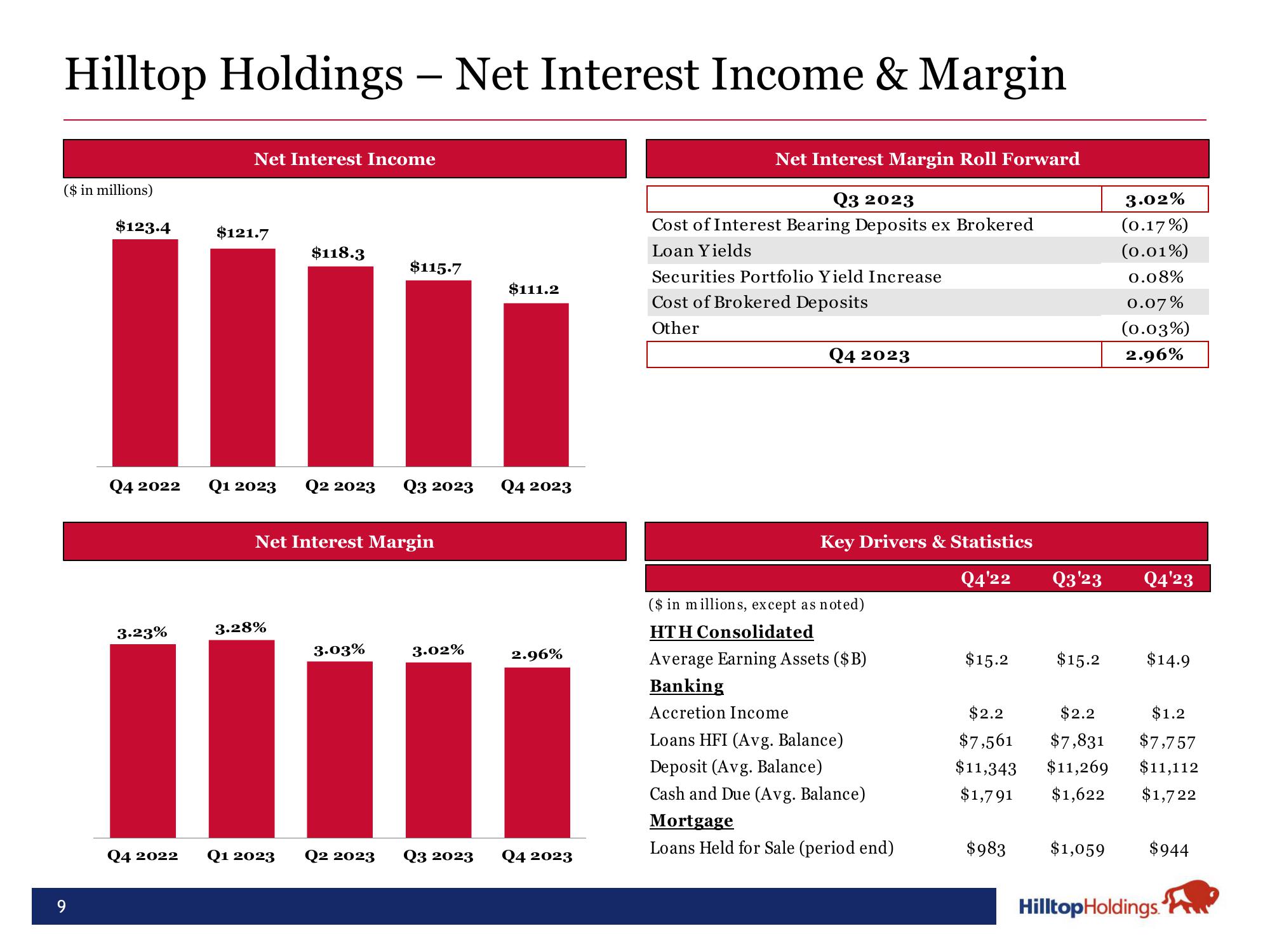

Hilltop Holdings - Net Interest Income & Margin

($ in millions)

a

$123.4

Q4 2022

3.23%

Net Interest Income

$121.7

$118.3

Q1 2023 Q2 2023 Q3 2023

3.28%

$115.7

Net Interest Margin

3.03%

3.02%

$111.2

Q4 2023

2.96%

Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023

Net Interest Margin Roll Forward

Q3 2023

Cost of Interest Bearing Deposits ex Brokered

Loan Yields

Securities Portfolio Yield Increase

Cost of Brokered Deposits

Other

Q4 2023

Key Drivers & Statistics

Q4'22

($ in millions, except as noted)

HTH Consolidated

Average Earning Assets ($B)

Banking

Accretion Income

Loans HFI (Avg. Balance)

Deposit (Avg. Balance)

Cash and Due (Avg. Balance)

Mortgage

Loans Held for Sale (period end)

$15.2

Q3'23

$983

$15.2

$2.2

$2.2

$7,561 $7,831

$11,343 $11,269

$1,791 $1,622

$1,059

3.02%

(0.17%)

(0.01%)

0.08%

0.07%

(0.03%)

2.96%

Q4'23

$14.9

$1.2

$7,757

$11,112

$1,722

$944

Hilltop Holdings.View entire presentation