IGI SPAC Presentation Deck

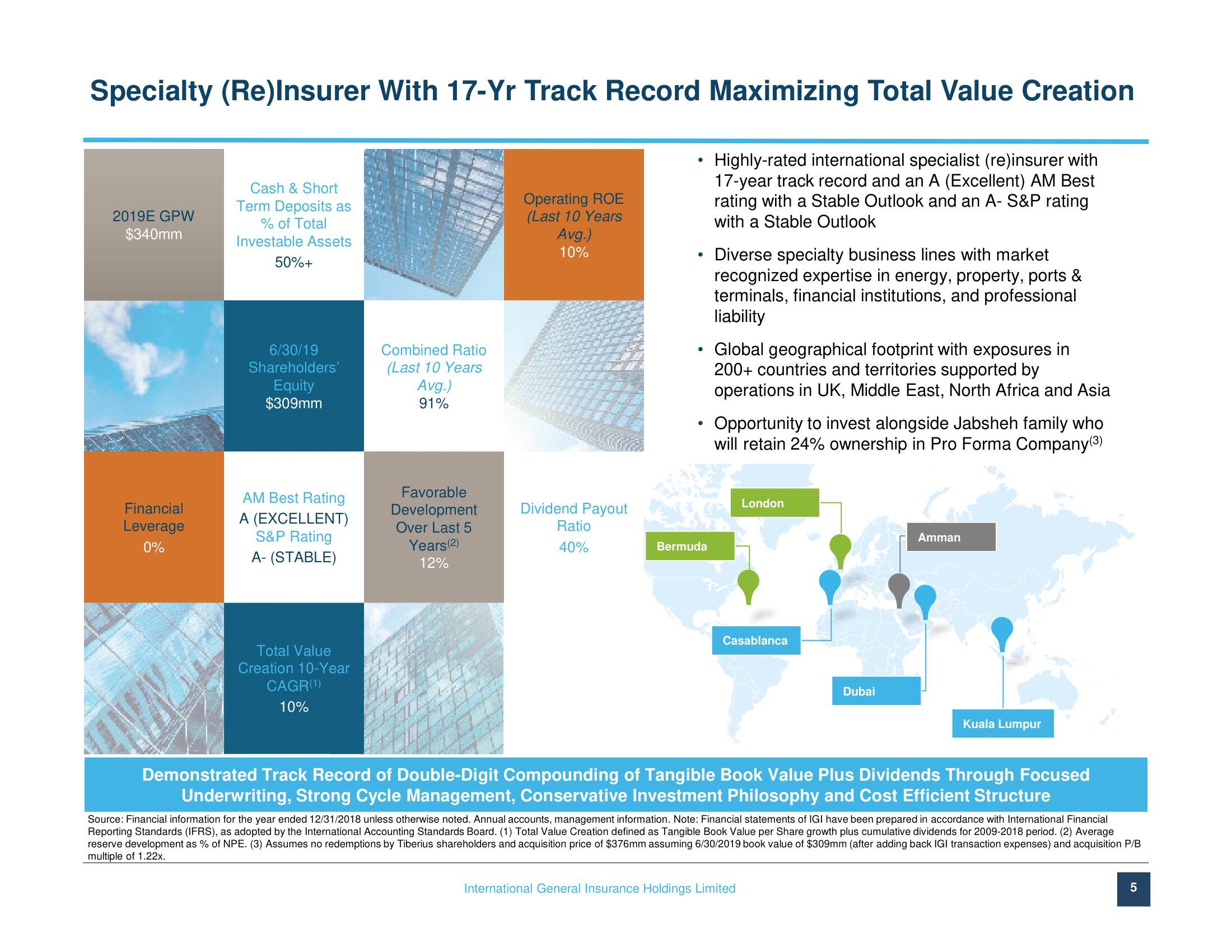

Specialty (Re)Insurer With 17-Yr Track Record Maximizing Total Value Creation

Highly-rated international specialist (re)insurer with

17-year track record and an A (Excellent) AM Best

rating with a Stable Outlook and an A- S&P rating

with a Stable Outlook

2019E GPW

$340mm

Financial

Leverage

0%

Cash & Short

Term Deposits as

% of Total

Investable Assets

50%+

6/30/19

Shareholders'

Equity

$309mm

AM Best Rating

A (EXCELLENT)

S&P Rating

A-(STABLE)

Total Value

Creation 10-Year

CAGR(1)

10%

Combined Ratio

(Last 10 Years

Avg.)

91%

Favorable

Development

Over Last 5

Years (2)

12%

Operating ROE

(Last 10 Years

Avg.)

10%

Dividend Payout

Ratio

40%

●

●

●

●

Bermuda

Diverse specialty business lines with market

recognized expertise in energy, property, ports &

terminals, financial institutions, and professional

liability

Global geographical footprint with exposures in

200+ countries and territories supported by

operations in UK, Middle East, North Africa and Asia

Opportunity to invest alongside Jabsheh family who

will retain 24% ownership in Pro Forma Company (3)

London

Casablanca

Dubai

International General Insurance Holdings Limited

Amman

Kuala Lumpur

Demonstrated Track Record of Double-Digit Compounding of Tangible Book Value Plus Dividends Through Focused

Underwriting, Strong Cycle Management, Conservative Investment Philosophy and Cost Efficient Structure

Source: Financial information for the year ended 12/31/2018 unless otherwise noted. Annual accounts, management information. Note: Financial statements of IGI have been prepared in accordance with International Financial

Reporting Standards (IFRS), as adopted by the International Accounting Standards Board. (1) Total Value Creation defined as Tangible Book Value per Share growth plus cumulative dividends for 2009-2018 period. (2) Average

reserve development as % of NPE. (3) Assumes no redemptions by Tiberius shareholders and acquisition price of $376mm assuming 6/30/2019 book value of $309mm (after adding back IGI transaction expenses) and acquisition P/B

multiple of 1.22x.

5View entire presentation