Bed Bath & Beyond Results Presentation Deck

Q4 key performance metrics

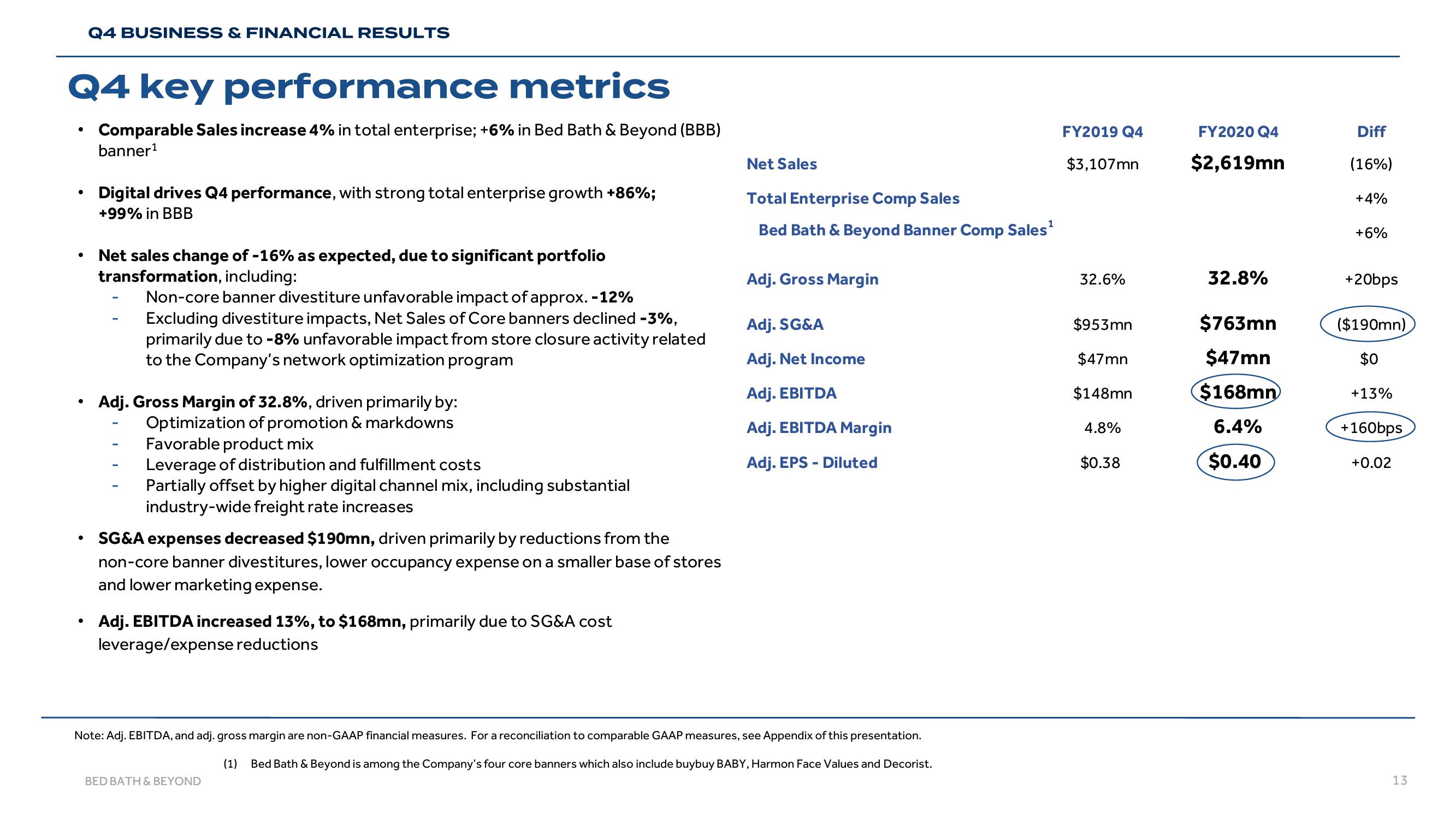

Comparable Sales increase 4% in total enterprise; +6% in Bed Bath & Beyond (BBB)

banner¹

●

●

Q4 BUSINESS & FINANCIAL RESULTS

●

Digital drives Q4 performance, with strong total enterprise growth +86%;

+99% in BBB

Net sales change of -16% as expected, due to significant portfolio

transformation, including:

Non-core banner divestiture unfavorable impact of approx. -12%

Excluding divestiture impacts, Net Sales of Core banners declined -3%,

primarily due to -8% unfavorable impact from store closure activity related

to the Company's network optimization program

Adj. Gross Margin of 32.8%, driven primarily by:

Optimization of promotion & markdowns

Favorable product mix

Leverage of distribution and fulfillment costs

Partially offset by higher digital channel mix, including substantial

industry-wide freight rate increases

SG&A expenses decreased $190mn, driven primarily by reductions from the

non-core banner divestitures, lower occupancy expense on a smaller base of stores

and lower marketing expense.

Adj. EBITDA increased 13%, to $168mn, primarily due to SG&A cost

leverage/expense reductions

Net Sales

BED BATH & BEYOND

Total Enterprise Comp Sales

Bed Bath & Beyond Banner Comp Sales¹

Adj. Gross Margin

Adj. SG&A

Adj. Net Income

Adj. EBITDA

Adj. EBITDA Margin

Adj. EPS - Diluted

Note: Adj. EBITDA, and adj. gross margin are non-GAAP financial measures. For a reconciliation to comparable GAAP measures, see Appendix of this presentation.

(1) Bed Bath & Beyond is among the Company's four core banners which also include buybuy BABY, Harmon Face Values and Decorist.

FY2019 Q4

$3,107mn

32.6%

$953mn

$47mn

$148mn

4.8%

$0.38

FY2020 Q4

$2,619mn

32.8%

$763mn

$47mn

$168mn

6.4%

$0.40

Diff

(16%)

+4%

+6%

+20bps

($190mn)

$0

+13%

+160bps

+0.02

13View entire presentation