Fresnillo Results Presentation Deck

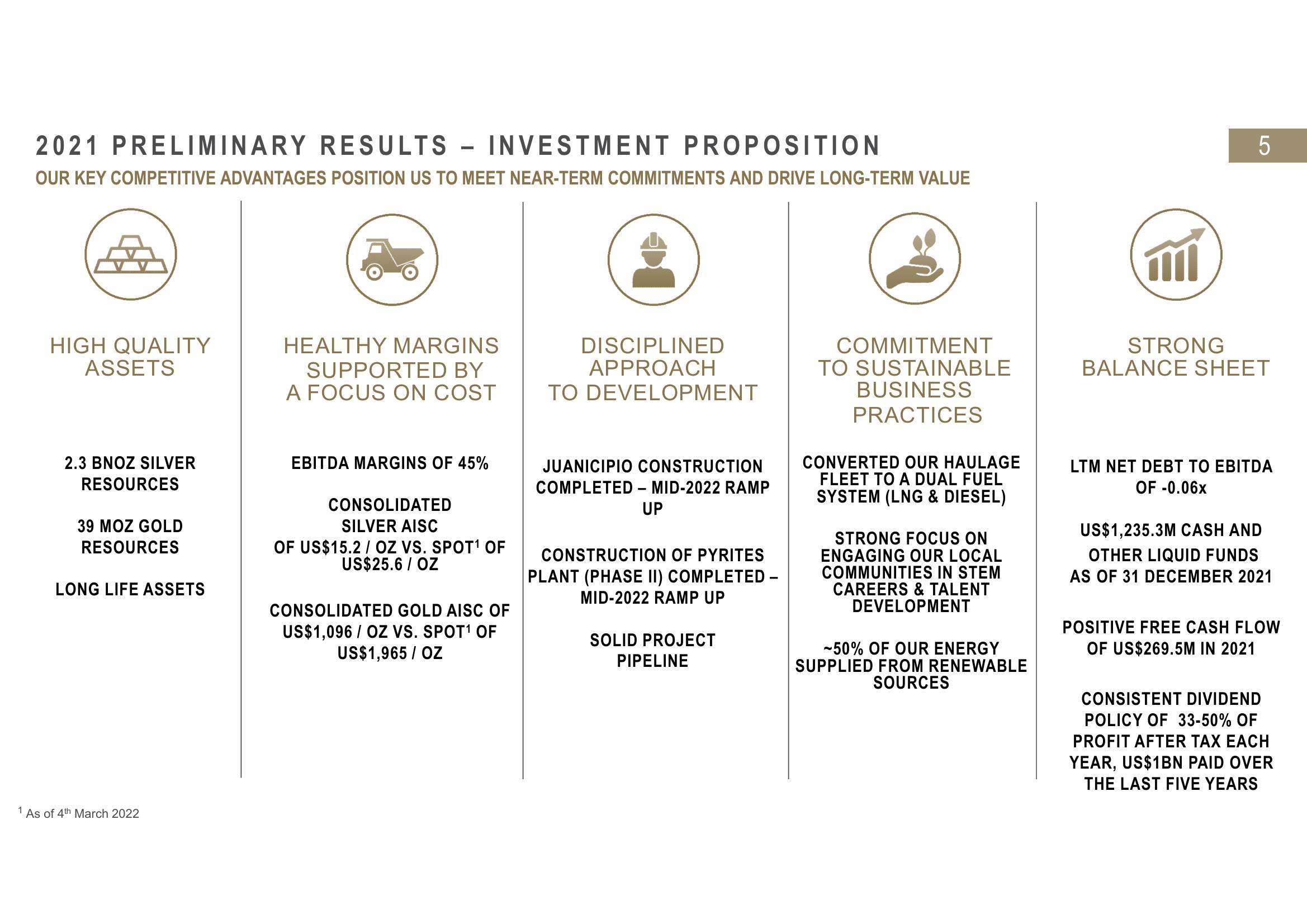

2021 PRELIMINARY RESULTS INVESTMENT PROPOSITION

OUR KEY COMPETITIVE ADVANTAGES POSITION US TO MEET NEAR-TERM COMMITMENTS AND DRIVE LONG-TERM VALUE

HIGH QUALITY

ASSETS

2.3 BNOZ SILVER

RESOURCES

39 MOZ GOLD

RESOURCES

LONG LIFE ASSETS

1 As of 4th March 2022

HEALTHY MARGINS

SUPPORTED BY

A FOCUS ON COST

EBITDA MARGINS OF 45%

CONSOLIDATED

SILVER AISC

OF US$15.2 / OZ VS. SPOT¹ OF

US$25.6 / OZ

CONSOLIDATED GOLD AISC OF

US$1,096 / OZ VS. SPOT¹ OF

US$1,965 / OZ

DISCIPLINED

APPROACH

TO DEVELOPMENT

JUANICIPIO CONSTRUCTION

COMPLETED - MID-2022 RAMP

UP

CONSTRUCTION OF PYRITES

PLANT (PHASE II) COMPLETED -

MID-2022 RAMP UP

SOLID PROJECT

PIPELINE

COMMITMENT

TO SUSTAINABLE

BUSINESS

PRACTICES

CONVERTED OUR HAULAGE

FLEET TO A DUAL FUEL

SYSTEM (LNG & DIESEL)

STRONG FOCUS ON

ENGAGING OUR LOCAL

COMMUNITIES IN STEM

CAREERS & TALENT

DEVELOPMENT

-50% OF OUR ENERGY

SUPPLIED FROM RENEWABLE

SOURCES

5

m

STRONG

BALANCE SHEET

LTM NET DEBT TO EBITDA

OF -0.06x

US$1,235.3M CASH AND

OTHER LIQUID FUNDS

AS OF 31 DECEMBER 2021

POSITIVE FREE CASH FLOW

OF US$269.5M IN 2021

CONSISTENT DIVIDEND

POLICY OF 33-50% OF

PROFIT AFTER TAX EACH

YEAR, US$1BN PAID OVER

THE LAST FIVE YEARSView entire presentation