Apollo Global Management Investor Day Presentation Deck

Funding Agreements

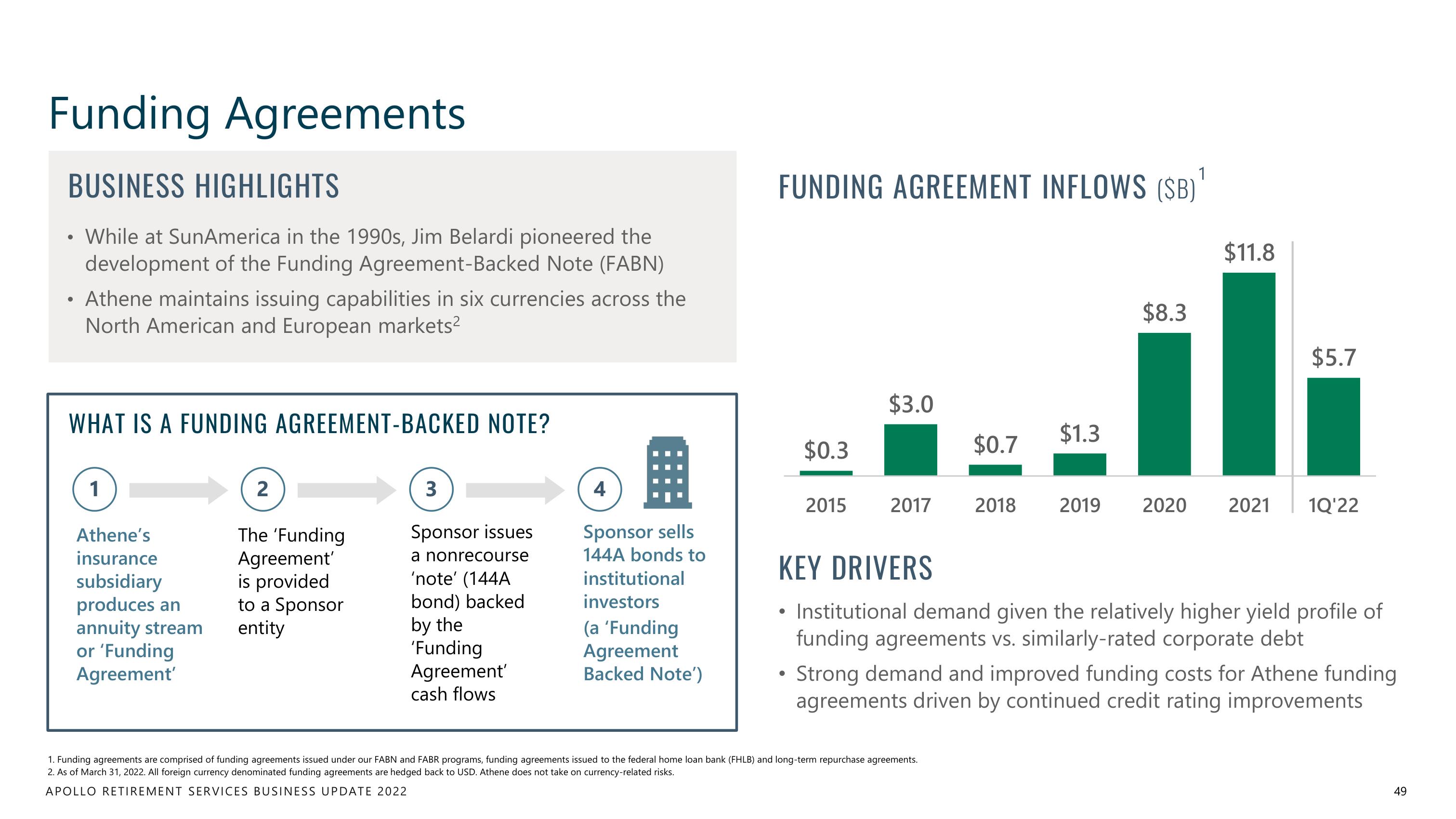

BUSINESS HIGHLIGHTS

• While at SunAmerica in the 1990s, Jim Belardi pioneered the

development of the Funding Agreement-Backed Note (FABN)

• Athene maintains issuing capabilities in six currencies across the

North American and European markets²

WHAT IS A FUNDING AGREEMENT-BACKED NOTE?

1

Athene's

insurance

subsidiary

produces an

annuity stream

or 'Funding

Agreement'

2

The 'Funding

Agreement'

is provided

to a Sponsor

entity

3

Sponsor issues

a nonrecourse

'note' (144A

bond) backed

by the

'Funding

Agreement'

cash flows

4

Sponsor sells

144A bonds to

institutional

investors

(a 'Funding

Agreement

Backed Note')

1

FUNDING AGREEMENT INFLOWS ($B)

●

$0.3

●

2015

$3.0

$0.7

$1.3

$8.3

1. Funding agreements are comprised of funding agreements issued under our FABN and FABR programs, funding agreements issued to the federal home loan bank (FHLB) and long-term repurchase agreements.

2. As of March 31, 2022. All foreign currency denominated funding agreements are hedged back to USD. Athene does not take on currency-related risks.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

$11.8

KEY DRIVERS

Institutional demand given the relatively higher yield profile of

funding agreements vs. similarly-rated corporate debt

$5.7

2017 2018 2019 2020 2021 1Q'22

Strong demand and improved funding costs for Athene funding

agreements driven by continued credit rating improvements

49View entire presentation