NewFortress Energy 2Q23 Results

(in thousands of $)

Appendix

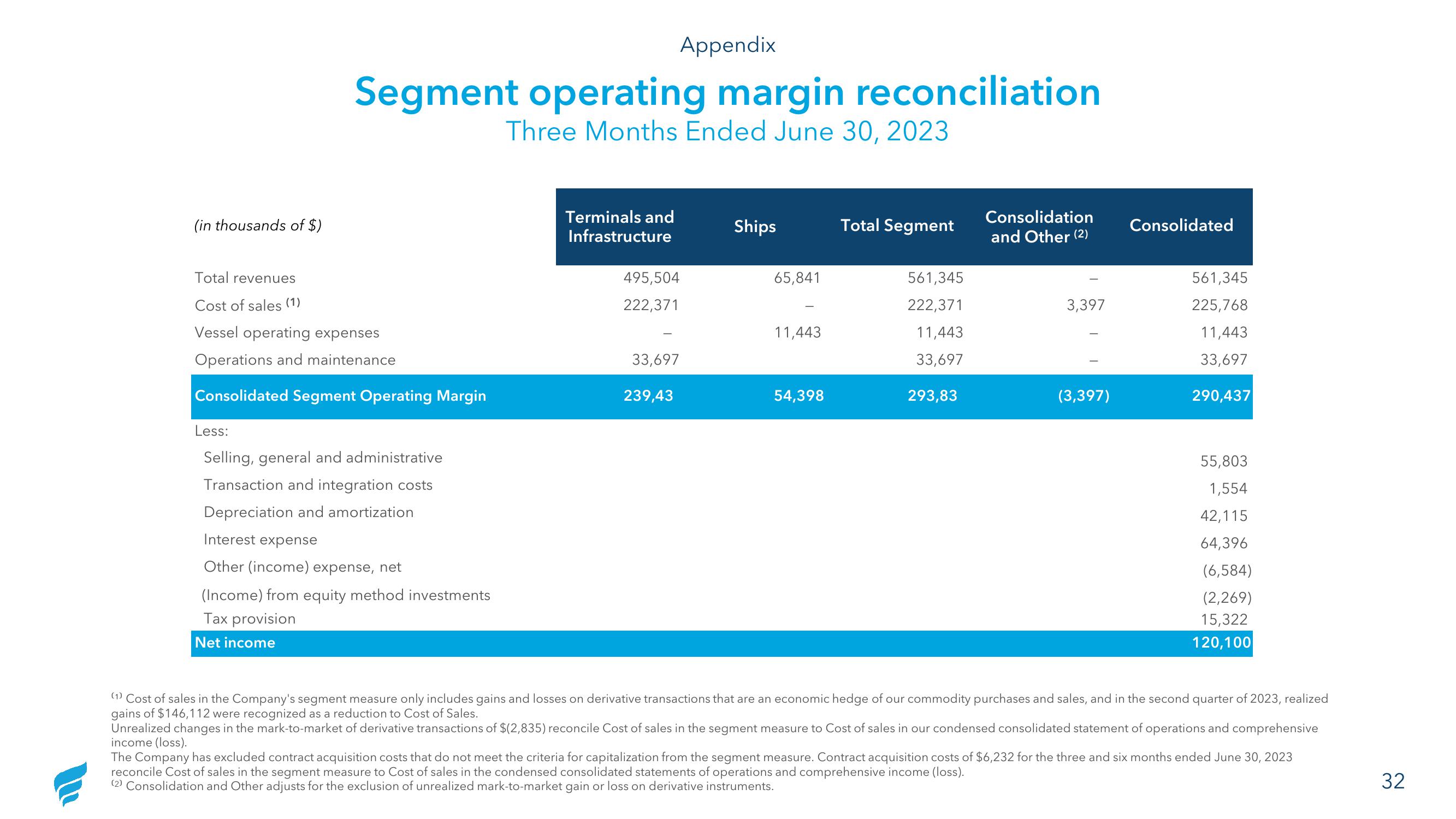

Segment operating margin reconciliation

Three Months Ended June 30, 2023

Total revenues

Cost of sales (1)

Vessel operating expenses

Operations and maintenance

Consolidated Segment Operating Margin

Less:

Selling, general and administrative

Transaction and integration costs

Depreciation and amortization

Interest expense

Other (income) expense, net

(Income) from equity method investments

Tax provision

Net income

Terminals and

Infrastructure

495,504

222,371

33,697

239,43

Ships

65,841

11,443

54,398

Total Segment

561,345

222,371

11,443

33,697

293,83

Consolidation

and Other (2)

3,397

(3,397)

Consolidated

561,345

225,768

11,443

33,697

290,437

55,803

1,554

42,115

64,396

(6,584)

(2,269)

15,322

120,100

(1) Cost of sales in the Company's segment measure only includes gains and losses on derivative transactions that are an economic hedge of our commodity purchases and sales, and in the second quarter of 2023, realized

gains of $146,112 were recognized as a reduction to Cost of Sales.

Unrealized changes in the mark-to-market of derivative transactions of $(2,835) reconcile Cost of sales in the segment measure to Cost of sales in our condensed consolidated statement of operations and comprehensive

income (loss).

The Company has excluded contract acquisition costs that do not meet the criteria for capitalization from the segment measure. Contract acquisition costs of $6,232 for the three and six months ended June 30, 2023

reconcile Cost of sales in the segment measure to Cost of sales in the condensed consolidated statements of operations and comprehensive income (loss).

(2) Consolidation and Other adjusts for the exclusion of unrealized mark-to-market gain or loss on derivative instruments.

32View entire presentation