HSBC ESG Presentation Deck

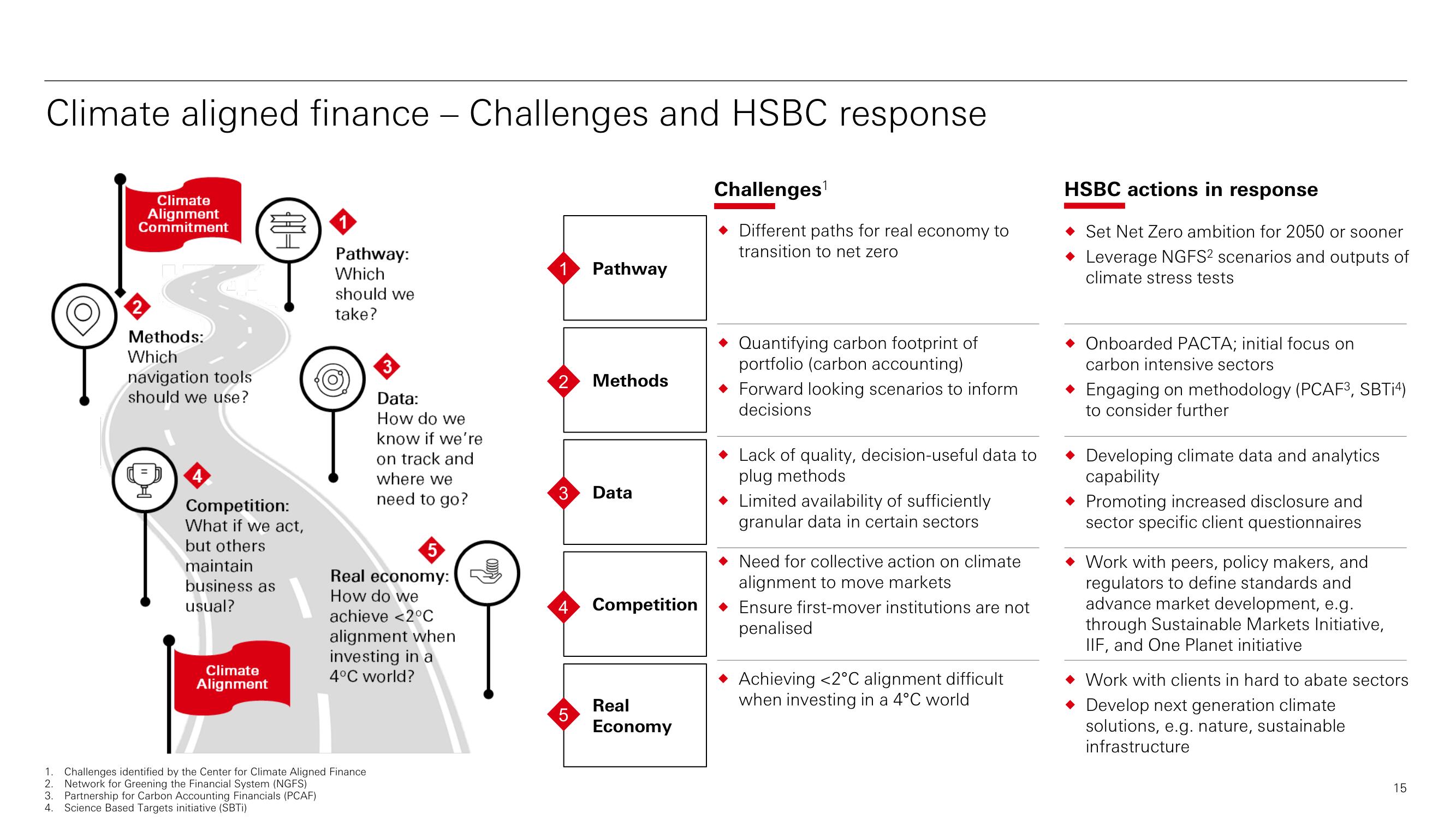

Climate aligned finance - Challenges and HSBC response

Climate

Alignment

Commitment

Methods:

Which

navigation tools

should we use?

4

004

Competition:

What if we act,

but others

maintain

business as

usual?

Climate

Alignment

Pathway:

Which

should we

take?

3

Data:

How do we

know if we're

on track and

where we

need to go?

5

Real economy:

How do we

achieve <2°C

alignment when

investing in a

4°C world?

1. Challenges identified by the Center for Climate Aligned Finance

2. Network for Greening the Financial System (NGFS)

3. Partnership for Carbon Accounting Financials (PCAF)

4. Science Based Targets initiative (SBTi)

2

Pathway

Methods

3 Data

5

4 Competition

Real

Economy

Challenges¹

Different paths for real economy to

transition to net ero

Quantifying carbon footprint of

portfolio (carbon accounting)

Forward looking scenarios to inform

decisions

Lack of quality, decision-useful data to

plug methods

Limited availability of sufficiently

granular data in certain sectors

Need for collective action on climate

alignment to move markets

◆ Ensure first-mover institutions are not

penalised

Achieving <2°C alignment difficult

when investing in a 4°C world

HSBC actions in response

Set Net Zero ambition for 2050 or sooner

Leverage NGFS2 scenarios and outputs of

climate stress tests

Onboarded PACTA; initial focus on

carbon intensive sectors

◆ Engaging on methodology (PCAF³, SBTi4)

to consider further

Developing climate data and analytics

capability

◆ Promoting increased disclosure and

sector specific client questionnaires

Work with peers, policy makers, and

regulators to define standards and

advance market development, e.g.

through Sustainable Markets Initiative,

IIF, and One Planet initiative

Work with clients in hard to abate sectors

Develop next generation climate

solutions, e.g. nature, sustainable

infrastructure

15View entire presentation