Solid Power SPAC Presentation Deck

Pro Forma Equity Ownership

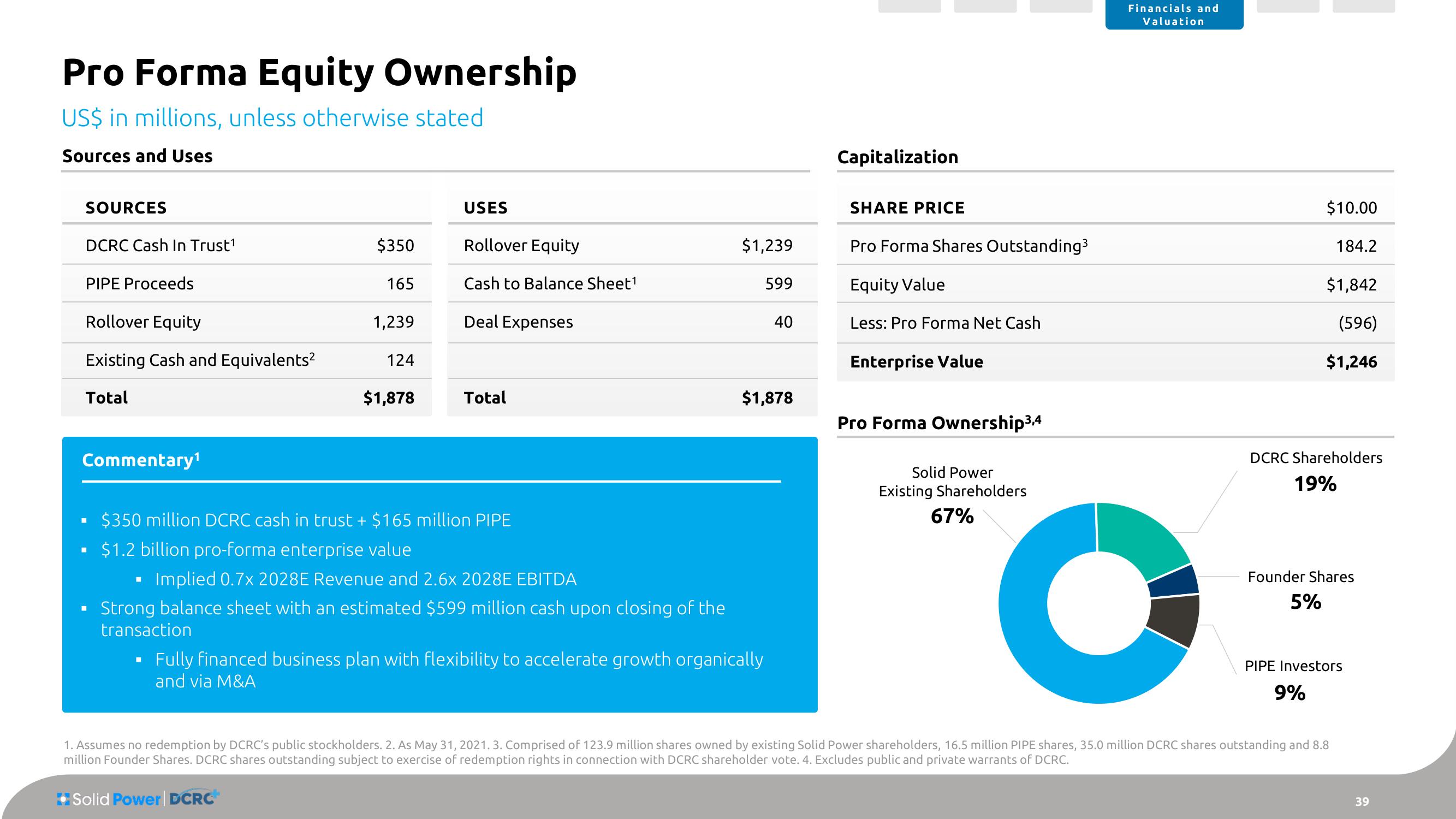

US$ in millions, unless otherwise stated

Sources and Uses

SOURCES

DCRC Cash In Trust¹

PIPE Proceeds

Rollover Equity

Existing Cash and Equivalents²

Total

Commentary¹

■

■

$350

165

■

1,239

124

$1,878

USES

Rollover Equity

Cash to Balance Sheet¹

Deal Expenses

Total

$350 million DCRC cash in trust + $165 million PIPE

$1.2 billion pro-forma enterprise value

Implied 0.7x 2028E Revenue and 2.6x 2028E EBITDA

Strong balance sheet with an estimated $599 million cash upon closing of the

transaction

$1,239

599

40

$1,878

Fully financed business plan with flexibility to accelerate growth organically

and via M&A

Capitalization

SHARE PRICE

Pro Forma Shares Outstanding³

Equity Value

Less: Pro Forma Net Cash

Enterprise Value

Pro Forma Ownership ³,4

Solid Power

Existing Shareholders

67%

Financials and

Valuation

$10.00

184.2

$1,842

(596)

$1,246

DCRC Shareholders

19%

9%

Founder Shares

5%

PIPE Investors

1. Assumes no redemption by DCRC's public stockholders. 2. As May 31, 2021. 3. Comprised of 123.9 million shares owned by existing Solid Power shareholders, 16.5 million PIPE shares, 35.0 million DCRC shares outstanding and 8.8

million Founder Shares. DCRC shares outstanding subject to exercise of redemption rights in connection with DCRC shareholder vote. 4. Excludes public and private warrants of DCRC.

Solid Power | DCRC

39View entire presentation