Freyr Results Presentation Deck

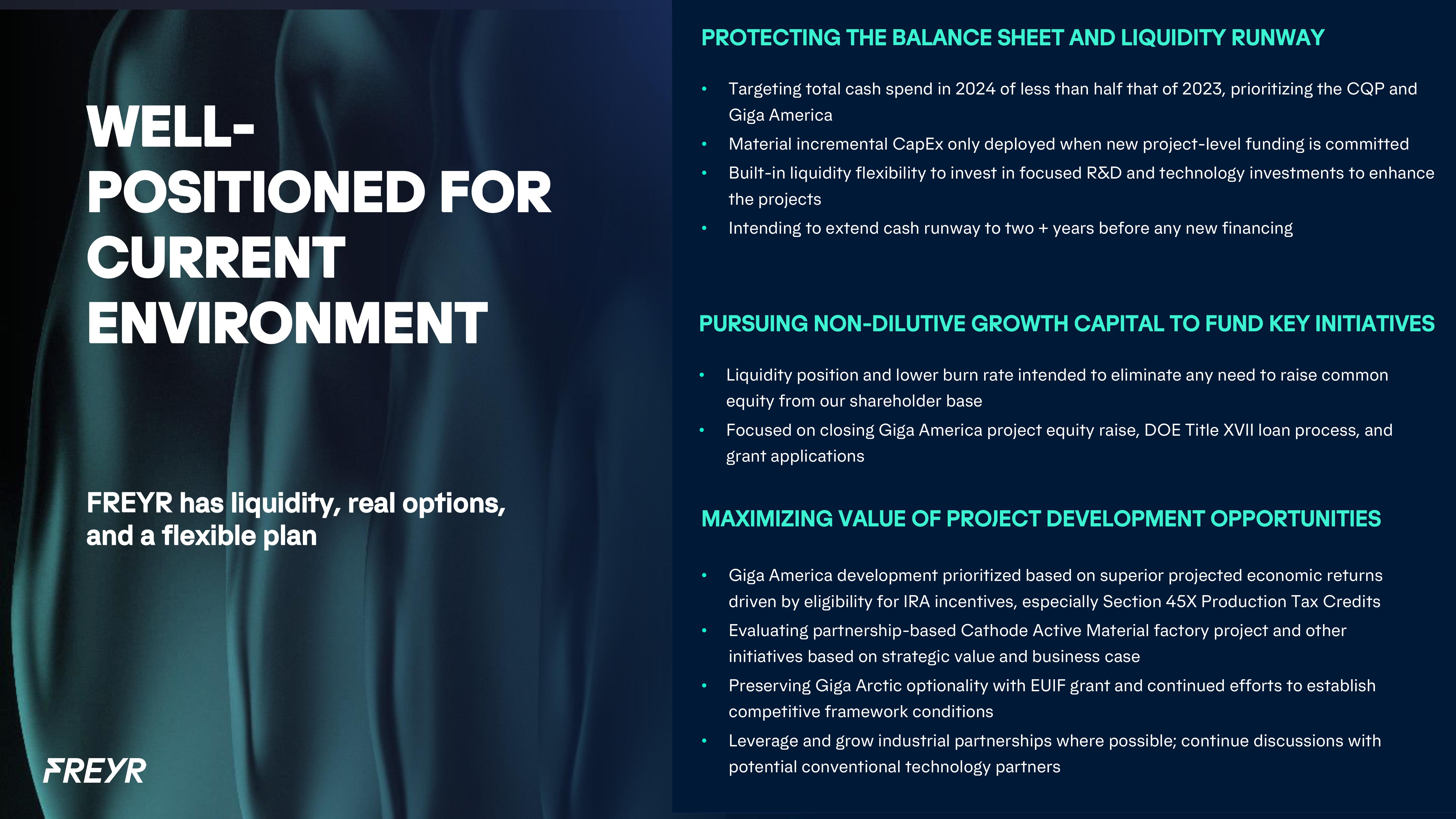

WELL-

POSITIONED FOR

CURRENT

ENVIRONMENT

FREYR has liquidity, real options,

and a flexible plan

FREYR

PROTECTING THE BALANCE SHEET AND LIQUIDITY RUNWAY

Targeting total cash spend in 2024 of less than half that of 2023, prioritizing the CQP and

Giga America

Material incremental CapEx only deployed when new project-level funding is committed

Built-in liquidity flexibility to invest in focused R&D and technology investments to enhance

the projects

Intending to extend cash runway to two + years before any new financing

PURSUING NON-DILUTIVE GROWTH CAPITAL TO FUND KEY INITIATIVES

Liquidity position and lower burn rate intended to eliminate any need to raise common

equity from our shareholder base

Focused on closing Giga America project equity raise, DOE Title XVII loan process, and

grant applications

MAXIMIZING VALUE OF PROJECT DEVELOPMENT OPPORTUNITIES

Giga America development prioritized based on superior projected economic returns

driven by eligibility for IRA incentives, especially Section 45X Production Tax Credits

Evaluating partnership-based Cathode Active Material factory project and other

initiatives based on strategic value and business case

Preserving Giga Arctic optionality with EUIF grant and continued efforts to establish

competitive framework conditions

Leverage and grow industrial partnerships where possible; continue discussions with

potential conventional technology partnersView entire presentation