Metals Acquisition Corp SPAC Presentation Deck

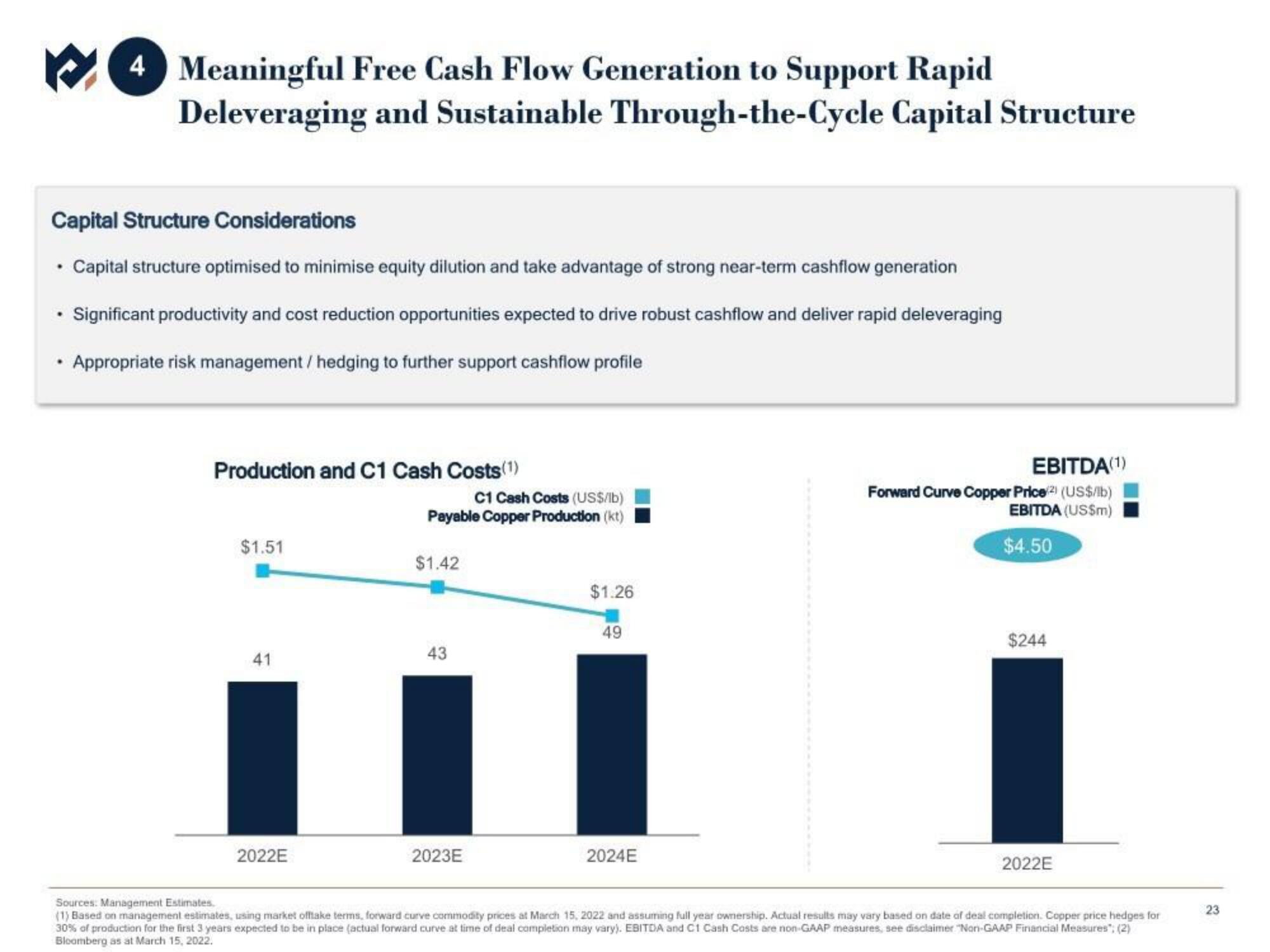

→ 4 Meaningful Free Cash Flow Generation to Support Rapid

Deleveraging and Sustainable Through-the-Cycle Capital Structure

Capital Structure Considerations

• Capital structure optimised to minimise equity dilution and take advantage of strong near-term cashflow generation

• Significant productivity and cost reduction opportunities expected to drive robust cashflow and deliver rapid deleveraging

• Appropriate risk management / hedging to further support cashflow profile

Production and C1 Cash Costs(¹)

$1.51

41

2022E

C1 Cash Costs (US$/lb)

Payable Copper Production (kt)

$1.42

43

2023E

$1.26

49

2024E

EBITDA(1)

Forward Curve Copper Price/2) (US$/b)

EBITDA (US$m)

$4.50

$244

2022E

Sources: Management Estimates.

(1) Based on management estimates, using market offtake terms, forward curve commodity prices at March 15, 2022 and assuming full year ownership. Actual results may vary based on date of deal completion. Copper price hedges for

30% of production for the first 3 years expected to be in place (actual forward curve at time of deal completion may vary). EBITDA and C1 Cash Costs are non-GAAP measures, see disclaimer "Non-GAAP Financial Measures"; (2)

Bloomberg as at March 15, 2022.

23View entire presentation