OppFi Results Presentation Deck

6

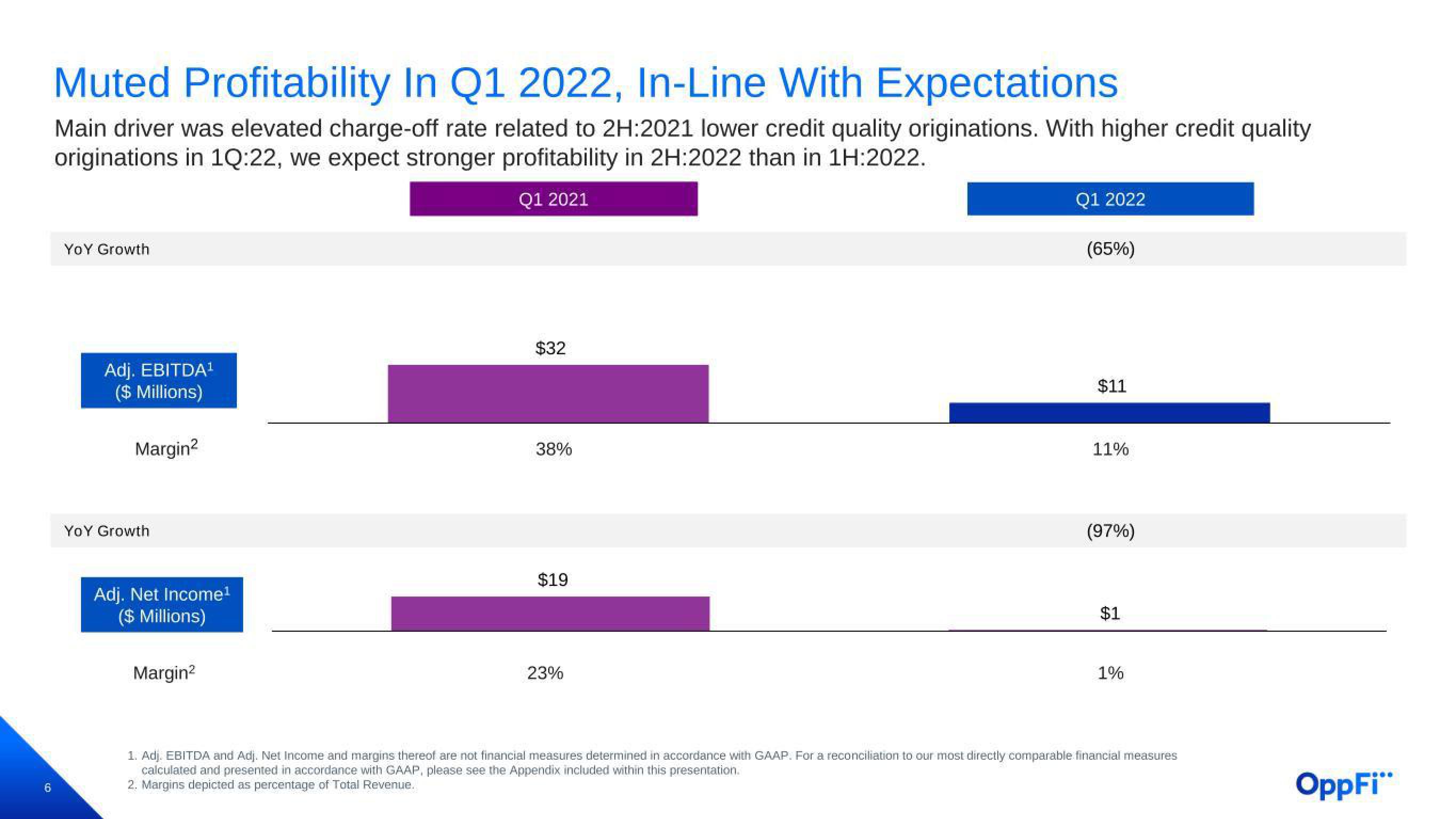

Muted Profitability In Q1 2022, In-Line With Expectations

Main driver was elevated charge-off rate related to 2H:2021 lower credit quality originations. With higher credit quality

originations in 1Q:22, we expect stronger profitability in 2H:2022 than in 1H:2022.

Q1 2021

YOY Growth

Adj. EBITDA¹

($ Millions)

Margin²

YOY Growth

Adj. Net Income¹

($ Millions)

Margin²

$32

38%

$19

23%

Q1 2022

(65%)

$11

11%

(97%)

$1

1%

1. Adj. EBITDA and Adj. Net Income and margins thereof are not financial measures determined in accordance with GAAP. For a reconciliation to our most directly comparable financial measures

calculated and presented in accordance with GAAP, please see the Appendix included within this presentation.

2. Margins depicted as percentage of Total Revenue.

OppFi"View entire presentation