Credit Suisse Results Presentation Deck

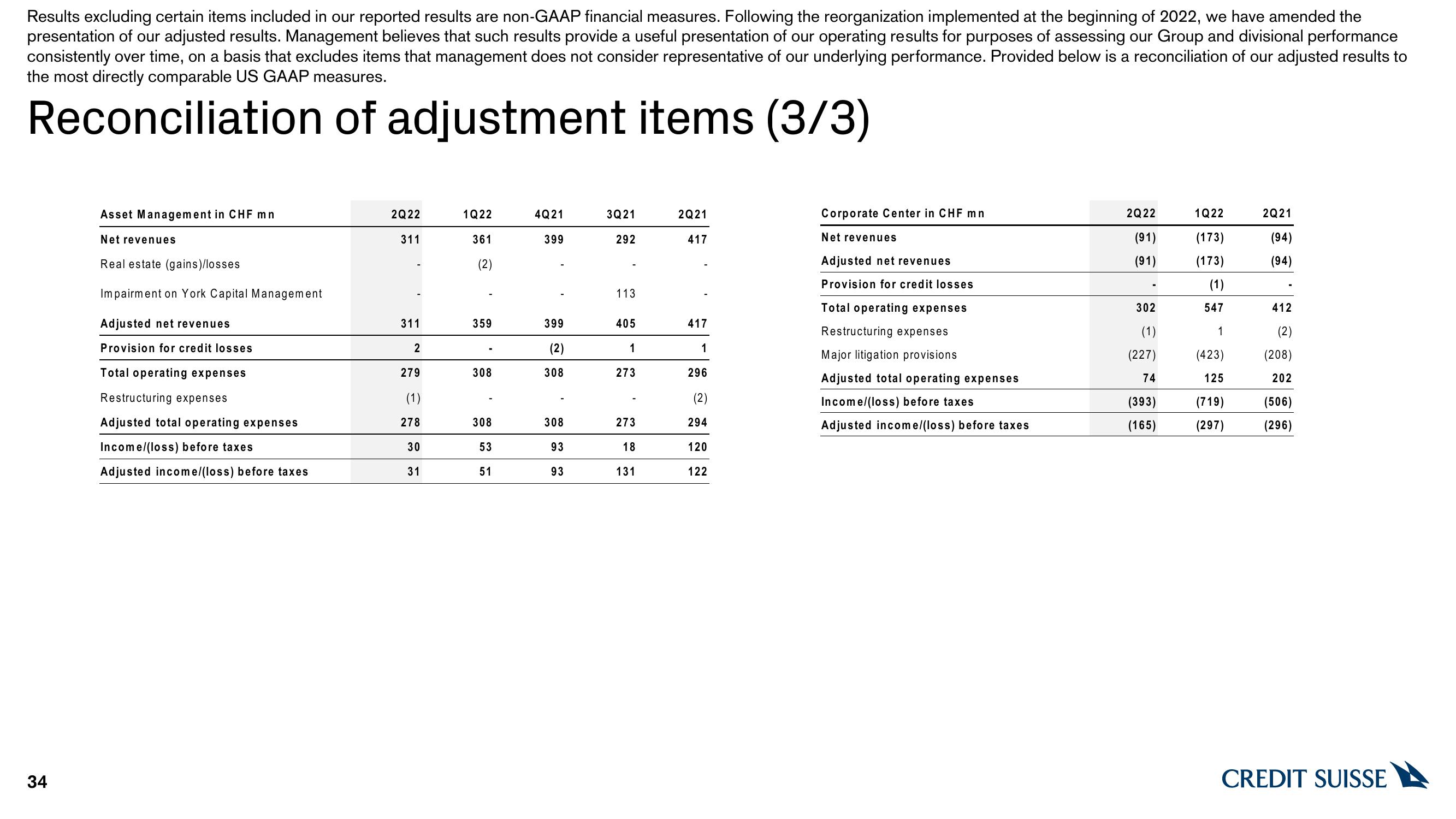

Results excluding certain items included in our reported results are non-GAAP financial measures. Following the reorganization implemented at the beginning of 2022, we have amended the

presentation of our adjusted results. Management believes that such results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance

consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation of our adjusted results to

the most directly comparable US GAAP measures.

Reconciliation of adjustment items (3/3)

34

Asset Management in CHF mn

Net revenues

Real estate (gains)/losses

Impairment on York Capital Management

Adjusted net revenues

Provision for credit losses

Total operating expenses

Restructuring expenses

Adjusted total operating expenses

Income/(loss) before taxes

Adjusted income/(loss) before taxes.

2Q22

311

311

2

279

(1)

278

30

31

1Q22

361

359

308

308

53

51

4Q21

399

399

(2)

308

308

93

93

3Q21

292

113

405

1

273

273

18

131

2Q21

417

417

1

296

(2)

294

120

122

Corporate Center in CHF mn

Net revenues

Adjusted net revenues

Provision for credit losses

Total operating expenses

Restructuring expenses

Major litigation provisions

Adjusted total operating expenses

Income/(loss) before taxes

Adjusted income/(loss) before taxes

2Q22

(91)

(91)

302

(1)

(227)

74

(393)

(165)

1Q22

(173)

(173)

(1)

547

1

(423)

125

(719)

(297)

2Q21

(94)

(94)

412

(2)

(208)

202

(506)

(296)

CREDIT SUISSEView entire presentation