First Quarter 2022 Financial Results

BALANCE SHEET AND LIQUIDITY UPDATE

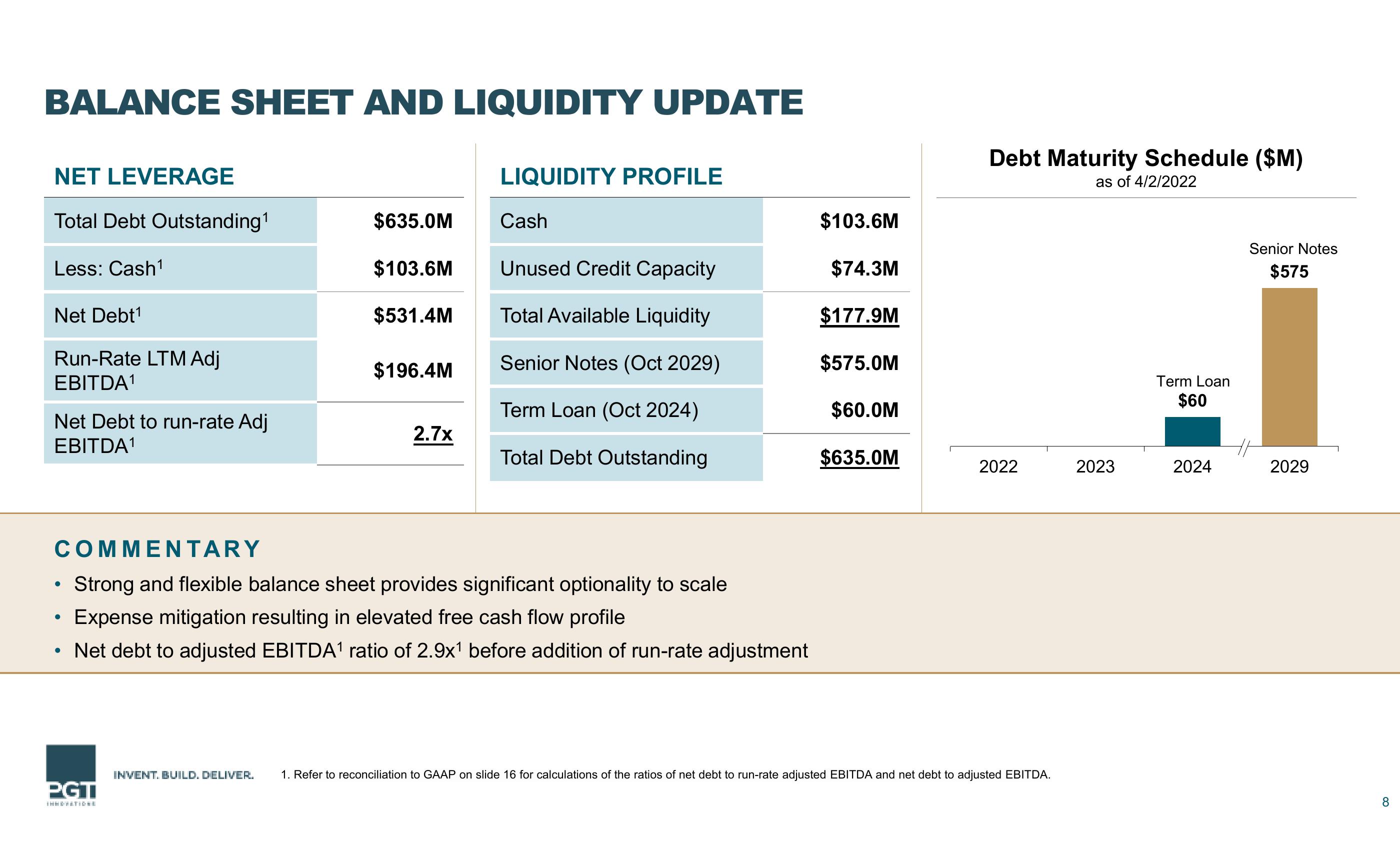

NET LEVERAGE

Total Debt Outstanding¹

Less: Cash¹1

Net Debt¹

Run-Rate LTM Adj

EBITDA¹

Net Debt to run-rate Adj

EBITDA¹

●

●

$635.0M

PGT

$103.6M

$531.4M

$196.4M

2.7x

LIQUIDITY PROFILE

COMMENTARY

Strong and flexible balance sheet provides significant optionality to scale

Expense mitigation resulting in elevated free cash flow profile

• Net debt to adjusted EBITDA¹ ratio of 2.9x¹ before addition of run-rate adjustment

Cash

Unused Credit Capacity

Total Available Liquidity

Senior Notes (Oct 2029)

Term Loan (Oct 2024)

Total Debt Outstanding

$103.6M

$74.3M

$177.9M

$575.0M

$60.0M

$635.0M

Debt Maturity Schedule ($M)

as of 4/2/2022

2022

INVENT. BUILD. DELIVER. 1. Refer to reconciliation to GAAP on slide 16 for calculations of the ratios of net debt to run-rate adjusted EBITDA and net debt to adjusted EBITDA.

2023

Term Loan

$60

2024

Senior Notes

$575

2029

8View entire presentation