Deutsche Bank Results Presentation Deck

Commercial Real Estate (CRE) 2/2

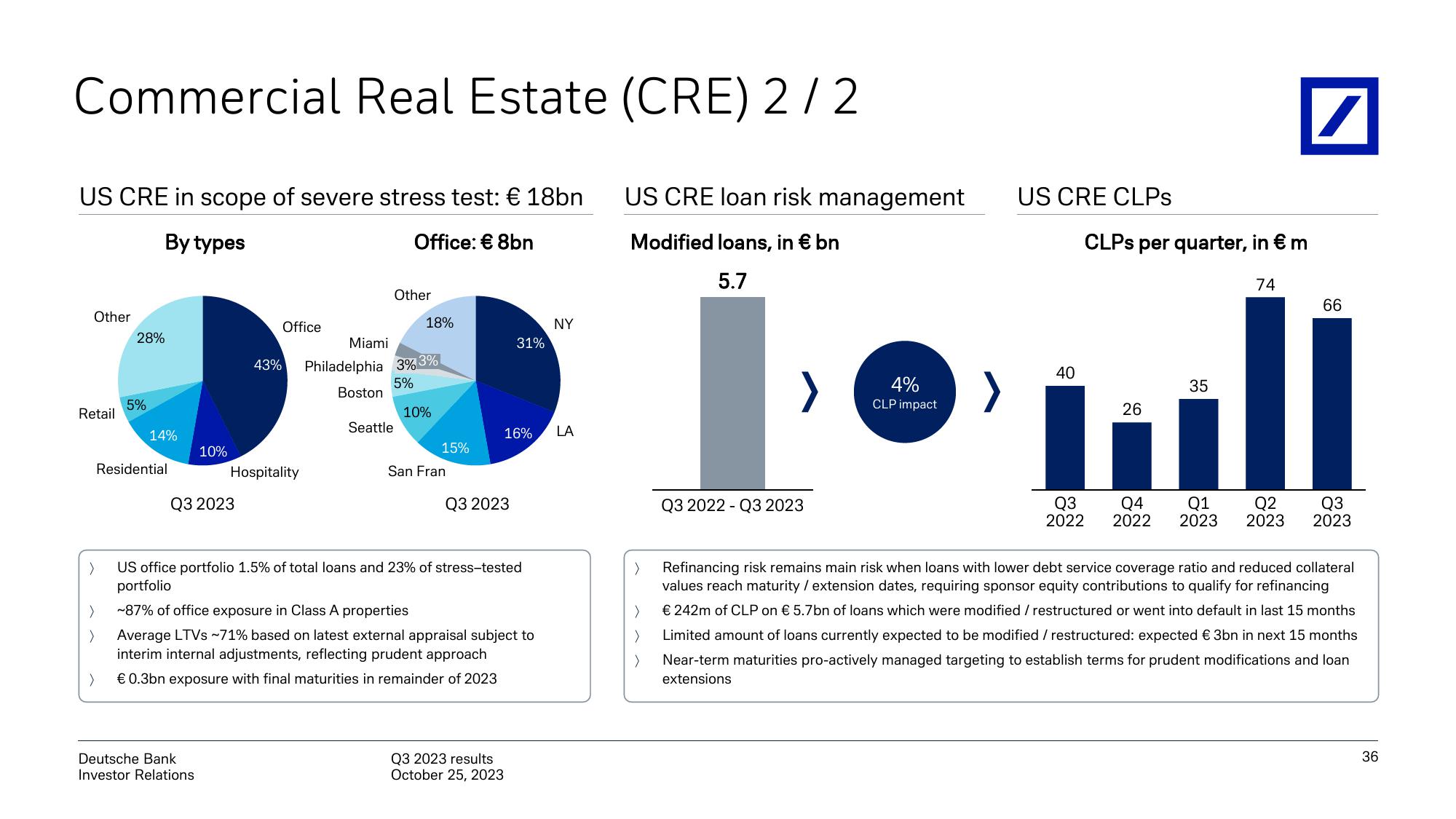

US CRE in scope of severe stress test: € 18bn

By types

Office: € 8bn

Other

Retail

28%

5%

14%

Residential

10%

Q3 2023

43%

Deutsche Bank

Investor Relations

Office

Hospitality

Miami

Philadelphia

Boston

Other

Seattle

18%

3% 3%

5%

10%

15%

San Fran

Q3 2023

31%

16%

US office portfolio 1.5% of total loans and 23% of stress-tested

portfolio

>

~87% of office exposure in Class A properties

> Average LTVs ~71% based on latest external appraisal subject to

interim internal adjustments, reflecting prudent approach

>

€ 0.3bn exposure with final maturities in remainder of 2023

Q3 2023 results

October 25, 2023

NY

LA

US CRE loan risk management

Modified loans, in € bn

5.7

>

>

>

Q3 2022-Q3 2023

4%

CLP impact

US CRE CLPs

40

CLPs per quarter, in € m

26

35

74

Q3 Q4 Q1 Q2

2022 2022 2023 2023

/

66

Refinancing risk remains main risk when loans with lower debt service coverage ratio and reduced collateral

values reach maturity / extension dates, requiring sponsor equity contributions to qualify for refinancing

>

€ 242m of CLP on € 5.7bn of loans which were modified / restructured or went into default in last 15 months

Limited amount of loans currently expected to be modified / restructured: expected € 3bn in next 15 months

Near-term maturities pro-actively managed targeting to establish terms for prudent modifications and loan

extensions

Q3

2023

36View entire presentation