jetBlue Mergers and Acquisitions Presentation Deck

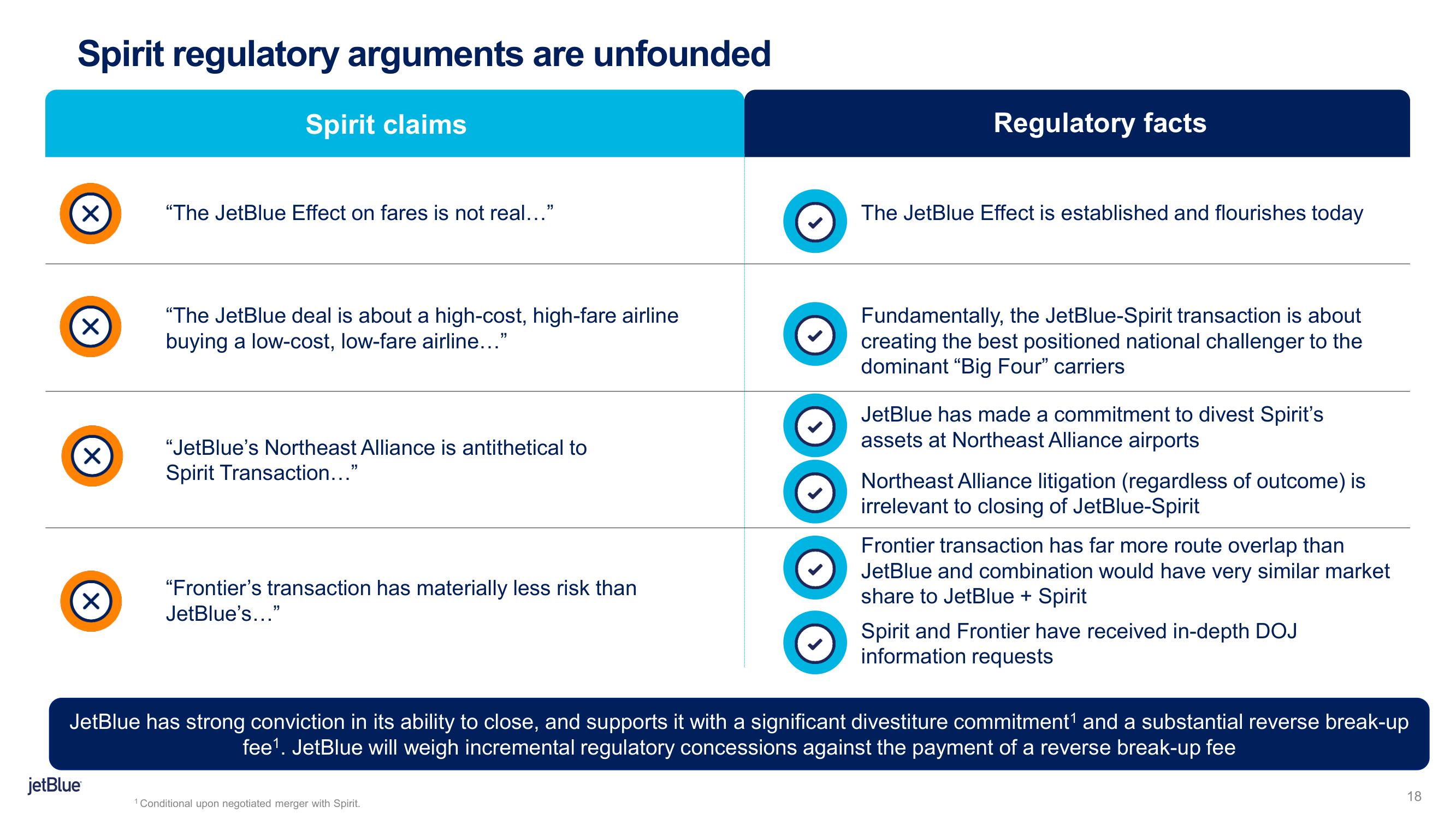

Spirit regulatory arguments are unfounded

Spirit claims

X

X

X

X

"The JetBlue Effect on fares is not real..."

jetBlue

"The JetBlue deal is about a high-cost, high-fare airline

buying a low-cost, low-fare airline..."

"JetBlue's Northeast Alliance is antithetical to

Spirit Transaction..."

"Frontier's transaction has materially less risk than

JetBlue's..."

Regulatory facts

1 Conditional upon negotiated merger with Spirit.

The JetBlue Effect is established and flourishes today

Fundamentally, the JetBlue-Spirit transaction is about

creating the best positioned national challenger to the

dominant "Big Four" carriers

JetBlue has made a commitment to divest Spirit's

assets at Northeast Alliance airports

Northeast Alliance litigation (regardless of outcome) is

irrelevant to closing of JetBlue-Spirit

Frontier transaction has far more route overlap than

JetBlue and combination would have very similar market

share to JetBlue + Spirit

JetBlue has strong conviction in its ability to close, and supports it with a significant divestiture commitment¹ and a substantial reverse break-up

fee¹. JetBlue will weigh incremental regulatory concessions against the payment of a reverse break-up fee

Spirit and Frontier have received in-depth DOJ

information requests

18View entire presentation