Experienced Senior Team Overview

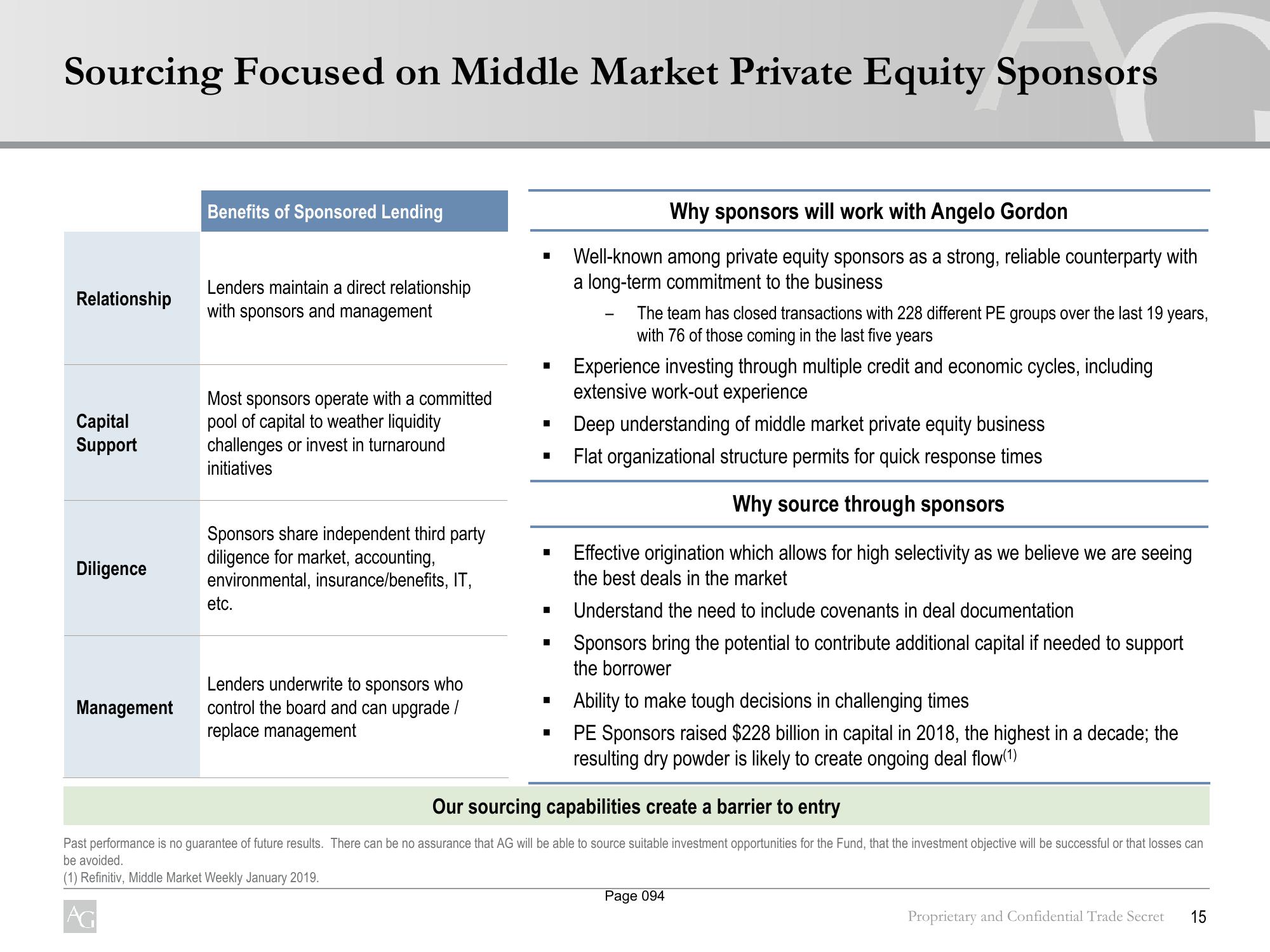

Sourcing Focused on Middle Market Private Equity Sponsors

Relationship

Capital

Support

Diligence

Management

Benefits of Sponsored Lending

Lenders maintain a direct relationship

with sponsors and management

Most sponsors operate with a committed

pool of capital to weather liquidity

challenges or invest in turnaround

initiatives

Sponsors share independent third party

diligence for market, accounting,

environmental, insurance/benefits, IT,

etc.

Lenders underwrite to sponsors who

control the board and can upgrade /

replace management

■

■

■

Why sponsors will work with Angelo Gordon

Well-known among private equity sponsors as a strong, reliable counterparty with

a long-term commitment to the business

The team has closed transactions with 228 different PE groups over the last 19 years,

with 76 of those coming in the last five years

Experience investing through multiple credit and economic cycles, including

extensive work-out experience

Deep understanding of middle market private equity business

Flat organizational structure permits for quick response times

Why source through sponsors

Effective origination which allows for high selectivity as we believe we are seeing

the best deals in the market

Understand the need to include covenants in deal documentation

Sponsors bring the potential to contribute additional capital if needed to support

the borrower

Ability to make tough decisions in challenging times

PE Sponsors raised $228 billion in capital in 2018, the highest in a decade; the

resulting dry powder is likely to create ongoing deal flow(1)

Our sourcing capabilities create a barrier to entry

Past performance is no guarantee of future results. There can be no assurance that AG will be able to source suitable investment opportunities for the Fund, that the investment objective will be successful or that losses can

be avoided.

(1) Refinitiv, Middle Market Weekly January 2019.

AG

Page 094

Proprietary and Confidential Trade Secret 15View entire presentation