OpenText Investor Presentation Deck

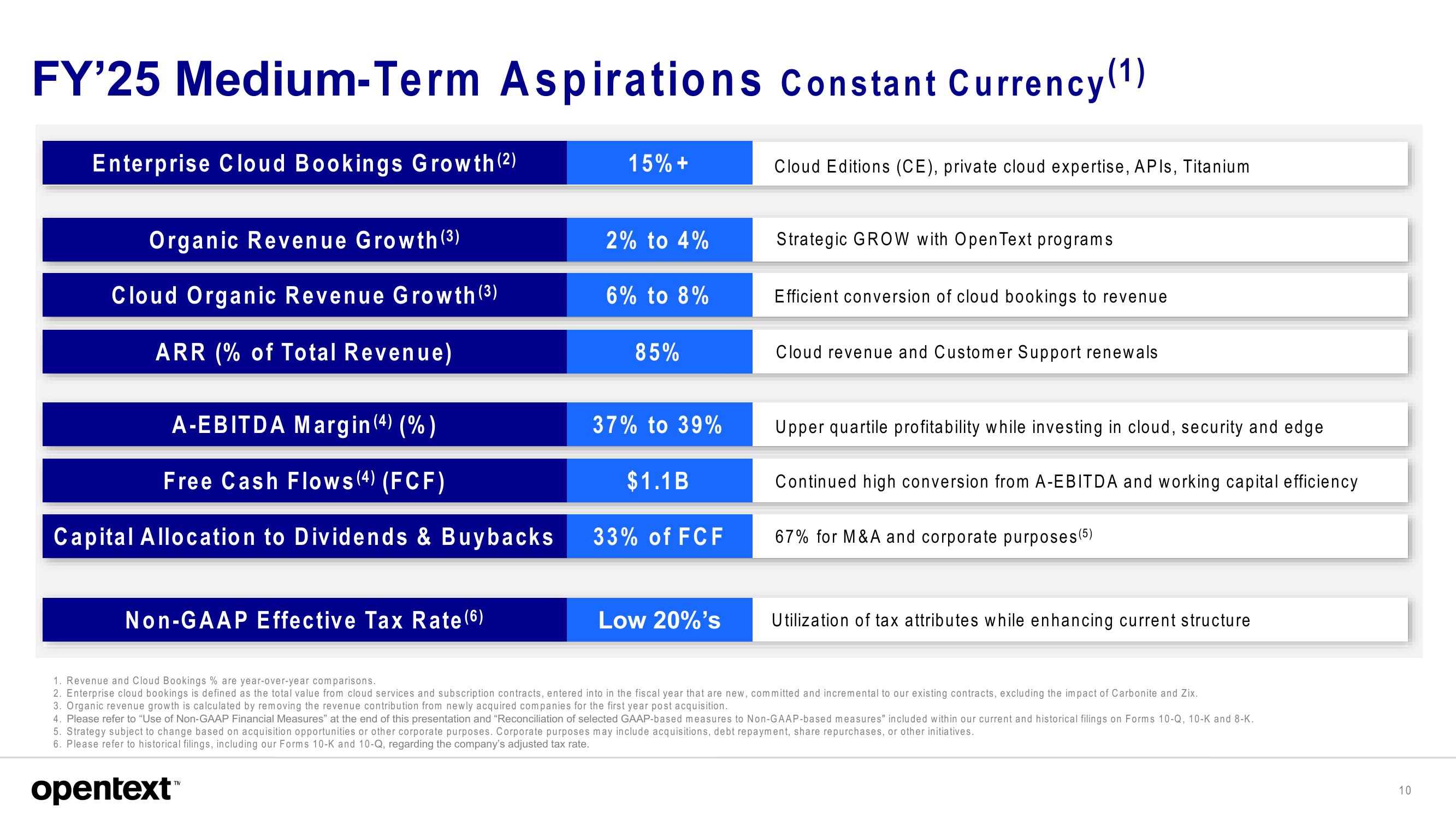

FY'25 Medium-Term Aspirations Constant Currency (1)

Enterprise Cloud Bookings Growth (2)

Organic Revenue Growth (3)

Cloud Organic Revenue Growth (3)

ARR (% of Total Revenue)

A-EBITDA Margin (4) (%)

Free Cash Flows (4) (FCF)

Capital Allocation to Dividends & Buybacks

Non-GAAP Effective Tax Rate (6)

15% +

opentext™

2% to 4%

6% to 8%

85%

37% to 39%

$1.1B

33% of FCF

Low 20%'s

Cloud Editions (CE), private cloud expertise, APIs, Titanium

Strategic GROW with Open Text programs

Efficient conversion of cloud bookings to revenue

Cloud revenue and Customer Support renewals

Upper quartile profitability while investing in cloud, security and edge

Continued high conversion from A-EBITDA and working capital efficiency

67% for M&A and corporate purposes (5)

Utilization of tax attributes while enhancing current structure

1. Revenue and Cloud Bookings % are year-over-year comparisons.

2. Enterprise cloud bookings is defined as the total value from cloud services and subscription contracts, entered into in the fiscal year that are new, committed and incremental to our existing contracts, excluding the impact of Carbonite and Zix.

3. Organic revenue growth is calculated by removing the revenue contribution from newly acquired companies for the first year post acquisition.

4. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms 10-Q, 10-K and 8-K.

5. Strategy subject to change based on acquisition opportunities or other corporate purposes. Corporate purposes may include acquisitions, debt repayment, share repurchases, or other initiatives.

6. Please refer to historical filings, including our Forms 10-K and 10-Q, regarding the company's adjusted tax rate.

10View entire presentation