SatixFy Investor Presentation Deck

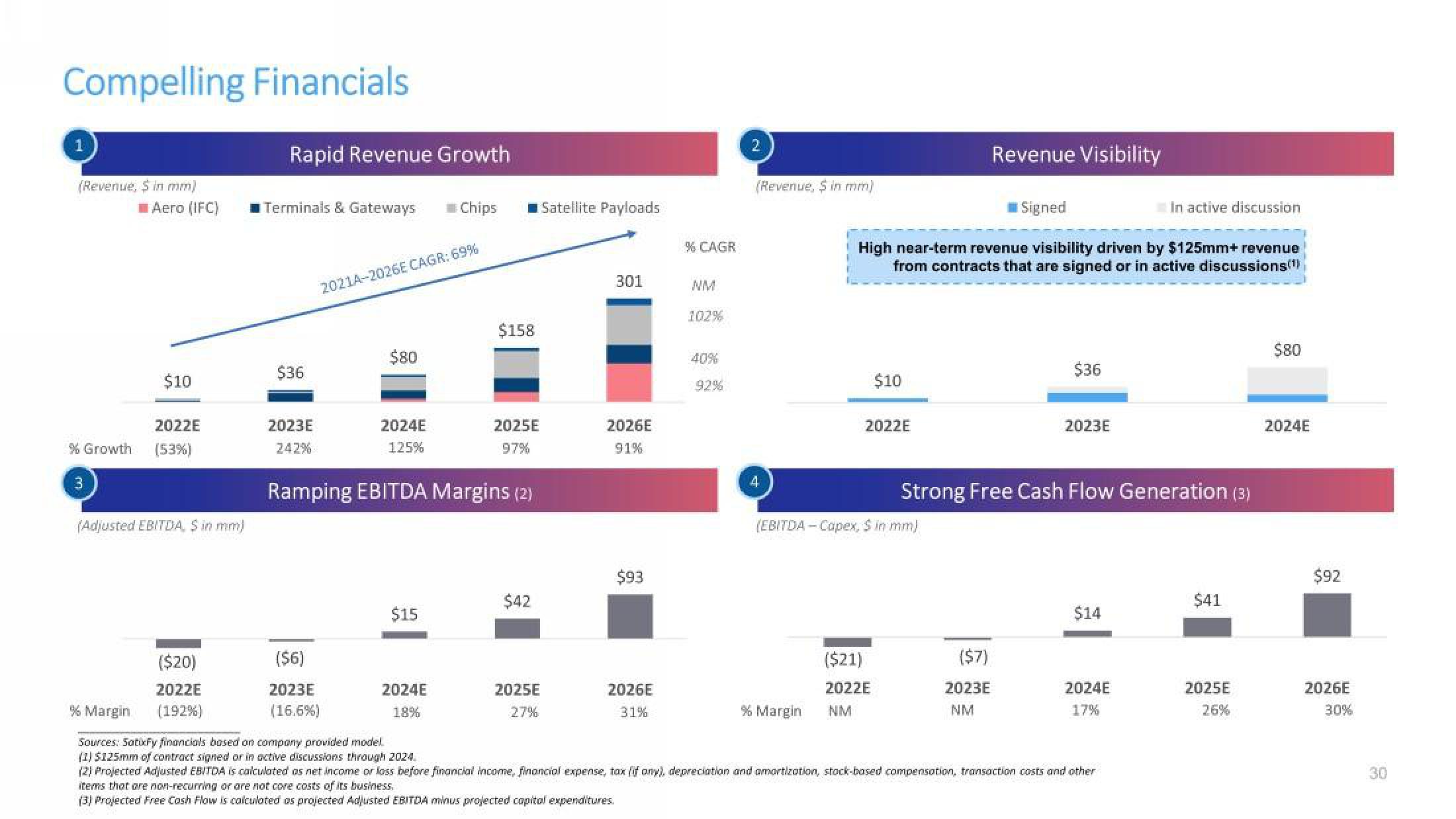

Compelling Financials

1

(Revenue, $ in mm)

Aero (IFC)

$10

2022E

% Growth (53%)

3

% Margin

(Adjusted EBITDA, S in mm)

($20)

2022E

(192%)

Rapid Revenue Growth

Terminals & Gateways

$36

2023E

242%

2021A-2026E CAGR: 69%

$80

($6)

2023E

(16.6%)

2024E

125%

2025E

97%

Ramping EBITDA Margins (2)

Chips

$15

2024E

18%

$158

$42

Satellite Payloads

2025E

27%

301

2026E

91%

$93

2026E

31%

% CAGR

NM

102%

40%

92%

2

(Revenue, $ in mm)

4

% Margin

$10

2022E

High near-term revenue visibility driven by $125mm+ revenue

from contracts that are signed or in active discussions(¹)

(EBITDA-Copex, $ in mm)

($21)

2022E

NM

Revenue Visibility

Signed

($7)

2023E

NM

$36

2023E

Strong Free Cash Flow Generation (3)

$14

In active discussion

2024E

17%

Sources: SatixFy financials based on company provided model.

(1) $125mm of contract signed or in active discussions through 2024.

(2) Projected Adjusted EBITDA is calculated as net income or loss before financial income, financial expense, tax (if any), depreciation and amortization, stock-based compensation, transaction costs and other

items that are non-recurring or are not core costs of its business.

(3) Projected Free Cash Flow is calculated as projected Adjusted EBITDA minus projected capital expenditures.

$41

2025E

26%

$80

2024E

$92

2026E

30%View entire presentation