First Quarter 2017 Financial Review

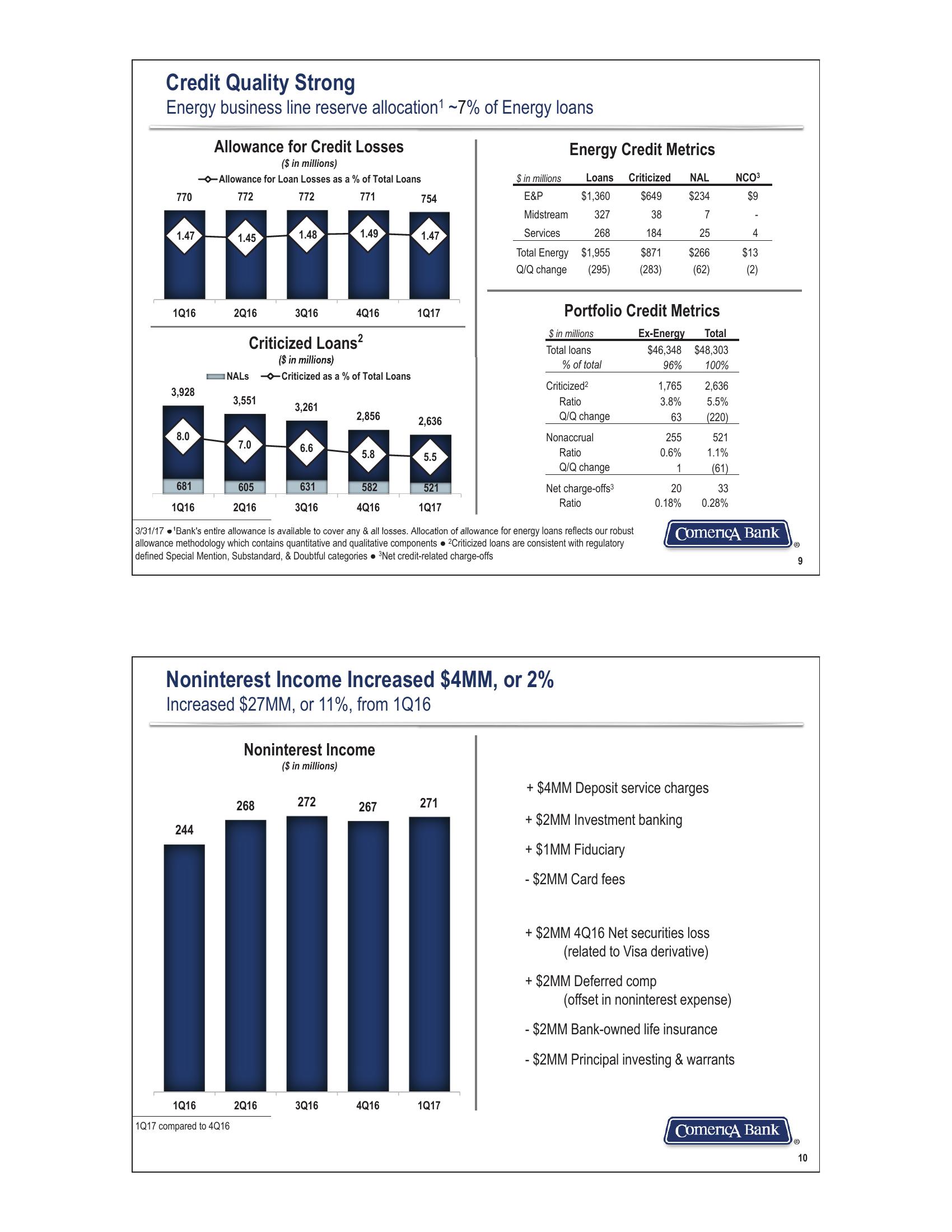

Credit Quality Strong

Energy business line reserve allocation¹ ~7% of Energy loans

Allowance for Credit Losses

($ in millions)

Allowance for Loan Losses as a % of Total Loans

Energy Credit Metrics

$ in millions

Loans Criticized NAL

NCO³

770

772

772

771

754

E&P

$1,360

$649

$234

$9

Midstream

327

38

7

1.47

1.45

1.48

1.49

1.47

Services

268

184

25

4

Total Energy $1,955

Q/Q change

$871

$266

$13

(295)

(283)

(62)

(2)

1Q16

2Q16

3Q16

Criticized Loans²

($ in millions)

NALS Criticized as a % of Total Loans

4Q16

1Q17

Portfolio Credit Metrics

$ in millions

Ex-Energy

Total

Total loans

$46,348

$48,303

% of total

96%

100%

Criticized²

1,765

2,636

3,928

3,551

Ratio

3.8%

5.5%

3,261

8.0

7.0

6.6

681

605

631

582

521

1Q16

2Q16

3Q16

4Q16

1Q17

00000

2,856

Q/Q change

63

2,636

(220)

Nonaccrual

255

521

5.8

5.5

Ratio

0.6%

1.1%

Q/Q change

1

(61)

Net charge-offs³

20

33

Ratio

0.18%

0.28%

3/31/17 'Bank's entire allowance is available to cover any & all losses. Allocation of allowance for energy loans reflects our robust

allowance methodology which contains quantitative and qualitative components 2Criticized loans are consistent with regulatory

defined Special Mention, Substandard, & Doubtful categories ³Net credit-related charge-offs

Comerica Bank

9

Noninterest Income Increased $4MM, or 2%

Increased $27MM, or 11%, from 1Q16

Noninterest Income

($ in millions)

272

268

271

267

24

244

1Q16

1Q17 compared to 4Q16

2Q16

3Q16

4Q16

1Q17

+ $4MM Deposit service charges

+ $2MM Investment banking

+$1MM Fiduciary

- $2MM Card fees

+$2MM 4Q16 Net securities loss

(related to Visa derivative)

+$2MM Deferred comp

(offset in noninterest expense)

- $2MM Bank-owned life insurance

- $2MM Principal investing & warrants

Comerica Bank

10View entire presentation