Ginkgo Investor Conference Presentation Deck

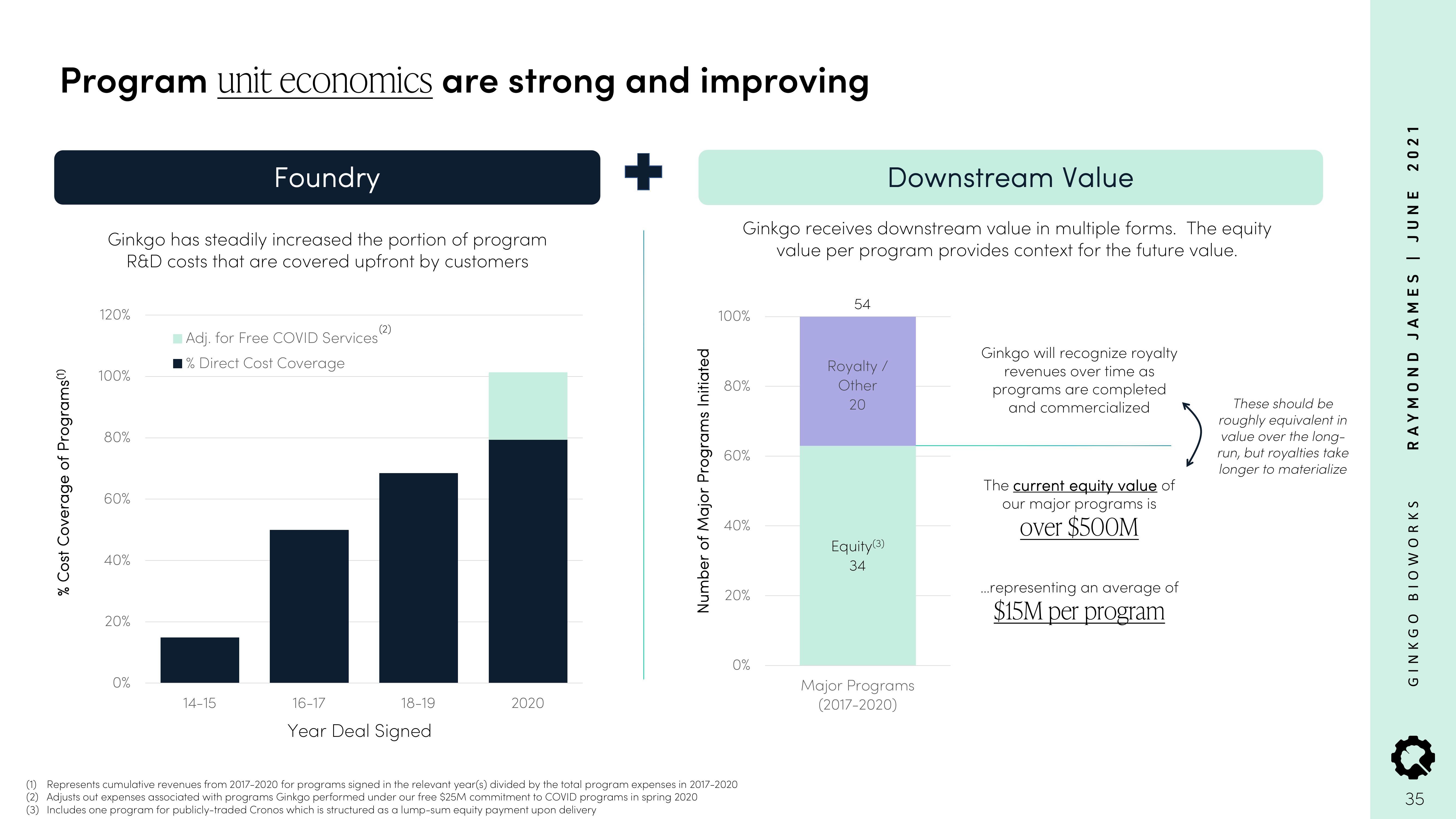

Program unit economics are strong and improving

% Cost Coverage of Programs(¹)

Foundry

Ginkgo has steadily increased the portion of program

R&D costs that are covered upfront by customers

120%

100%

80%

60%

40%

20%

0%

(2)

Adj. for Free COVID Services

■% Direct Cost Coverage

14-15

16-17

18-19

Year Deal Signed

11

2020

Number of Major Programs Initiated

Downstream Value

Ginkgo receives downstream value in multiple forms. The equity

value per program provides context for the future value.

100%

80%

60%

40%

20%

0%

(1) Represents cumulative revenues from 2017-2020 for programs signed in the relevant year(s) divided by the total program expenses in 2017-2020

(2) Adjusts out expenses associated with programs Ginkgo performed under our free $25M commitment to COVID programs in spring 2020

(3) Includes one program for publicly-traded Cronos which is structured as a lump-sum equity payment upon delivery

54

Royalty /

Other

20

Equity (3)

34

Major Programs

(2017-2020)

Ginkgo will recognize royalty

revenues over time as

programs are completed

and commercialized

The current equity value of

our major programs is

over $500M

...representing an average of

$15M per program

These should be

roughly equivalent in

value over the long-

run, but royalties take

longer to materialize

2021

RAYMOND JAMES | JUNE

GINKGO BIOWORKS

35View entire presentation