LSE Investor Presentation Deck

1

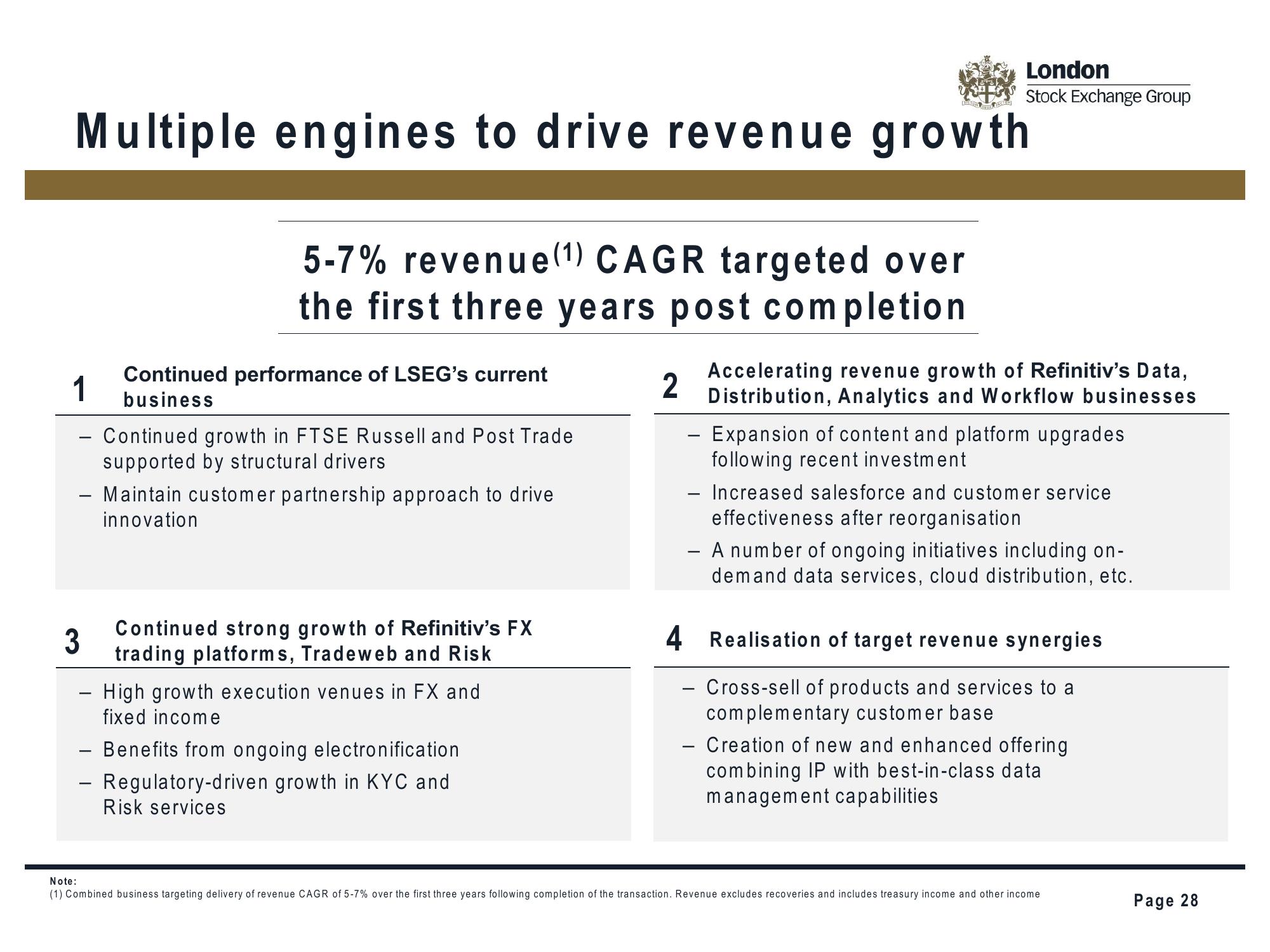

Multiple engines to drive revenue growth

5-7% revenue (1) CAGR targeted over

the first three years post completion

Continued performance of LSEG's current

business

Continued growth in FTSE Russell and Post Trade

supported by structural drivers

- Maintain customer partnership approach to drive

innovation

Continued strong growth of Refinitiv's FX

trading platforms, Tradeweb and Risk

3

- High growth execution venues in FX and

fixed income

FESTE

- Benefits from ongoing electronification

- Regulatory-driven growth in KYC and

Risk services

London

Stock Exchange Group

Accelerating revenue growth of Refinitiv's Data,

Distribution, Analytics and Workflow businesses

2

- Expansion of content and platform upgrades

following recent investment

-

- Increased salesforce and customer service

effectiveness after reorganisation

- A number of ongoing initiatives including on-

demand data services, cloud distribution, etc.

4 Realisation of target revenue synergies

-

- Cross-sell of products and services to a

complementary customer base

-

- Creation of new and enhanced offering

combining with best-in-class data

management capabilities

Note:

(1) Combined business targeting delivery of revenue CAGR of 5-7% over the first three years following completion of the transaction. Revenue excludes recoveries and includes treasury income and other income

Page 28View entire presentation