HSBC Results Presentation Deck

Focus: Repositioning for higher growth

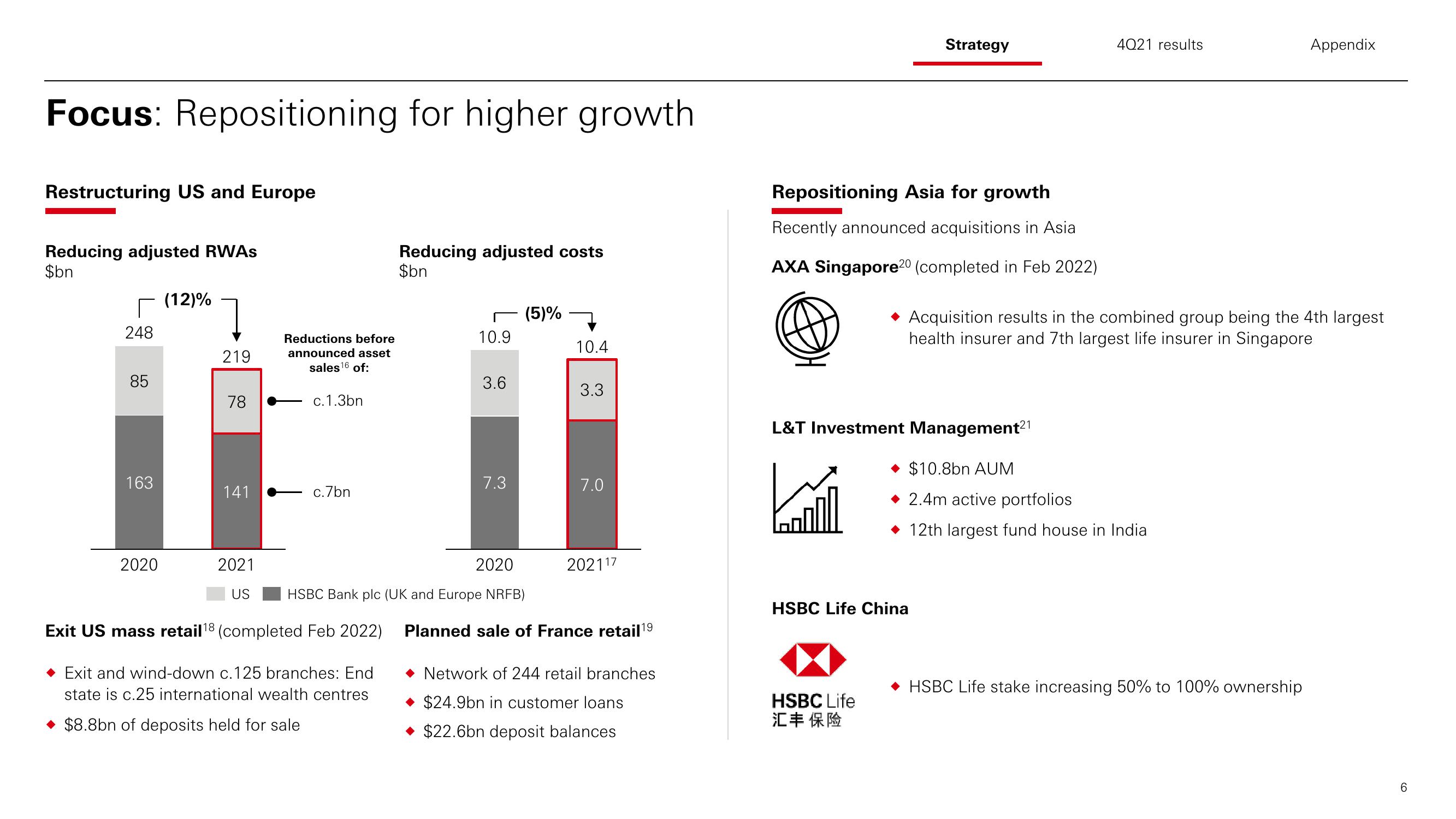

Restructuring US and Europe

Reducing adjusted RWAs

$bn

୮

248

85

163

(12)%

2020

]

219

78

141

Reductions before

announced asset

sales ¹6 of:

c.1.3bn

2021

US

c.7bn

Reducing adjusted costs

$bn

Exit and wind-down c. 125 branches: End

state is c.25 international wealth centres

◆ $8.8bn of deposits held for sale

10.9

3.6

2020

HSBC Bank plc (UK and Europe NRFB)

Exit US mass retail ¹8 (completed Feb 2022)

7.3

(5)%

10.4

3.3

7.0

202117

Planned sale of France retail 19

Network of 244 retail branches

$24.9bn in customer loan

$22.6bn deposit balances

Repositioning Asia for growth

Recently announced acquisitions in Asia

AXA Singapore20 (completed in Feb 2022)

آیا

Strategy

L&T Investment Management²1

HSBC Life China

HSBC Life

汇丰保险

4021 results

◆ Acquisition results in the combined group being the 4th largest

health insurer and 7th largest life insurer in Singapore

$10.8bn AUM

2.4m active portfolios

12th largest fund house in India

Appendix

HSBC Life stake increasing 50% to 100% ownership

6View entire presentation