Deutsche Bank Results Presentation Deck

Investment Bank

In € m, unless stated otherwise

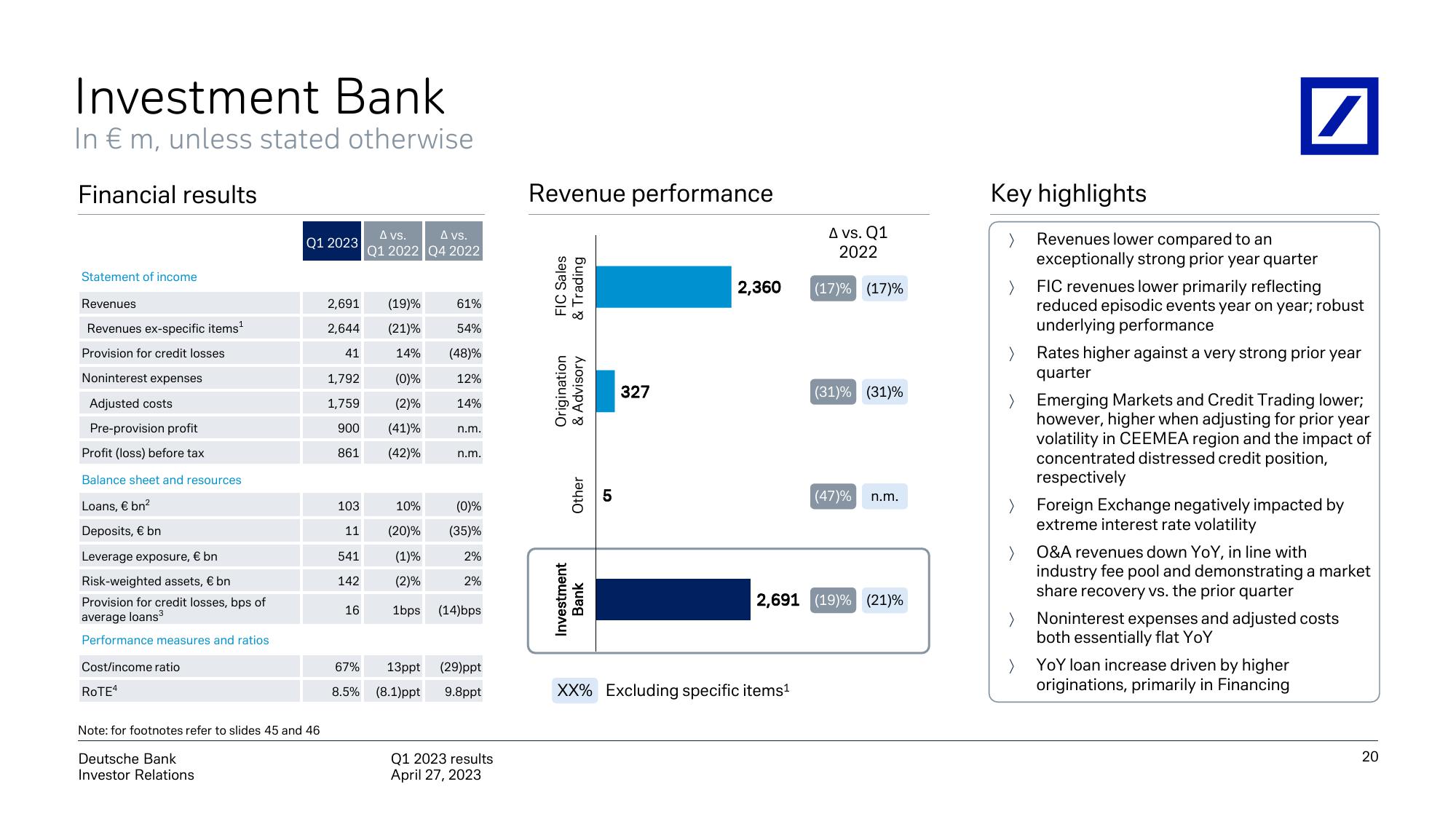

Financial results

Statement of income

Revenues

Revenues ex-specific items¹

Provision for credit losses

Noninterest expenses

Adjusted costs

Pre-provision profit

Profit (loss) before tax

Balance sheet and resources

Loans, € bn²

Deposits, € bn

Leverage exposure, € bn

Risk-weighted assets, € bn

Provision for credit losses, bps of

average loans³

Performance measures and ratios

Cost/income ratio

ROTE4

Q1 2023

Note: for footnotes refer to slides 45 and 46

Deutsche Bank

Investor Relations

2,691 (19)%

2,644

(21)%

41

1,792

1,759

900

861

103

11

541

142

16

A vs.

A vs.

Q1 2022 Q4 2022

67%

8.5%

61%

54%

14% (48)%

(0)%

12%

(2)%

14%

(41)%

(42)%

n.m.

n.m.

10%

(0)%

(20)% (35)%

(1)%

(2)%

1bps (14)bps

2%

2%

13ppt (29)ppt

(8.1)ppt 9.8ppt

Q1 2023 results

April 27, 2023

Revenue performance

FIC Sales

& Trading

Origination

& Advisory

Other

Investment

Bank

327

2,360

A vs. Q1

2022

XX% Excluding specific items¹

(17) % (17) %

(31) % (31) %

(47)%

n.m.

2,691 (19) % (21)%

Key highlights

/

Revenues lower compared to an

exceptionally strong prior year quarter

FIC revenues lower primarily reflecting

reduced episodic events year on year; robust

underlying performance

Rates higher against a very strong prior year

quarter

Emerging Markets and Credit Trading lower;

however, higher when adjusting for prior year

volatility in CEEMEA region and the impact of

concentrated distressed credit position,

respectively

Foreign Exchange negatively impacted by

extreme interest rate volatility

O&A revenues down YoY, in line with

industry fee pool and demonstrating a market

share recovery vs. the prior quarter

Noninterest expenses and adjusted costs

both essentially flat YoY

YOY loan increase driven by higher

originations, primarily in Financing

20View entire presentation