Cameco IPO Presentation Deck

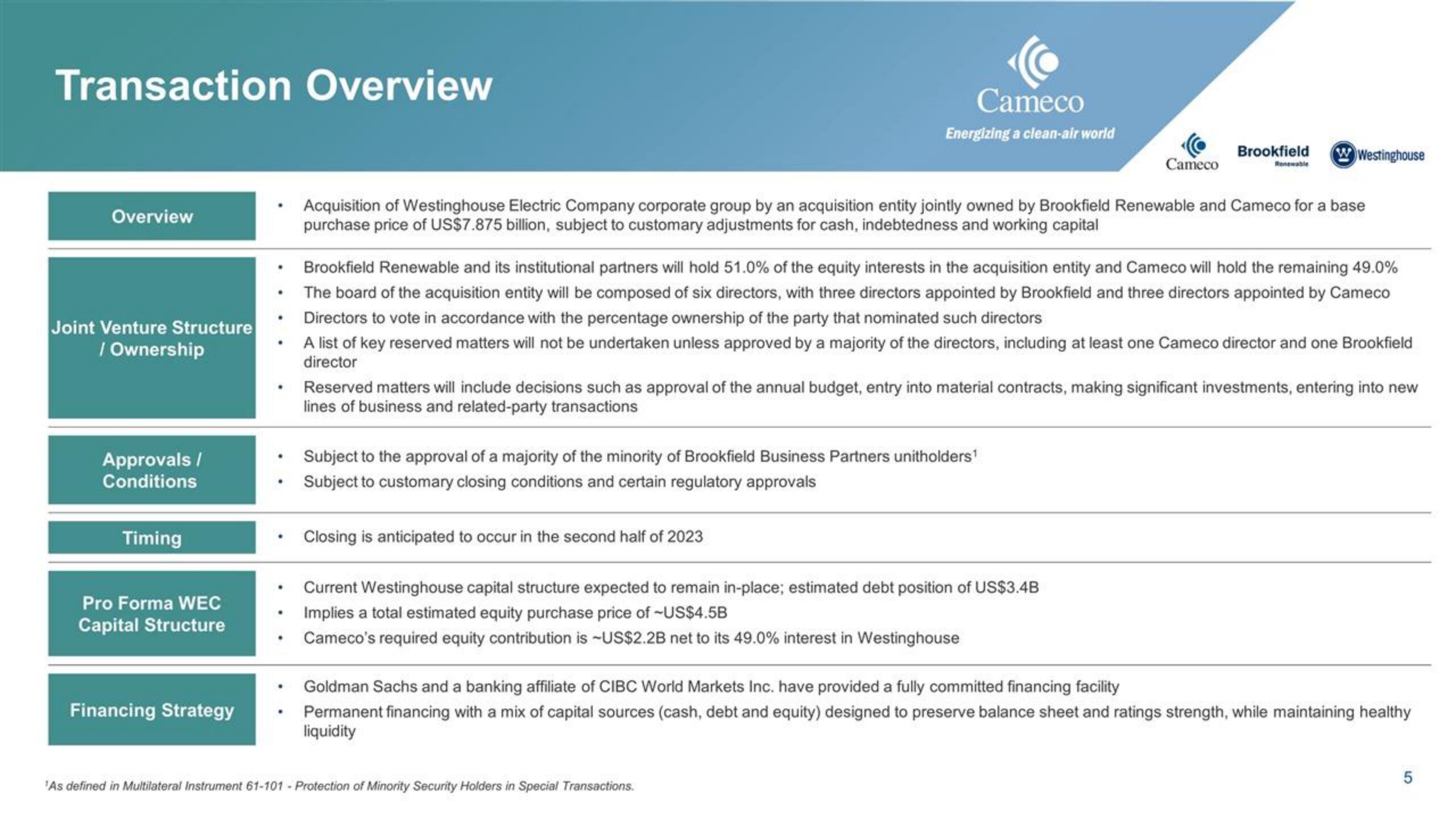

Transaction Overview

Overview

Joint Venture Structure

/ Ownership

Approvals /

Conditions

Timing

Pro Forma WEC

Capital Structure

Financing Strategy

.

.

.

Cameco

Energizing a clean-air world

Acquisition of Westinghouse Electric Company corporate group by an acquisition entity jointly owned by Brookfield Renewable and Cameco for a base

purchase price of US$7.875 billion, subject to customary adjustments for cash, indebtedness and working capital

Subject to the approval of a majority of the minority of Brookfield Business Partners unitholders¹

Subject to customary closing conditions and certain regulatory approvals

Closing is anticipated to occur in the second half of 2023

Cameco

Brookfield Renewable and its institutional partners will hold 51.0% of the equity interests in the acquisition entity and Cameco will hold the remaining 49.0%

The board of the acquisition entity will be composed of six directors, with three directors appointed by Brookfield and three directors appointed by Cameco

Directors to vote in accordance with the percentage ownership of the party that nominated such directors

A list of key reserved matters will not be undertaken unless approved by a majority of the directors, including at least one Cameco director and one Brookfield

director

Brookfield

Renewable

Reserved matters will include decisions such as approval of the annual budget, entry into material contracts, making significant investments, entering into new

lines of business and related-party transactions

Current Westinghouse capital structure expected to remain in-place; estimated debt position of US$3.4B

Implies a total estimated equity purchase price of -US$4.5B

Cameco's required equity contribution is ~US$2.2B net to its 49.0% interest in Westinghouse

WWestinghouse

'As defined in Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions.

Goldman Sachs and a banking affiliate of CIBC World Markets Inc. have provided a fully committed financing facility

Permanent financing with a mix of capital sources (cash, debt and equity) designed to preserve balance sheet and ratings strength, while maintaining healthy

liquidity

5View entire presentation