Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

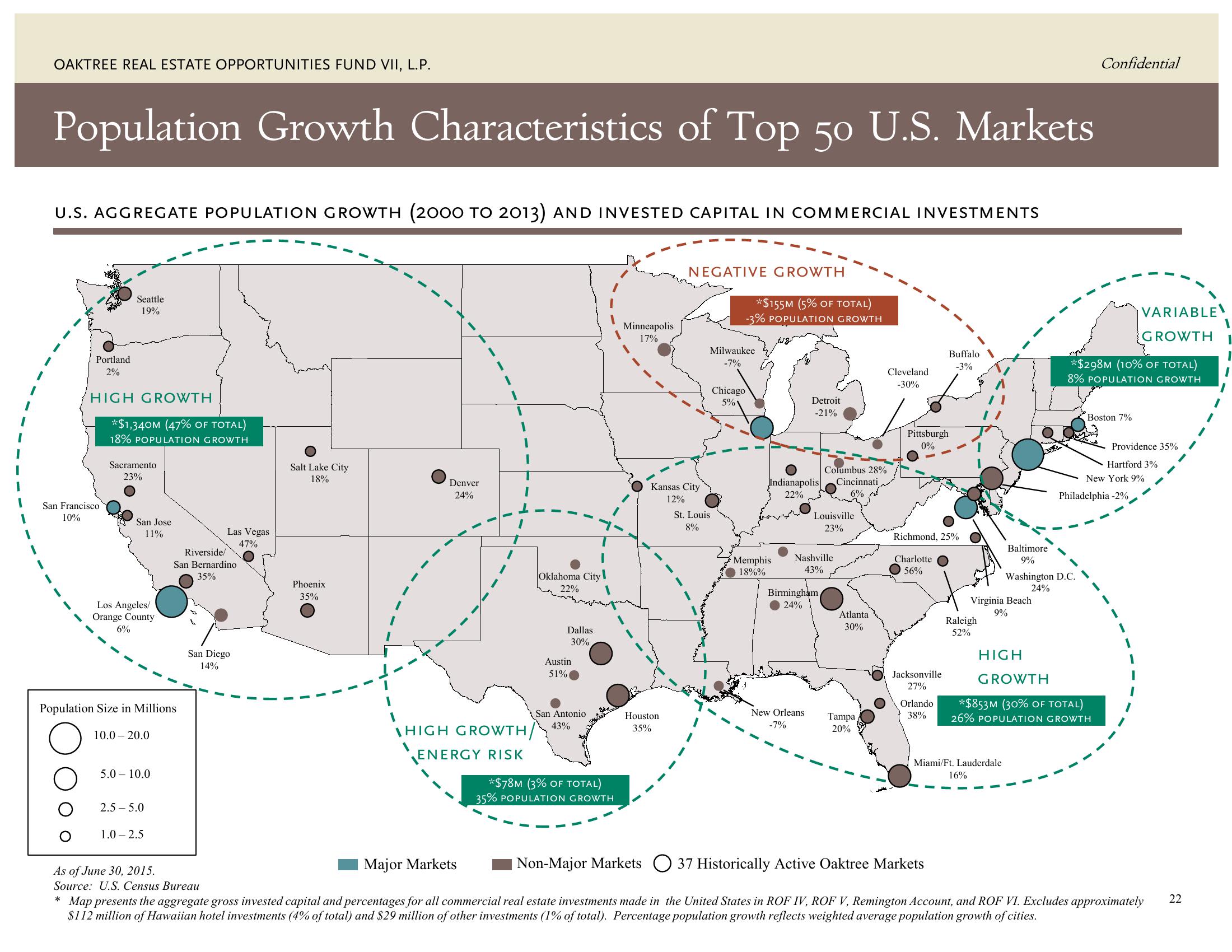

Population Growth Characteristics of Top 50 U.S. Markets

U.S. AGGREGATE POPULATION GROWTH (2000 TO 2013) AND INVESTED CAPITAL IN COMMERCIAL INVESTMENTS

Seattle

19%

Portland

2%

HIGH GROWTH

San Francisco

10%

*$1,340M (47% OF TOTAL)

18% POPULATION GROWTH

Sacramento

23%

San Jose

11%

Los Angeles/

Orange County

6%

Population Size in Millions

10.0 20.0

5.0 10.0

2.5-5.0

1.0-2.5

Riverside/

San Bernardino

35%

Las Vegas

47%

San Diego

14%

As of June 30, 2015.

Source: U.S. Census Bureau

Salt Lake City

18%

Phoenix

35%

Denver

24%

HIGH GROWTH

ENERGY RISK

Oklahoma City

22%

Dallas

30%

Austin

51%

San Antonio

43%

*$78M (3% OF TOTAL)

35% POPULATION GROWTH

Minneapolis

17%

NEGATIVE GROWTH

Kansas City

12%

Houston

35%

*$155M (5% OF TOTAL)

-3% POPULATION GROWTH

Milwaukee

-7%

St. Louis

8%

Chicago

5%

Indianapolis

22%

Memphis

18%%

Detroit

-21%

New Orleans

-7%

Columbus 28%

Cincinnati

6%

Louisville

23%

Nashville

43%

Birmingham

24%

Atlanta

30%

Tampa

20%

Cleveland

-30%

Pittsburgh

0%

Buffalo

-3%

Richmond, 25%

Charlotte

56%

Jacksonville

27%

Orlando

38%

Raleigh

52%

Virginia Beach

9%

Miami/Ft. Lauderdale

16%

Baltimore

9%

Washington D.C.

24%

Confidential

*$298M (10% OF TOTAL)

8% POPULATION GROWTH

Boston 7%

HIGH

GROWTH

*$853M (30% OF TOTAL)

26% POPULATION GROWTH

VARIABLE

GROWTH

Philadelphia -2%

Providence 35%

Hartford 3%

New York 9%

Major Markets

|Non-Major Markets O 37 Historically Active Oaktree Markets

* Map presents the aggregate gross invested capital and percentages for all commercial real estate investments made in the United States in ROF IV, ROF V, Remington Account, and ROF VI. Excludes approximately

$112 million of Hawaiian hotel investments (4% of total) and $29 million of other investments (1% of total). Percentage population growth reflects weighted average population growth of cities.

22View entire presentation