SeaSpine Investor Update

Total revenue, net

Less: Cost of goods sold

Gross profit

Add back:

APPENDIX A

Reconciliation of Non-GAAP

to GAAP Financial

($ in millions)

Technology-related intangible asset amortization

Fixed NanoMetalene supplier processing charge

Purchase accounting inventory fair market value adjustments

Idle manufacturing plant costs

Adjusted gross profit

Adjusted gross margin (Adjusted gross profit/Total revenue, net)

($ in millions)

GAAP net loss

Non-GAAP adjustments

Depreciation and intangible asset amortization expense

Other (income) expense

Income tax (benefit) provision

Fixed NanoMetalene supplier processing charge

Idle manufacturing plant costs

Spinal set instrument replacement expense

Spinal set instrument impairment expense

Stock-based compensation

Impairment on intangible assets

European sales and marketing organization restructuring

Purchase accounting inventory fair market value adjustments

Acquisition and integration-related charges

Total Non-GAAP adjustments

Adjusted EBITDA loss

$

$

$

$

$

Q1 20

36.111 $

13.812

22.299

0.294

22.593 $

62.6%

Q1 20

(12.551) $

2.608 $

(0.227)

0.035

0.379

0.2

1.983

1.325

6.337 $

(6.214) $

Q2 20

28.589 $

11.659

16.930

0.241

0.974

18.145

63.5%

$

Q2 20

(13.713) $

2.608 $

(0.014)

0.033

0.974

0.551

(0.024)

2.769

6.897 $

(6.816) $

Q3 20

43.209 $

14.074

29.135

0.254

29.389 $

68.0%

Q3 20

(6.574) $

2.713 $

(0.136)

0.064

0.625

3.182

6.448 $

(0.126) $

Q4 20

46.436 $

17.296

29.140

0.257

29.397

63.3%

Q4 20

(10.343) $

$

2.796 $

(0.086)

0.086

1.244

2.423

6.463 $

(3.880) $

Q1 21

41.954 $

15.366

26.588

0.267

26.855 $

64.0%

2.747 $

0.159

0.025

0.730

Q1 21

Q2 21

(12.720) $ (5.213) $

2.546

Q2 21

47.463 $

17.482

29.981

1.276

7.483 $

(5.237) $

0.609

30.590 $

64.5%

3.133 $

(6.079)

0.158

0.915

3.096

0.519

1.742 $

(3.471) $

Q3 21

Q4 21

Q1 22

46.445 $ 55.589 $ 50.693 $

18.289

25.727

20.376

28.156

29.862

30.317

1.291

0.417

29.864 $ 34.242 $

64.3%

61.6%

4.400 $

0.231

(0.872)

1.020

0.551

3.704

0.125

3.149

1.665

0.417

0.200

10.210 $

(7.417) $

Q3 21

Q4 21

Q1 22

(17.627) $ (18.786) $ (16.604) $

3.653 $

0.157

(0.411)

3.704

1.239

Financial Measures

Measures

3.065

0.161

0.125

0.305

11.998 $

(6.788) $

0.986

0.125

31.428 $

62.0%

4.202 $

(0.002)

(0.228)

1.018

2.819

0.279

0.125

0.372

8.585 $

(8.019) $

Ⓒ2022 SeaSpine Orthopedics Corporation. All rights reserved | 26

Q2 22

56.318

19.127

37.191

0.986

0.083

38.260

67.9%

Q2 22

(13.947)

4.295

0.559

(1.147)

1.665

3.701

0.127

0.083

(0.010)

9.273

(4.674)

