Xos SPAC Presentation Deck

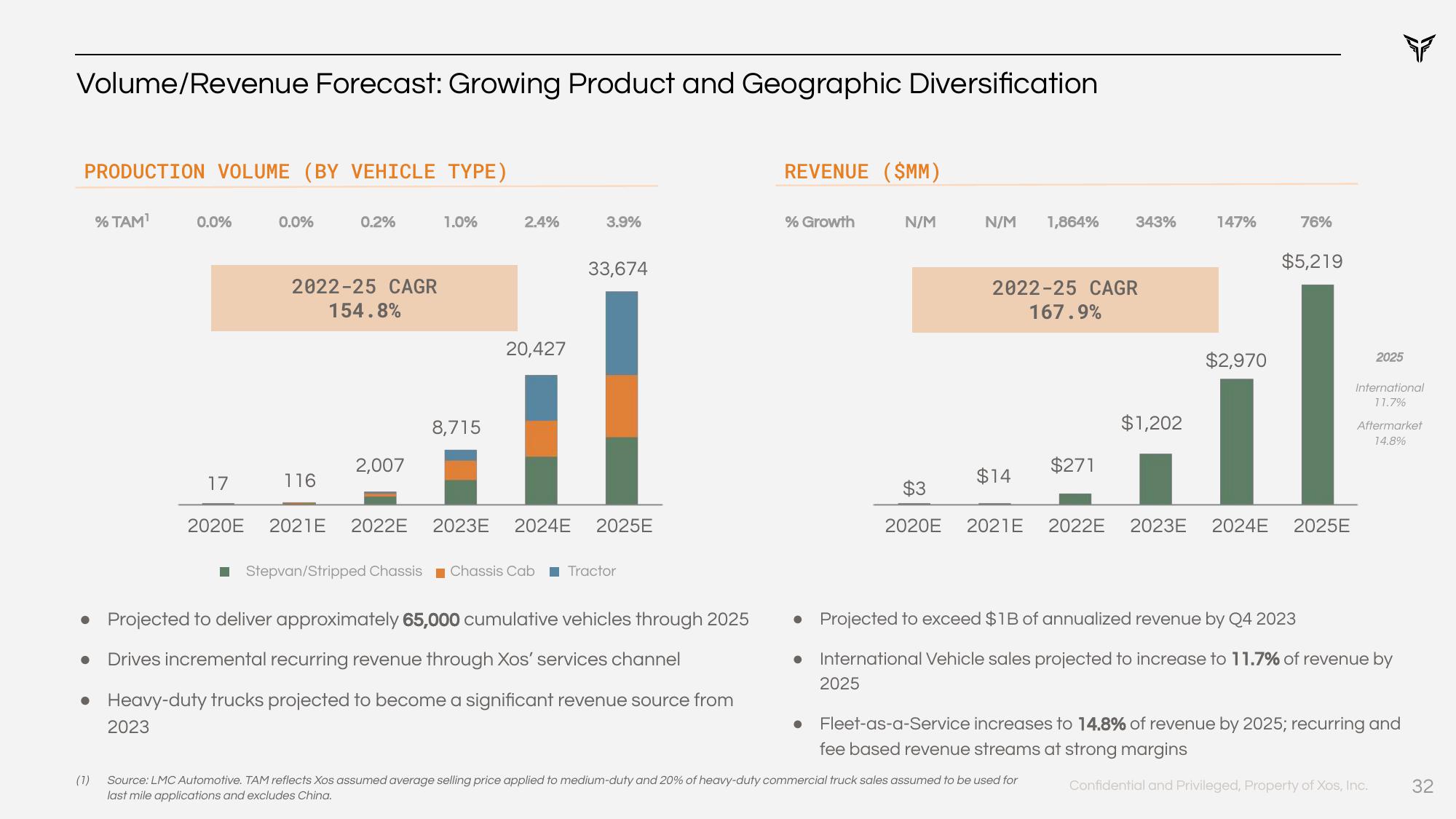

Volume/Revenue Forecast: Growing Product and Geographic Diversification

PRODUCTION VOLUME (BY VEHICLE TYPE)

% TAM¹

(1)

0.0%

2023

17

0.0%

0.2%

2022-25 CAGR

154.8%

116

2,007

1.0%

8,715

2.4%

20,427

3.9%

33,674

2020E 2021E 2022E 2023E 2024E 2025E

• Projected to deliver approximately 65,000 cumulative vehicles through 2025

● Drives incremental recurring revenue through Xos' services channel

• Heavy-duty trucks projected to become a significant revenue source from

Stepvan/Stripped Chassis Chassis Cab Tractor

REVENUE (SMM)

% Growth

●

N/M

2025

$3

2020E

N/M 1,864%

2022-25 CAGR

167.9%

$14

2021E

343%

$271

Source: LMC Automotive. TAM reflects Xos assumed average selling price applied to medium-duty and 20% of heavy-duty commercial truck sales assumed to be used for

last mile applications and excludes China.

$1,202

147%

$2,970

76%

$5,219

2022E 2023E 2024E 2025E

2025

● Projected to exceed $1B of annualized revenue by Q4 2023

International Vehicle sales projected to increase to 11.7% of revenue by

International

11.7%

Aftermarket

14.8%

Fleet-as-a-Service increases to 14.8% of revenue by 2025; recurring and

fee based revenue streams at strong margins

Confidential and Privileged, Property of Xos, Inc.

32View entire presentation