Baird Investment Banking Pitch Book

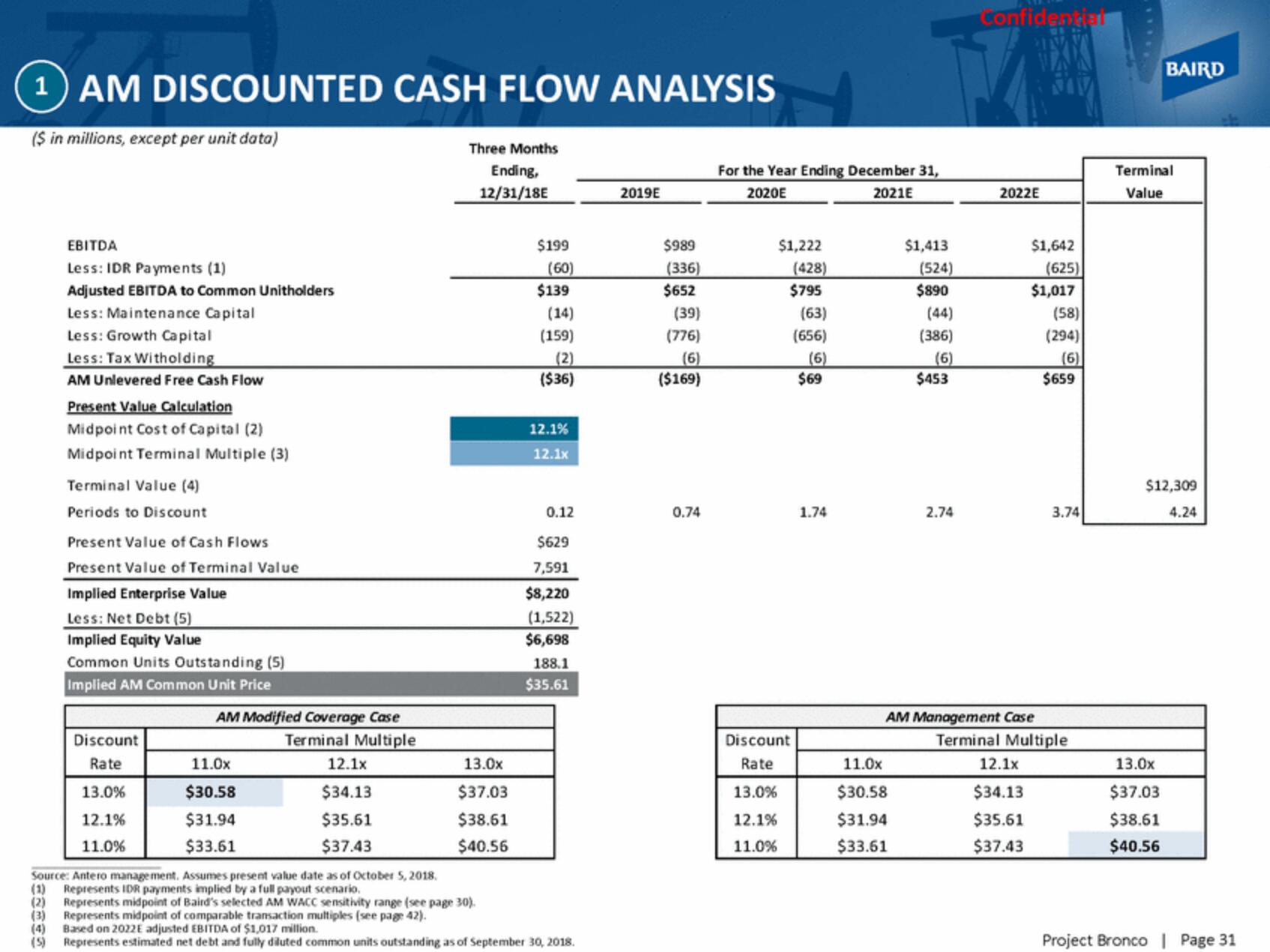

1AM DISCOUNTED CASH FLOW ANALYSIS

($ in millions, except per unit data)

EBITDA

Less: IDR Payments (1)

Adjusted EBITDA to Common Unitholders

Less: Maintenance Capital

Less: Growth Capital

Less: Tax Witholding

AM Unlevered Free Cash Flow

Present Value Calculation

Midpoint Cost of Capital (2)

Midpoint Terminal Multiple (3)

Terminal Value (4)

Periods to Discount

Present Value of Cash Flows

Present Value of Terminal Value

Implied Enterprise Value

Less: Net Debt (5)

Implied Equity Value

Common Units Outstanding (5)

Implied AM Common Unit Price

Discount

Rate

13.0%

12.1%

11.0%

AM Modified Coverage Case

Terminal Multiple

11.0x

$30.58

$31.94

$33.61

12.1x

$34.13

$35.61

$37.43

Three Months

Ending,

12/31/18E

13.0x

$37.03

$38.61

$40.56

$199

(60)

$139

(14)

(159)

(2)

($36)

12.1%

12.1x

0.12

$629

7,591

$8,220

(1,522)

$6,698

188.1

$35.61

Source: Antero management. Assumes present value date as of October 5, 2018.

(1)

Represents IDR payments implied by a full payout scenario.

(2) Represents midpoint of Baird's selected AM WACC sensitivity range (see page 30).

(3)

Represents midpoint of comparable transaction multiples (see page 42).

Based on 2022E adjusted EBITDA of $1,017 million.

(5)

Represents estimated net debt and fully diluted common units outstanding as of September 30, 2018.

2019E

$989

(336)

$652

(39)

(776)

(6)

($169)

0.74

For the Year Ending December 31,

2020E

2021E

$1,222

(428)

$795

Discount

Rate

13.0%

12.1%

11.0%

(63)

(656)

(6)

$69

1.74

$1,413

11.0x

$30.58

$31.94

$33.61

(524)

$890

(44)

(386)

(6)

$453

2.74

Confidential

2022E

$1,642

12.1x

$34.13

$35.61

$37.43

(625)

$1,017

(58)

(294)

(6)

$659

AM Management Case

Terminal Multiple

3.74

BAIRD

Terminal

Value

$12,309

4.24

13.0x

$37.03

$38.61

$40.56

Project Bronco | Page 31View entire presentation