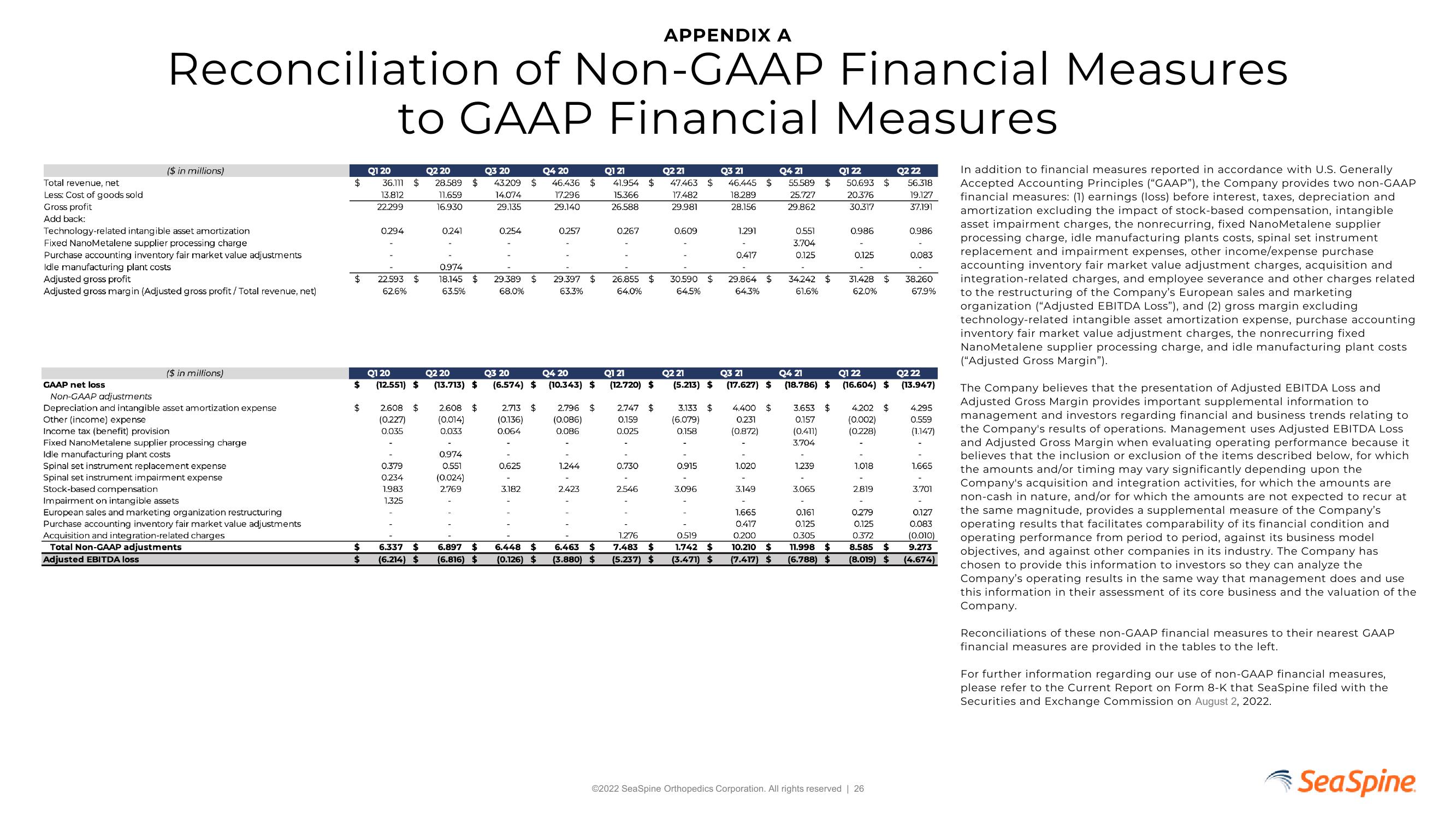

In addition to financial measures reported in accordance with U.S. Generally

Accepted Accounting Principles ("GAAP"), the Company provides two non-GAAP

financial measures: (1) earnings (loss) before interest, taxes, depreciation and

amortization excluding the impact of stock-based compensation, intangible

asset impairment charges, the nonrecurring, fixed NanoMetalene supplier

processing charge, idle manufacturing plants costs, spinal set instrument

replacement and impairment expenses, other income/expense purchase

accounting inventory fair market value adjustment charges, acquisition and

integration-related charges, and employee severance and other charges related

to the restructuring of the Company's European sales and marketing

organization ("Adjusted EBITDA Loss"), and (2) gross margin excluding

technology-related intangible asset amortization expense, purchase accounting

inventory fair market value adjustment charges, the nonrecurring fixed

NanoMetalene supplier processing charge, and idle manufacturing plant costs

("Adjusted Gross Margin").

The Company believes that the presentation of Adjusted EBITDA Loss and

Adjusted Gross Margin provides important supplemental information to

management and investors regarding financial and business trends relating to

the Company's results of operations. Management uses Adjusted EBITDA Loss

and Adjusted Gross Margin when evaluating operating performance because it

believes that the inclusion or exclusion of the items described below, for which

the amounts and/or timing may vary significantly depending upon the

Company's acquisition and integration activities, for which the amounts are

non-cash in nature, and/or for which the amounts are not expected to recur at

the same magnitude, provides a supplemental measure of the Company's

operating results that facilitates comparability of its financial condition and

operating performance from period to period, against its business model

objectives, and against other companies in its industry. The Company has

chosen to provide this information to investors so they can analyze the

Company's operating results in the same way that management does and use

this information in their assessment of its core business and the valuation of the

Company.

Reconciliations of these non-GAAP financial measures to their nearest GAAP

financial measures are provided in the tables to the left.

For further information regarding our use of non-GAAP financial measures,

please refer to the Current Report on Form 8-K that SeaSpine filed with the

Securities and Exchange Commission on August 2, 2022.

SeaSpineView entire presentation