Apollo Global Management Investor Day Presentation Deck

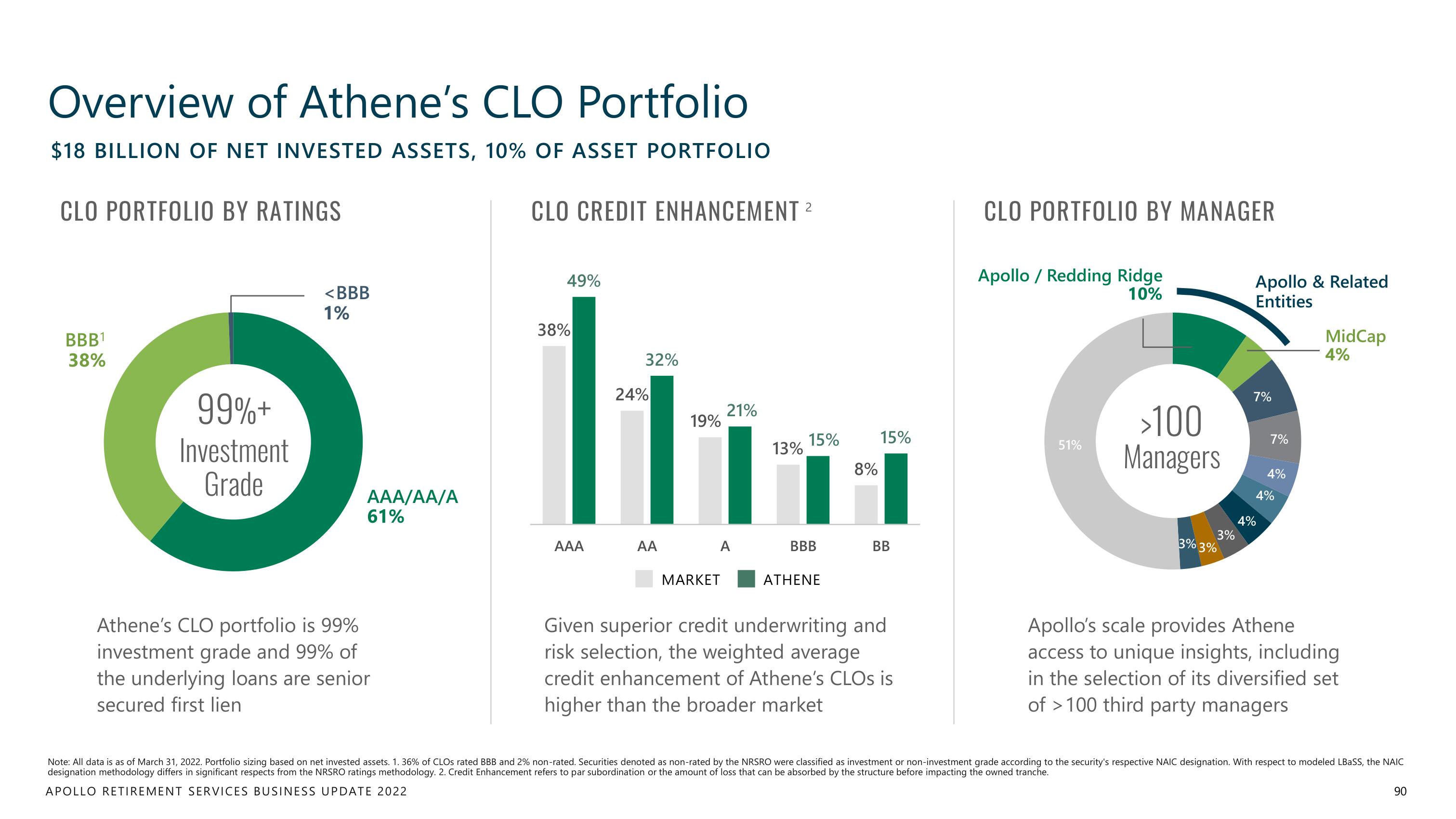

Overview of Athene's CLO Portfolio

$18 BILLION OF NET INVESTED ASSETS, 10% OF ASSET PORTFOLIO

CLO PORTFOLIO BY RATINGS

BBB¹

38%

99%+

Investment

Grade

<BBB

1%

AAA/AA/A

61%

Athene's CLO portfolio is 99%

investment grade and 99% of

the underlying loans are senior

secured first lien

CLO CREDIT ENHANCEMENT 2

49%

32%

24%

1...

21%

19%

15%

13%

A

38%

AAA

AA

MARKET

BBB

ATHENE

8%

15%

BB

Given superior credit underwriting and

risk selection, the weighted average

credit enhancement of Athene's CLOs is

higher than the broader market

CLO PORTFOLIO BY MANAGER

Apollo / Redding Ridge

10%

51%

>100

Managers

3%

3% 3%

Apollo & Related

Entities

7%

7%

4%

4%

4%

MidCap

4%

Apollo's scale provides Athene

access to unique insights, including

in the selection of its diversified set

of >100 third party managers

Note: All data is as of March 31, 2022. Portfolio sizing based on net invested assets. 1. 36% of CLOS rated BBB and 2% non-rated. Securities denoted as non-rated by the NRSRO were classified as investment or non-investment grade according to the security's respective NAIC designation. With respect to modeled LBaSS, the NAIC

designation methodology differs in significant respects from the NRSRO ratings methodology. 2. Credit Enhancement refers to par subordination or the amount of loss that can be absorbed by the structure before impacting the owned tranche.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

90View entire presentation