Trian Partners Activist Presentation Deck

Confidential-Not for Reproduction or Distribution

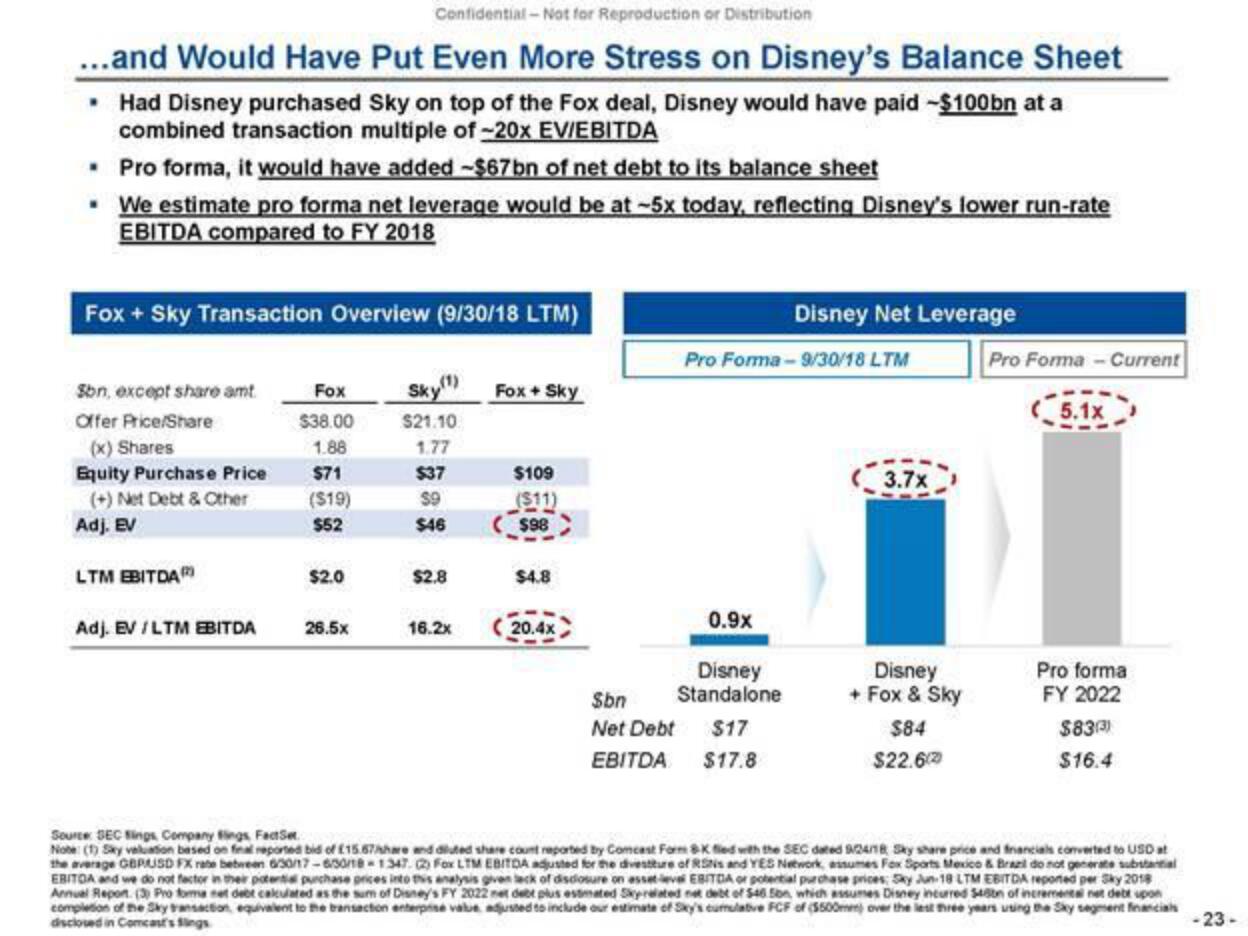

...and Would Have Put Even More Stress on Disney's Balance Sheet

• Had Disney purchased Sky on top of the Fox deal, Disney would have paid -$100bn at a

combined transaction multiple of -20x EV/EBITDA

. Pro forma, it would have added -$67 bn of net debt to its balance sheet

. We estimate pro forma net leverage would be at -5x today, reflecting Disney's lower run-rate

EBITDA compared to FY 2018

Fox + Sky Transaction Overview (9/30/18 LTM)

Sbn, except share amt

Offer Price/Share

(x) Shares

Equity Purchase Price

(+) Net Debt & Other

Adj. EV

LTM EBITDA

Adj. EV /LTM EBITDA

Fox

$38.00 $21.10

1.88

1.77

$71

$37

($19)

$9

$52

$46

$2.0

26.5×

$2.8

16.2x

Fox + Sky

$109

$98

$4.8

(20.4x

0.9x

Disney

Standalone

$17

$17.8

$bn

Net Debt

EBITDA

Disney Net Leverage

Pro Forma - 9/30/18 LTM

3.7x

Disney

+ Fox & Sky

$84

$22.6/20

Pro Forma - Current

(5.1x

Pro forma

FY 2022

$83(3)

$16.4

Source SEC ings Company fings, FactSet

Note: (1) Sky valuation based on final reported bid of £15.67share and diluted share count reported by Comcast Form SK fied with the SEC dated 24/18 Sky share price and financials converted to USD at

the average GBPUSD FX rate between 6/30/17-6/30/18-1347. (2) Fox LTM EBITDA adjusted for the divestiture of RNs and YES Network, assumes Fox Sports Mexico & Brazil do not generate substantial

EBITOA and we do not factor in their potential purchase prices into this analysis given tack of disclosure on asset-level EBITDA or potential purchase prices; Sky Jun-18 LTM EBITDA reported per Sky 2018

Annual Report (3) Pro forma net debt calculated as the sum of Disney's FY 2022 net debt plus estimated Sky-related net debt of $46. 5on, which assumes Disney incurred $48bn of incremental net debt upon

completion of the Sky transaction, equivalent to the bransaction enterprise value adjusted to include our estimate of Sky's cumulative FCF of ($500mm) over the last three years using the Sky segment financials

disclosed in Comcast's Sings

-23-View entire presentation