TradeStation SPAC Presentation Deck

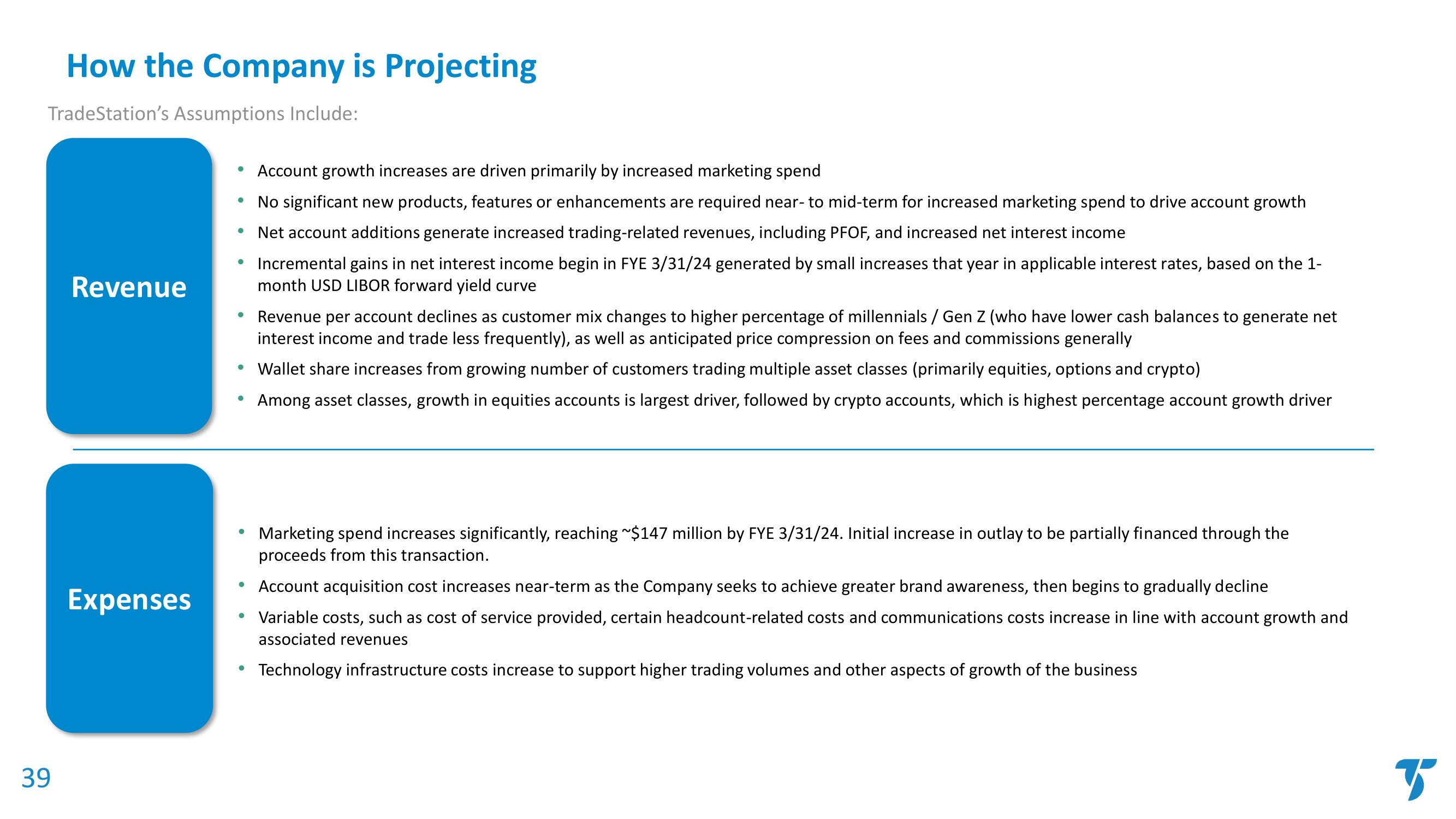

How the Company is Projecting

TradeStation's Assumptions Include:

39

Revenue

Expenses

• Account growth increases are driven primarily by increased marketing spend

No significant new products, features or enhancements are required near- to mid-term for increased marketing spend to drive account growth

Net account additions generate increased trading-related revenues, including PFOF, and increased net interest income

• Incremental gains in net interest income begin in FYE 3/31/24 generated by small increases that year in applicable interest rates, based on the 1-

month USD LIBOR forward yield curve

• Revenue per account declines as customer mix changes to higher percentage of millennials / Gen Z (who have lower cash balances to generate net

interest income and trade less frequently), as well as anticipated price compression on fees and commissions generally

• Wallet share increases from growing number of customers trading multiple asset classes (primarily equities, options and crypto)

Among asset classes, growth in equities accounts is largest driver, followed by crypto accounts, which is highest percentage account growth driver

●

• Marketing spend increases significantly, reaching ~$147 million by FYE 3/31/24. Initial increase in outlay to be partially financed through the

proceeds from this transaction.

• Account acquisition cost increases near-term as the Company seeks to achieve greater brand awareness, then begins to gradually decline

• Variable costs, such as cost of service provided, certain headcount-related costs and communications costs increase in line with account growth and

associated revenues

Technology infrastructure costs increase to support higher trading volumes and other aspects of growth of the business

BView entire presentation