ZipRecruiter Investor Presentation Deck

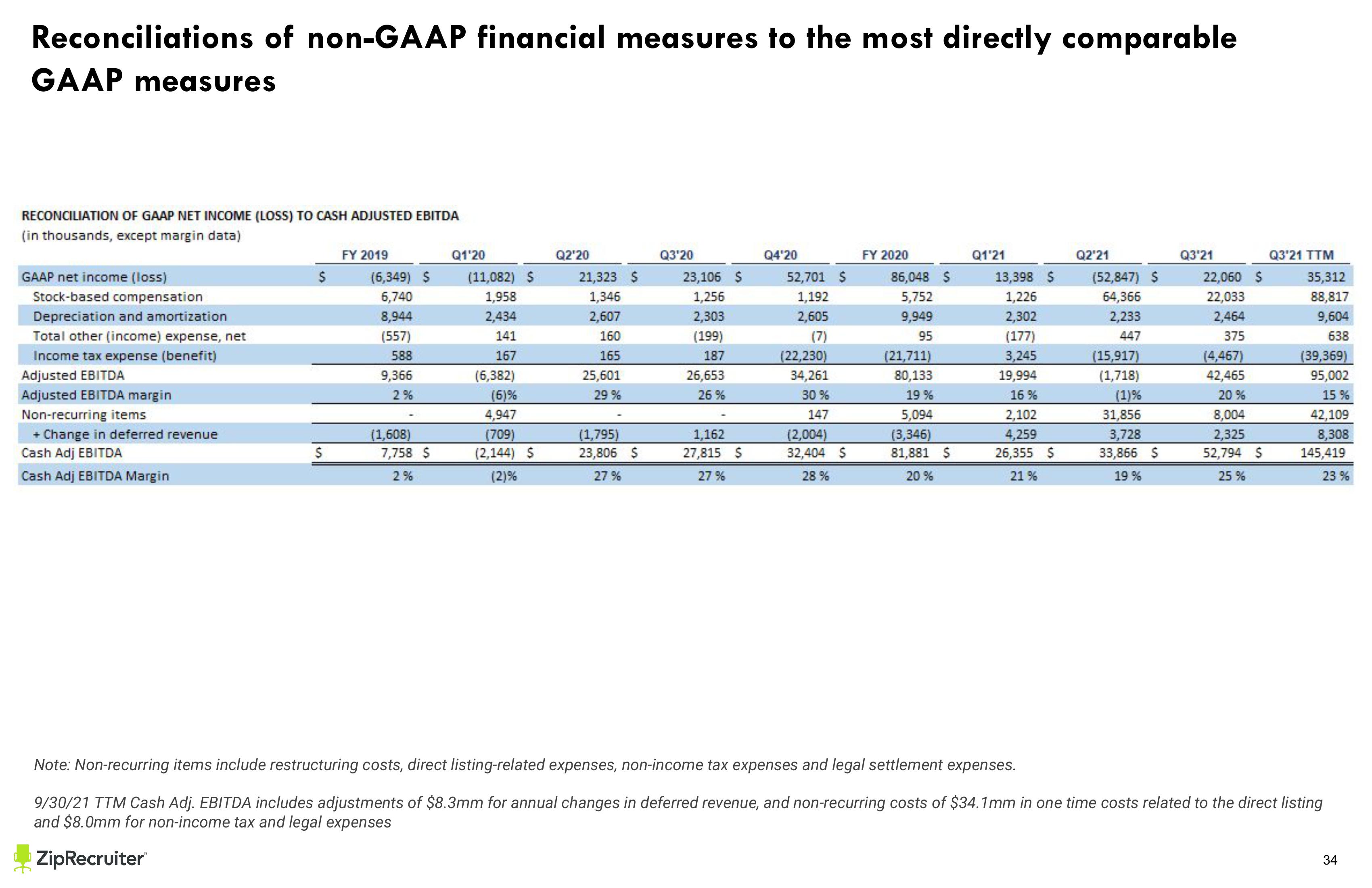

Reconciliations of non-GAAP financial measures to the most directly comparable

GAAP measures

RECONCILIATION OF GAAP NET INCOME (LOSS) TO CASH ADJUSTED EBITDA

(in thousands, except margin data)

GAAP net income (loss)

Stock-based compensation

Depreciation and amortization

Total other (income) expense, net

Income tax expense (benefit)

Adjusted EBITDA

Adjusted EBITDA margin

Non-recurring items

+ Change in deferred revenue

Cash Adj EBITDA

Cash Adj EBITDA Margin

$

$

FY 2019

(6,349) $

6,740

8,944

(557)

588

9,366

2%

(1,608)

7,758 $

2%

Q1'20

(11,082) S

1,958

2,434

141

167

(6,382)

(6)%

4,947

(709)

(2,144) S

(2)%

Q2'20

21,323 $

1,346

2,607

160

165

25,601

29 %

(1,795)

23,806 $

27%

Q3'20

23,106 $

1,256

2,303

(199)

187

26,653

26%

1,162

27,815 $

27%

Q4'20

52,701 $

1,192

2,605

(7)

(22,230)

34,261

30%

147

(2,004)

32,404 $

28%

FY 2020

86,048 $

5,752

9,949

95

(21,711)

80,133

19 %

5,094

(3,346)

81,881 $

20%

Q1'21

13,398 $

1,226

2,302

(177)

3,245

19,994

16%

2,102

4,259

26,355 $

21%

Q2'21

(52,847) $

64,366

2,233

447

(15,917)

(1,718)

(1)%

31,856

3,728

33,866 $

19 %

Q3'21

22,060 $

22,033

2,464

375

(4,467)

42,465

20%

8,004

2,325

52,794 $

25%

Q3'21 TTM

35,312

88,817

9,604

638

(39,369)

95,002

15 %

42,109

8,308

145,419

23 %

Note: Non-recurring items include restructuring costs, direct listing-related expenses, non-income tax expenses and legal settlement expenses.

9/30/21 TTM Cash Adj. EBITDA includes adjustments of $8.3mm for annual changes in deferred revenue, and non-recurring costs of $34.1mm in one time costs related to the direct listing

and $8.0mm for non-income tax and legal expenses

ZipRecruiter

34View entire presentation