Blackwells Capital Activist Presentation Deck

■

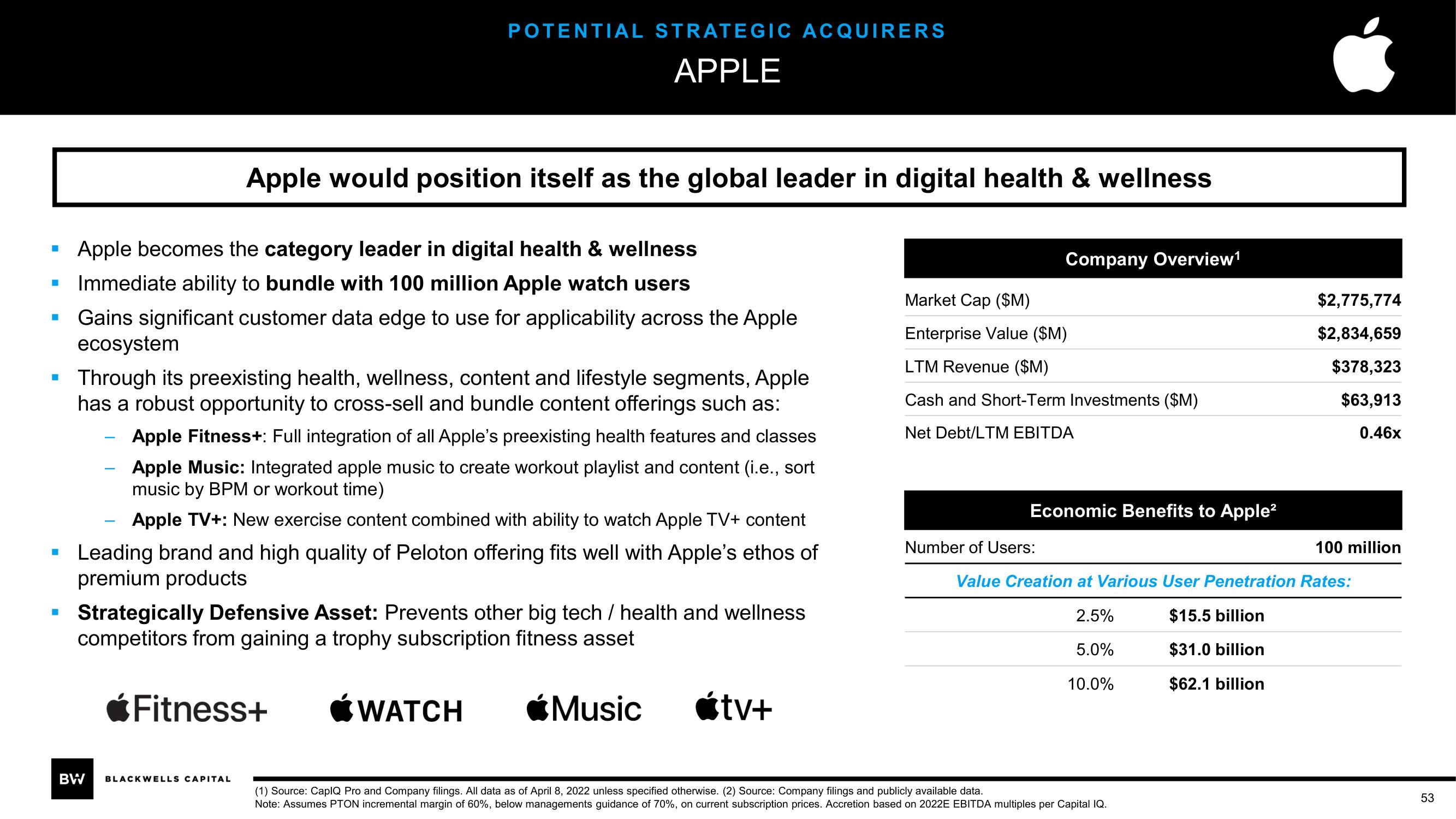

Apple becomes the category leader in digital health & wellness

Immediate ability to bundle with 100 million Apple watch users

Gains significant customer data edge to use for applicability across the Apple

ecosystem

▪ Through its preexisting health, wellness, content and lifestyle segments, Apple

has a robust opportunity to cross-sell and bundle content offerings such as:

■

■

■

POTENTIAL STRATEGIC ACQUIRERS

APPLE

Apple would position itself as the global leader in digital health & wellness

Apple Fitness+: Full integration of all Apple's preexisting health features and classes

Apple Music: Integrated apple music to create workout playlist and content (i.e., sort

music by BPM or workout time)

Apple TV+: New exercise content combined with ability to watch Apple TV+ content

Leading brand and high quality of Peloton offering fits well with Apple's ethos of

premium products

BW

Strategically Defensive Asset: Prevents other big tech / health and wellness

competitors from gaining a trophy subscription fitness asset

*Fitness+

Music

BLACKWELLS CAPITAL

WATCH

tv+

Company Overview¹

Market Cap ($M)

Enterprise Value ($M)

LTM Revenue ($M)

Cash and Short-Term Investments ($M)

Net Debt/LTM EBITDA

Economic Benefits to Apple²

Number of Users:

$2,775,774

$2,834,659

$378,323

$63,913

0.46x

(1) Source: CapIQ Pro and Company filings. All data as of April 8, 2022 unless specified otherwise. (2) Source: Company filings and publicly available data.

Note: Assumes PTON incremental margin of 60%, below managements guidance of 70%, on current subscription prices. Accretion based on 2022E EBITDA multiples per Capital IQ.

100 million

Value Creation at Various User Penetration Rates:

$15.5 billion

2.5%

5.0%

$31.0 billion

10.0%

$62.1 billion

53View entire presentation