Uber Shareholder Engagement Presentation Deck

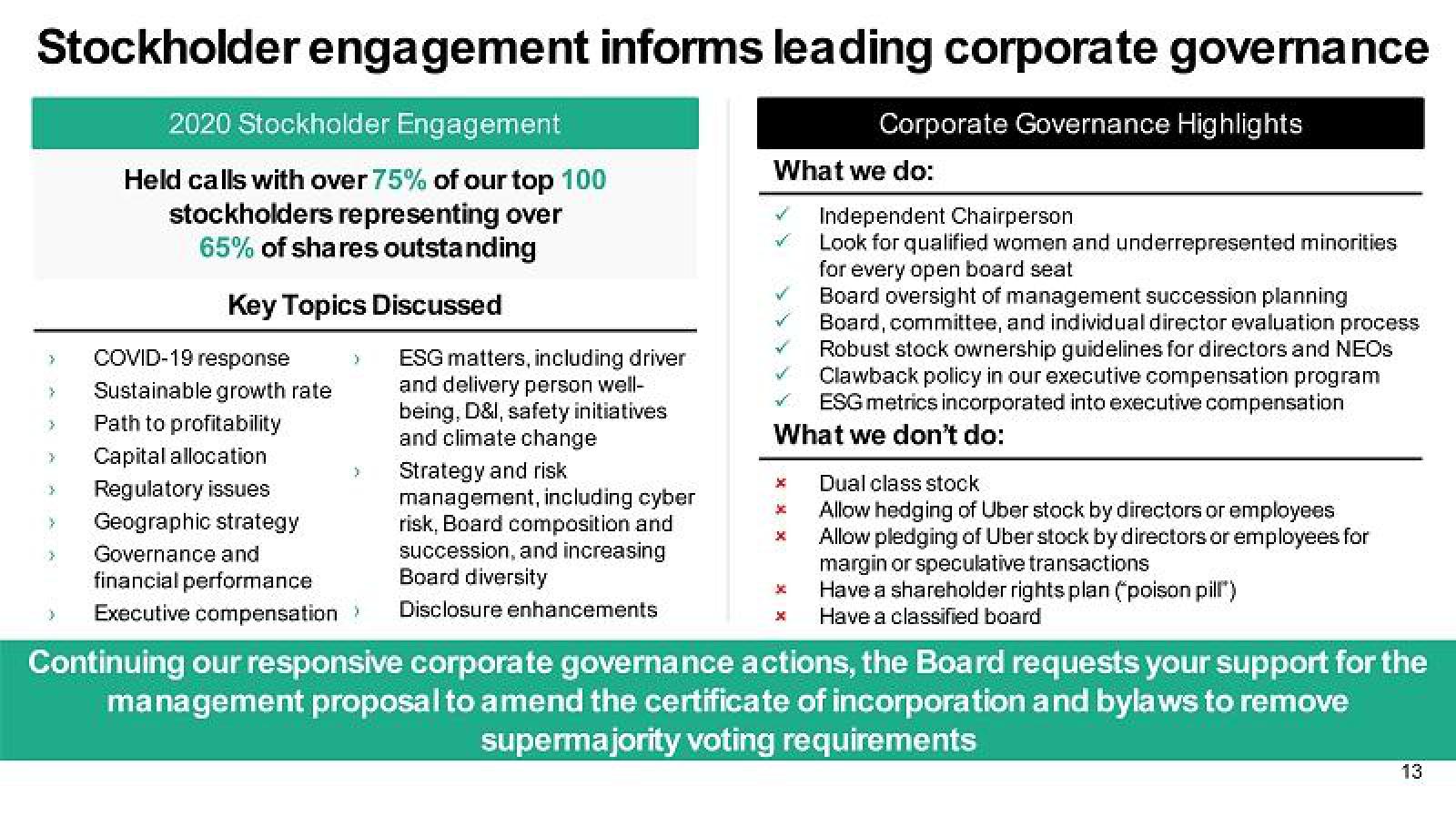

Stockholder engagement informs leading corporate governance

2020 Stockholder Engagement

Corporate Governance Highlights

Held calls with over 75% of our top 100

stockholders representing over

65% of shares outstanding

}

}

}

Key Topics Discussed

COVID-19 response

Sustainable growth rate

Path to profitability

Capital allocation

)

Regulatory issues

Geographic strategy

Governance and

financial performance

Executive compensation >

ESG matters, including driver

and delivery person well-

being, D&I, safety initiatives

and climate change

Strategy and risk

management, including cyber

risk, Board composition and

succession, and increasing

Board diversity

Disclosure enhancements

What we do:

Board oversight of management succession planning

Board, committee, and individual director evaluation process

Robust stock ownership guidelines for directors and NEOS

Clawback policy in our executive compensation program

ESG metrics incorporated into executive compensation

What we don't do:

Bove

Independent Chairperson

Look for qualified women and underrepresented minorities

for every open board seat

Je

Dual class stock

x Allow hedging of Uber stock by directors or employees

Allow pledging of Uber stock by directors or employees for

margin or speculative transactions

3 Have a shareholder rights plan ("poison pill")

Have a classified board

Continuing our responsive corporate governance actions, the Board requests your support for the

management proposal to amend the certificate of incorporation and bylaws to remove

supermajority voting requirements

13View entire presentation